Whether you're borrowing money or providing a loan to someone else, a Promissory Note is usually the best way to establish a record of the transaction and make sure that repayment terms, for example, are clear and fair.

However, an “IOU†is generally regarded as only an acknowledgment of a debt, not a promise to pay the debt. However, this form is a written promise to pay a debt.

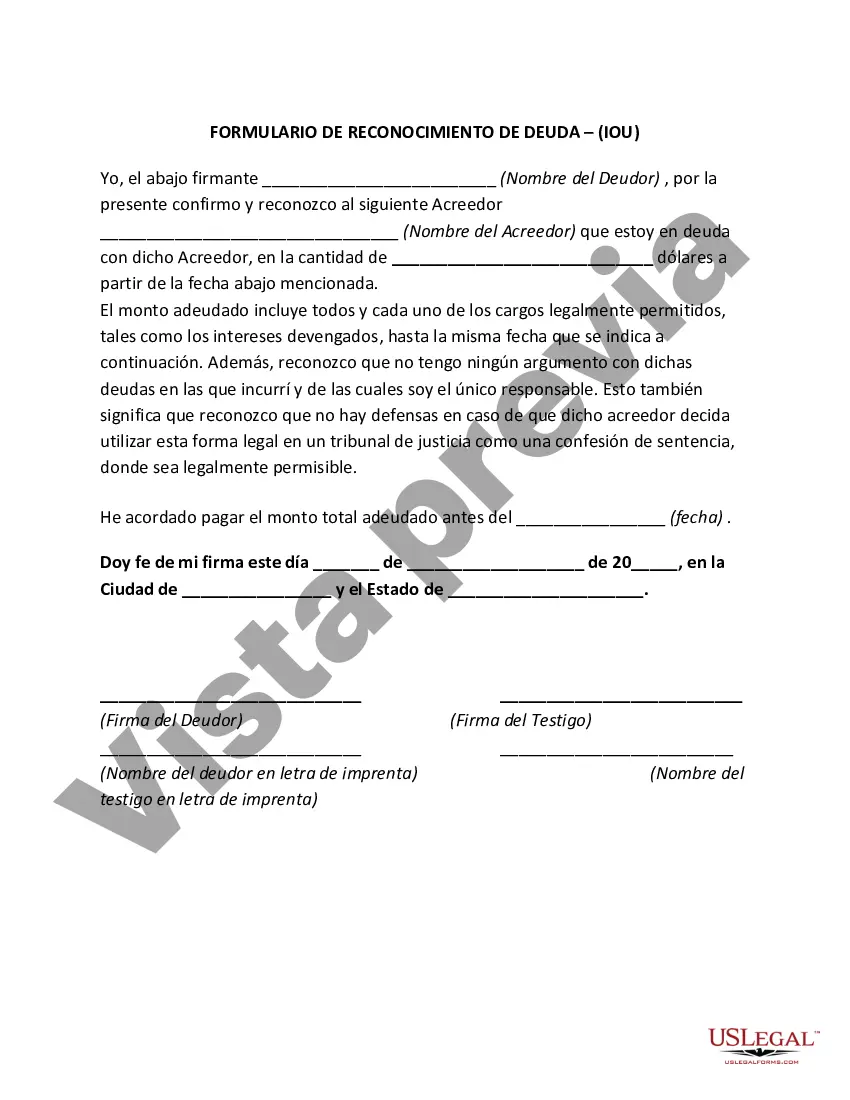

Connecticut Debt Acknowledgment, also known as IOU (I Owe You), is a legal document commonly used in the state of Connecticut to acknowledge and record the existence of a debt owed by one party to another. It serves as evidence of an agreement between the debtor and the creditor, outlining the terms and conditions under which the debt will be repaid. The Connecticut Debt Acknowledgment document generally includes relevant information such as the names and addresses of both the debtor and the creditor, the date of acknowledgment, the amount of debt owed, and any specific terms of repayment agreed upon. It may also include the option to specify interest rates, penalties for late payment, and a repayment schedule. This type of document is typically used for various types of debts, including personal loans, business loans, student loans, and other financial obligations. Different types of Connecticut Debt Acknowledgment or IOU documents may exist based on the specific nature of the debt or the parties involved. For example, there might be separate templates for promissory notes, demand notes, installment payment agreements, or mortgage notes, each tailored to address the specific nuances and legal requirements associated with different types of debts. The Connecticut Debt Acknowledgment — IO— - I Owe You is legally binding, enforceable by the courts, and provides protection for both parties involved. It establishes clear terms and expectations regarding the repayment of the debt, ensuring that all parties have a written record of their agreement to avoid any potential misunderstandings or disputes that may arise in the future. It is important for both the debtor and the creditor to carefully review and understand the terms outlined in the Connecticut Debt Acknowledgment before signing it. If any terms need to be negotiated or amended, it is advisable to consult with legal professionals or financial advisors. Overall, the Connecticut Debt Acknowledgment — IO— - I Owe You is a valuable legal document that facilitates transparency and mutual understanding between debtors and creditors, serving as a written testament to the existence and terms of a debt obligation in the state of Connecticut.Connecticut Debt Acknowledgment, also known as IOU (I Owe You), is a legal document commonly used in the state of Connecticut to acknowledge and record the existence of a debt owed by one party to another. It serves as evidence of an agreement between the debtor and the creditor, outlining the terms and conditions under which the debt will be repaid. The Connecticut Debt Acknowledgment document generally includes relevant information such as the names and addresses of both the debtor and the creditor, the date of acknowledgment, the amount of debt owed, and any specific terms of repayment agreed upon. It may also include the option to specify interest rates, penalties for late payment, and a repayment schedule. This type of document is typically used for various types of debts, including personal loans, business loans, student loans, and other financial obligations. Different types of Connecticut Debt Acknowledgment or IOU documents may exist based on the specific nature of the debt or the parties involved. For example, there might be separate templates for promissory notes, demand notes, installment payment agreements, or mortgage notes, each tailored to address the specific nuances and legal requirements associated with different types of debts. The Connecticut Debt Acknowledgment — IO— - I Owe You is legally binding, enforceable by the courts, and provides protection for both parties involved. It establishes clear terms and expectations regarding the repayment of the debt, ensuring that all parties have a written record of their agreement to avoid any potential misunderstandings or disputes that may arise in the future. It is important for both the debtor and the creditor to carefully review and understand the terms outlined in the Connecticut Debt Acknowledgment before signing it. If any terms need to be negotiated or amended, it is advisable to consult with legal professionals or financial advisors. Overall, the Connecticut Debt Acknowledgment — IO— - I Owe You is a valuable legal document that facilitates transparency and mutual understanding between debtors and creditors, serving as a written testament to the existence and terms of a debt obligation in the state of Connecticut.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.