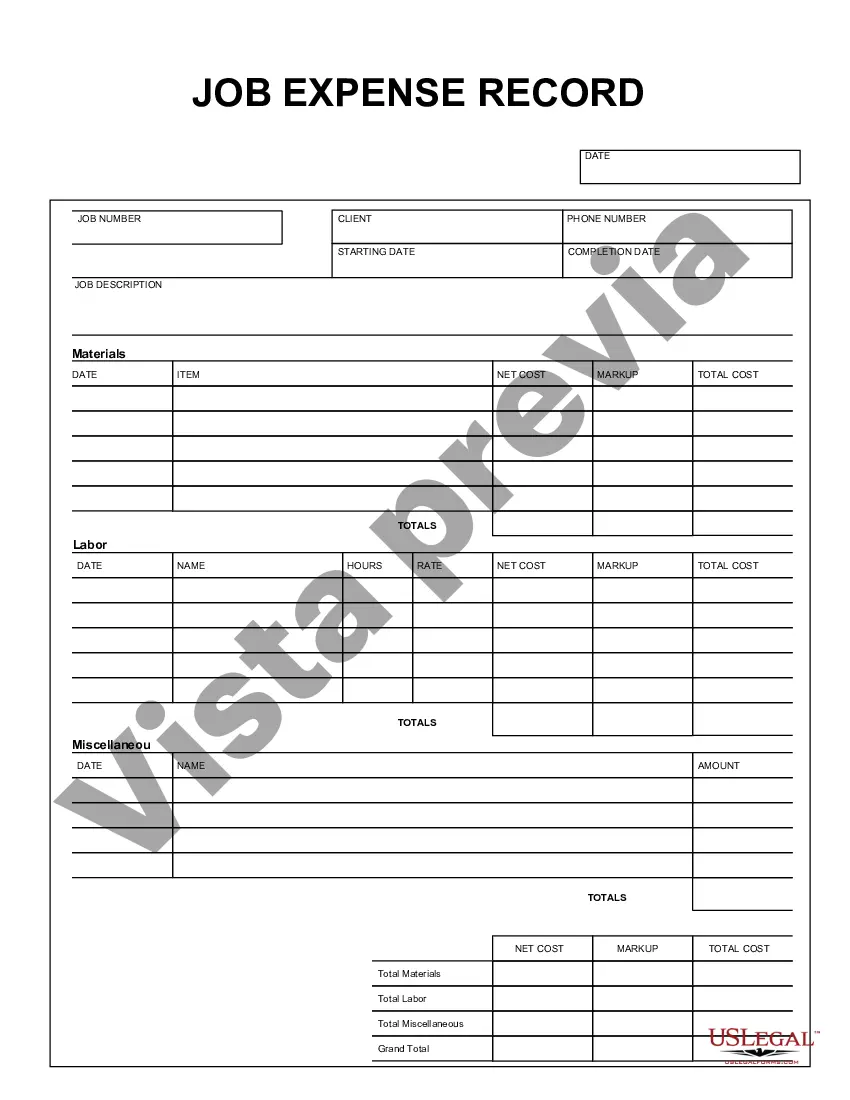

The Colorado Job Expense Record is a crucial document used by individuals and businesses operating within the state of Colorado to track and record job-related expenses. It is a detailed record-keeping tool that helps ensure accurate expense reporting, facilitate tax deductions, and support compliance with financial regulations. This expense record aims to capture all types of job expenses incurred by an individual or business entity based in Colorado. It is designed to account for both business expenses and those reimbursable by employers. The record typically includes categories such as travel expenses, equipment and supply costs, meals and entertainment, vehicle expenses, and other miscellaneous expenses directly related to the job. There are different types of Colorado Job Expense Record templates available to cater to various industries or self-employed individuals' unique needs. Some specific types include: 1. Contractor Job Expense Record: Tailored for contractors, subcontractors, or freelance workers, this type of record allows them to meticulously track job-related expenses, such as material costs, equipment rentals, subcontractor payments, and utility expenses. 2. Sales Representative Job Expense Record: Designed specifically for salespersons, this record helps track and document sales-related expenses, including travel expenses, client meetings, promotional materials, trade show costs, and commission-related expenditures. 3. Remote Worker Job Expense Record: With the rise of remote work, this type of record helps individuals working from home track expenses like office supplies, internet and phone bills, computer or software costs, and even utility bills for deductions or reimbursements. 4. Professional Service Provider Job Expense Record: Tailored for professionals like lawyers, accountants, or consultants, this record assists in tracking work-related expenses such as professional memberships, legal research expenses, continuing education costs, marketing and advertising charges, and conference or networking event expenses. It's worth noting that these are just a few examples, and the Colorado Job Expense Record can be customized to suit other professions or businesses as well. Accurate and exhaustive record-keeping using the Colorado Job Expense Record is vital for businesses and individuals looking to maximize tax deductions and properly manage their financial affairs. Utilizing this tool helps ensure compliance with Colorado state laws and regulations while maintaining transparency in job-related expenditures.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Colorado Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Colorado Registro De Gastos De Trabajo?

You are able to spend time online attempting to find the authorized papers template that fits the federal and state specifications you want. US Legal Forms offers a large number of authorized varieties which can be examined by professionals. You can actually obtain or printing the Colorado Job Expense Record from my support.

If you have a US Legal Forms accounts, you are able to log in and click the Down load button. Afterward, you are able to full, modify, printing, or signal the Colorado Job Expense Record. Every authorized papers template you purchase is your own property eternally. To obtain one more backup of any obtained kind, go to the My Forms tab and click the corresponding button.

Should you use the US Legal Forms site the very first time, stick to the easy guidelines beneath:

- Initially, ensure that you have selected the correct papers template for that state/metropolis of your choosing. Browse the kind information to make sure you have selected the proper kind. If available, take advantage of the Review button to search with the papers template at the same time.

- If you would like discover one more version in the kind, take advantage of the Search field to discover the template that fits your needs and specifications.

- When you have located the template you desire, click on Acquire now to proceed.

- Select the rates prepare you desire, type in your credentials, and sign up for your account on US Legal Forms.

- Total the financial transaction. You can use your Visa or Mastercard or PayPal accounts to fund the authorized kind.

- Select the file format in the papers and obtain it to the product.

- Make modifications to the papers if needed. You are able to full, modify and signal and printing Colorado Job Expense Record.

Down load and printing a large number of papers themes while using US Legal Forms website, which offers the largest assortment of authorized varieties. Use expert and express-particular themes to deal with your company or person requirements.