Colorado Payroll Deduction — Special Services is a state-specific program that allows employees to allocate a portion of their wages to pay for special services offered by the state government. This voluntary deduction program provides employees with convenient access to a variety of special services without the need for upfront payments or additional paperwork. One type of Colorado Payroll Deduction — Special Service is the ColoradERARA (Public Employees' Retirement Association) option. Through this deduction, employees can contribute a percentage of their wages towards their retirement fund, ensuring a secure financial future. The Colorado ERA program offers various retirement plans and investment options to suit employees' preferences and goals. Another type of special service offered through Colorado Payroll Deduction is the state's Higher Education Savings Program. This deduction allows employees to contribute towards a qualified college savings account, such as a 529 plan. By deducting a portion of their wages, employees can consistently save for their or their dependent's higher education expenses, such as tuition, books, and room and board. This program aims to alleviate the burden of education costs and promote access to quality education for Colorado residents. Colorado Payroll Deduction — Special Services also include deductions for state-sponsored charitable giving campaigns. Employees can choose to contribute a portion of their earnings towards charitable organizations that support various causes such as education, health services, environmental conservation, and community development. This deduction program provides employees with a convenient way to give back to their communities and support causes they are passionate about. Additionally, Colorado Payroll Deduction — Special Services may encompass deductions for health and welfare benefit plans. Employees can opt to have certain insurance premiums, such as health, dental, or vision insurance, deducted from their wages. These deductions ensure that employees have access to essential healthcare services and coverage. In summary, Colorado Payroll Deduction — Special Services offers employees the opportunity to allocate a portion of their wages towards various services offered by the state government. This includes retirement savings through Colorado ERA, college savings programs, charitable giving campaigns, and health and welfare benefit plans. By participating in these deductions, employees can conveniently access these services and improve their financial well-being, education prospects, and support worthy causes in their communities.

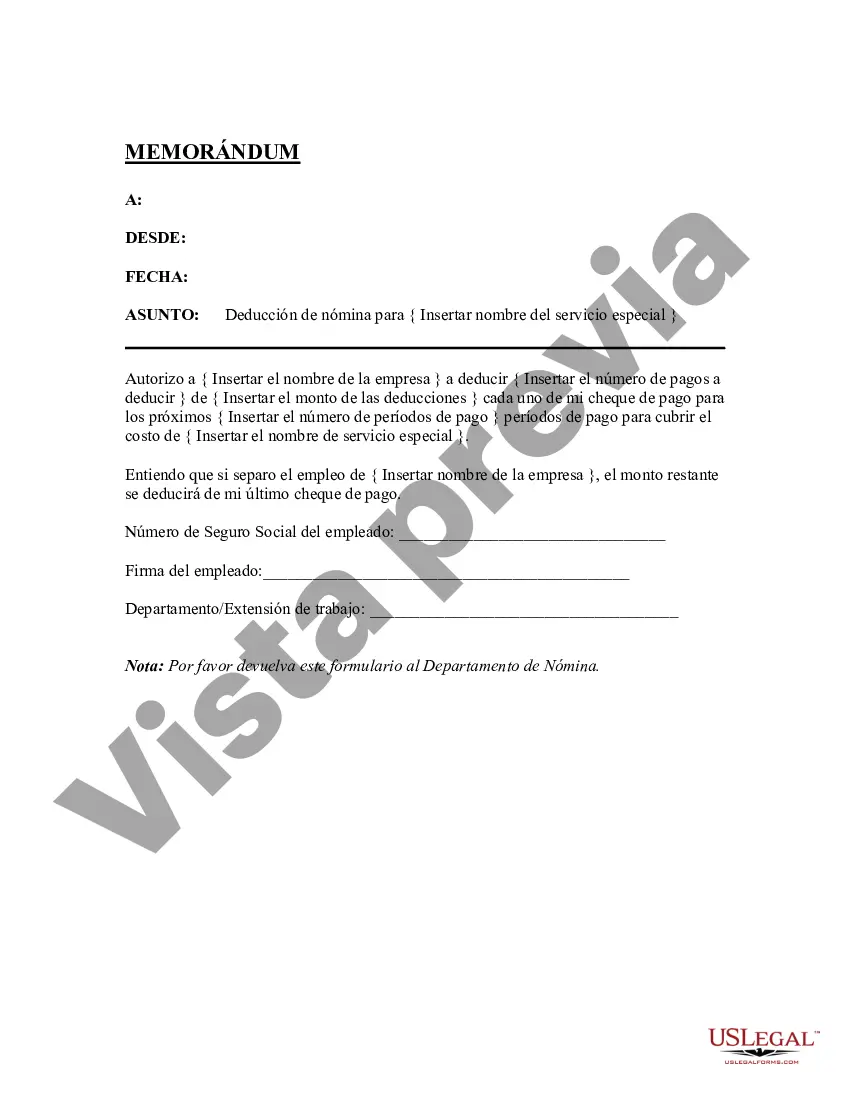

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Colorado Deducción de Nómina - Servicios Especiales - Payroll Deduction - Special Services

Description

How to fill out Colorado Deducción De Nómina - Servicios Especiales?

If you have to comprehensive, download, or print out legal papers templates, use US Legal Forms, the most important assortment of legal forms, that can be found online. Use the site`s simple and easy hassle-free research to find the documents you want. Various templates for enterprise and person reasons are sorted by types and says, or keywords and phrases. Use US Legal Forms to find the Colorado Payroll Deduction - Special Services within a handful of click throughs.

If you are currently a US Legal Forms client, log in to the profile and click on the Obtain option to obtain the Colorado Payroll Deduction - Special Services. You can also accessibility forms you earlier acquired in the My Forms tab of your own profile.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Make sure you have chosen the shape for that correct town/land.

- Step 2. Make use of the Preview method to examine the form`s information. Do not overlook to see the outline.

- Step 3. If you are unsatisfied together with the type, make use of the Research industry on top of the screen to locate other versions in the legal type web template.

- Step 4. After you have discovered the shape you want, go through the Purchase now option. Select the rates program you choose and add your accreditations to register on an profile.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal profile to perform the financial transaction.

- Step 6. Select the formatting in the legal type and download it in your system.

- Step 7. Complete, edit and print out or indicator the Colorado Payroll Deduction - Special Services.

Each and every legal papers web template you buy is yours forever. You may have acces to every type you acquired with your acccount. Click the My Forms portion and select a type to print out or download yet again.

Compete and download, and print out the Colorado Payroll Deduction - Special Services with US Legal Forms. There are many expert and state-distinct forms you can utilize to your enterprise or person requirements.