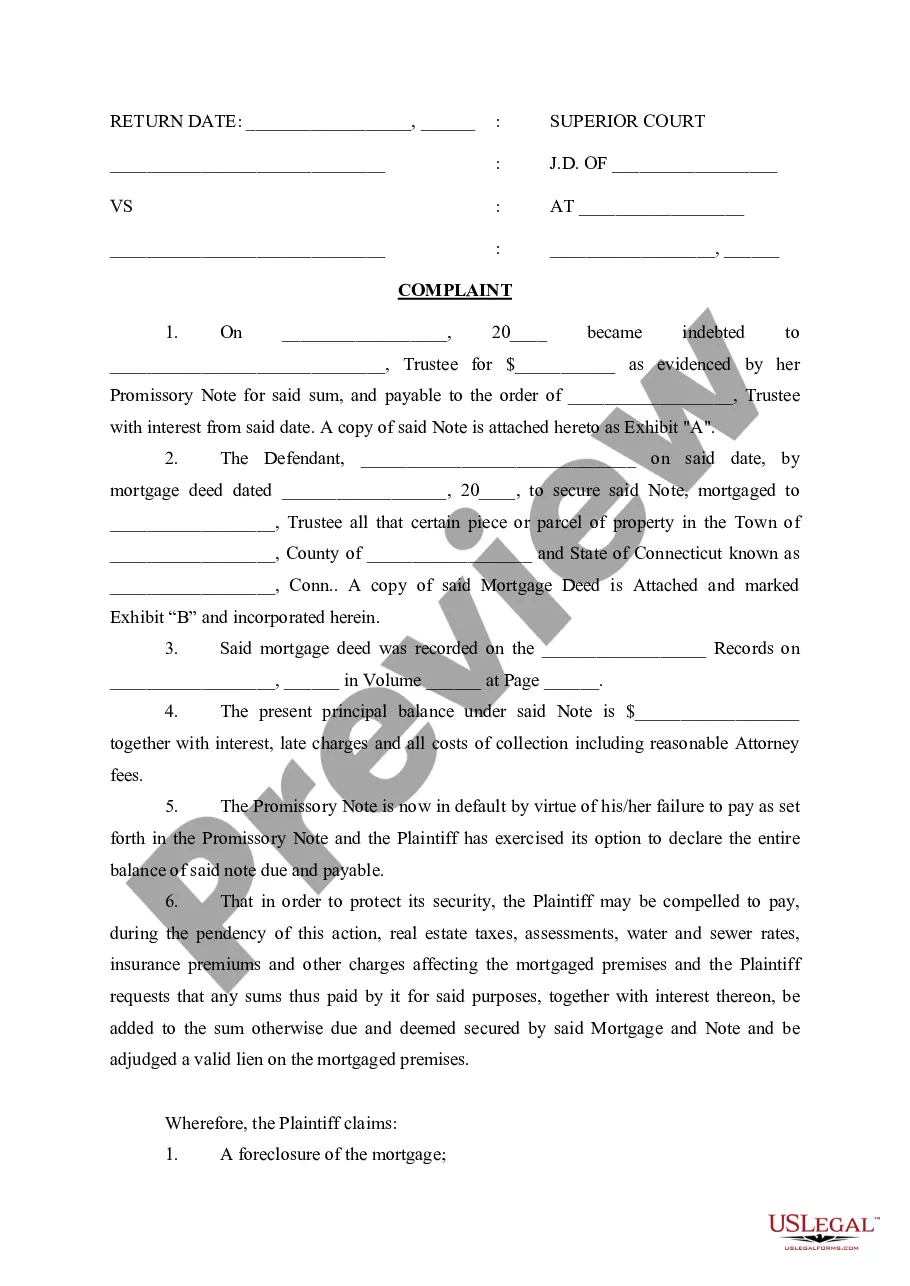

Connecticut Complaint (Default of Promissory Note)

Description

How to fill out Connecticut Complaint (Default Of Promissory Note)?

Utilize US Legal Forms to acquire a printable Connecticut Complaint (Default of Promissory Note). Our court-acceptable forms are created and frequently updated by licensed attorneys.

Ours is the most extensive collection of forms available online and offers budget-friendly and precise templates for clients, legal professionals, and small to medium-sized businesses.

The documents are organized into state-specific categories, and numerous forms can be previewed before downloading.

Create your account and pay using PayPal or a credit card. Download the template to your device and feel welcome to reuse it multiple times. Use the search function if you wish to discover another document template. US Legal Forms provides thousands of legal and tax templates and bundles for business and personal purposes, including Connecticut Complaint (Default of Promissory Note). Over three million users have successfully employed our service. Choose your subscription plan and obtain high-quality documents in just a few clicks.

- To download samples, users need to possess a subscription and to Log In to their account.

- Select Download next to any form you wish and locate it in My documents.

- For those without a subscription, follow the guidelines below to swiftly find and download the Connecticut Complaint (Default of Promissory Note).

- Verify to ensure that you obtain the correct template regarding the state it applies to.

- Examine the form by reviewing the description and utilizing the Preview feature.

- Click Buy Now if it’s the template you require.

Form popularity

FAQ

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

A simple promissory note is a legal document that evidences a loan. The individual or entity executing the note is promising to repay the debt to the lender. The terms of the promissory note include: Parties to the contract.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Deficiency Judgment After a Short Sale in Connecticut In Connecticut, the bank can get a deficiency judgment after a short sale. To avoid a deficiency judgment, a short sale agreement must expressly state that the bank waives its right to the deficiency.

If you are owed money under a promissory note that has not been repaid in full, it may be necessary to file a breach of contract lawsuit.

Foreclosures in Connecticut are judicial, which means they must go through the court.In Connecticut, the foreclosure may be a decree of sale foreclosure, which is basically a typical judicial foreclosure, or a strict foreclosure, a slightly different process.

The owner of the promissory note can file a civil lawsuit against the signer of the note if the signer refuses to pay. The purpose of the lawsuit is to obtain a judgment against the note's signer, which will give the owner of the note the ability to pursue the signer's assets.

A Promissory Note will only be enforceable if it includes all the elements which are necessary to make it a legal document. To make a Promissory Note enforceable, I must contain the following information.Date of Repayment - The note must clearly state the date on which the repayment for the loaned amount must be paid.