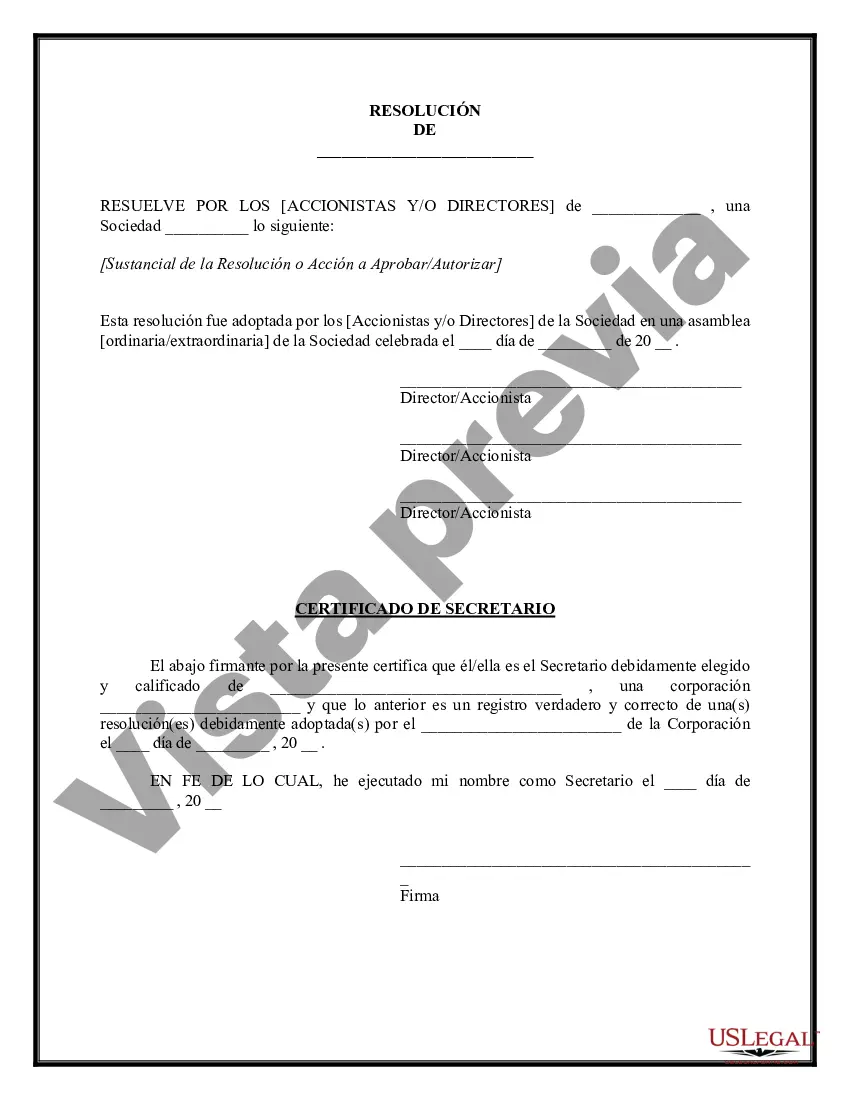

A Connecticut Corporate Resolution for Sole Owner refers to a legal document that outlines the decisions and actions taken by a sole owner of a corporation in the state of Connecticut. This document serves as evidence of a sole owner's approval of significant business matters and is commonly utilized in various corporate transactions and important decision-making processes. One type of Connecticut Corporate Resolution for Sole Owner is the Appointment of Officers resolution. This resolution allows the sole owner to appoint officers for the corporation, such as a president, vice president, treasurer, and secretary. It outlines the responsibilities, powers, and authorities of each officer and ensures that the proper individuals are appointed to key positions within the corporation. Another type is the Authorization to Open a Bank Account resolution. This resolution grants the sole owner the authority to open and operate a bank account on behalf of the corporation. It provides specific instructions and authorizations required by banks or financial institutions to establish the account, such as designating authorized signatories and setting withdrawal limits. Furthermore, the Sale or Transfer of Assets resolution is another relevant type of Connecticut Corporate Resolution for Sole Owner. This resolution enables the sole owner to approve the sale, transfer, or disposal of valuable assets owned by the corporation. It outlines the terms and conditions of the transaction, including the identification of the assets, the buyer or recipient, the purchase price or consideration exchanged, and any conditions or restrictions associated with the transfer. Additionally, the Adoption of Bylaws resolution is crucial for a Connecticut corporation with a sole owner. Bylaws are the rules and regulations that govern how a corporation operates internally. This resolution allows the sole owner to adopt and implement these bylaws, encompassing provisions regarding shareholders' rights, officer elections, board meetings, voting procedures, and other key aspects of the corporation's internal governance. In summary, Connecticut Corporate Resolution for Sole Owner encompasses several distinct types, including Appointment of Officers, Authorization to Open a Bank Account, Sale or Transfer of Assets, and Adoption of Bylaws. These resolutions facilitate the decision-making process for a sole owner, ensuring legal compliance, defining roles and responsibilities, establishing key business relationships, and promoting smooth internal operations within the corporation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Resolución Societaria de Único Propietario - Corporate Resolution for Sole Owner

Description

How to fill out Connecticut Resolución Societaria De Único Propietario?

Choosing the right legal record template could be a battle. Naturally, there are a variety of templates available on the Internet, but how do you find the legal form you need? Take advantage of the US Legal Forms site. The services gives 1000s of templates, such as the Connecticut Corporate Resolution for Sole Owner, which can be used for business and private needs. All the types are examined by specialists and meet state and federal specifications.

When you are presently signed up, log in to your accounts and then click the Download option to find the Connecticut Corporate Resolution for Sole Owner. Make use of accounts to look from the legal types you may have ordered previously. Visit the My Forms tab of your respective accounts and get another copy in the record you need.

When you are a whole new consumer of US Legal Forms, allow me to share straightforward directions so that you can stick to:

- Initial, make certain you have chosen the right form for the metropolis/county. You are able to look through the form while using Review option and study the form description to ensure it will be the best for you.

- In case the form does not meet your requirements, use the Seach discipline to get the appropriate form.

- Once you are certain that the form is proper, go through the Get now option to find the form.

- Pick the pricing prepare you would like and enter in the essential information and facts. Build your accounts and purchase an order utilizing your PayPal accounts or charge card.

- Choose the data file structure and download the legal record template to your device.

- Full, modify and produce and indication the obtained Connecticut Corporate Resolution for Sole Owner.

US Legal Forms is the greatest library of legal types that you will find a variety of record templates. Take advantage of the company to download expertly-produced files that stick to state specifications.