Connecticut Bill of Sale for a Coin Collection serves as a legally binding document that outlines the transfer of ownership of a coin collection from a seller to a buyer. This document ensures both parties are protected and establishes a record of the transaction. It is essential to utilize a bill of sale to have a clear understanding and proof of ownership of the coin collection. The Connecticut Bill of Sale for a Coin Collection typically includes crucial details, such as the names and addresses of both the buyer and the seller, the date of the transaction, a detailed description of the coin collection being sold, including the type, quantity, quality, and any unique characteristics or notable historical value. The bill of sale should also include the agreed-upon purchase price, any down payment made, and the payment method. When preparing a Connecticut Bill of Sale for a Coin Collection, it is important to include specific keywords to accurately describe the transaction and the coin collection being sold. These keywords could include: 1. Coin collection: Mention the specific collection being sold, such as ancient coins, rare gold coins, commemorative coins, or silver dollar coins. 2. Condition: Describe the condition of the coins, such as circulated, proof, or circulated. 3. Appraisals: If the coin collection has been appraised, mention the appraiser's name or a brief appraisal summary. 4. Rarity: Highlight any rare or uncommon coins within the collection, emphasizing their significance and potential value. 5. Historical value: If the coins have historical importance or connections, mention relevant historical events or figures associated with them. 6. Packaging: If the coin collection comes with special packaging, such as a display case or original boxes, include these details. Alternatively, if there are different types of Connecticut Bill of Sale for a Coin Collection, they may include: 1. General Bill of Sale for a Coin Collection: This type of bill of sale is suitable for a straightforward transaction involving standard coin collections without any specific additional terms or conditions. 2. As-Is Bill of Sale for a Coin Collection: This document is specifically used when the seller does not provide any guarantees or warranties about the condition, value, or authenticity of the coins being sold. 3. Certified Authenticity Bill of Sale for a Coin Collection: With this type of bill of sale, the seller certifies that the coins being sold are authentic, outlining any documentation or certifications provided to support their claim. It is crucial to consult an attorney or seek professional advice when creating a Connecticut Bill of Sale for a Coin Collection to ensure compliance with the state's regulations and to accurately reflect the transaction and the specific coin collection involved.

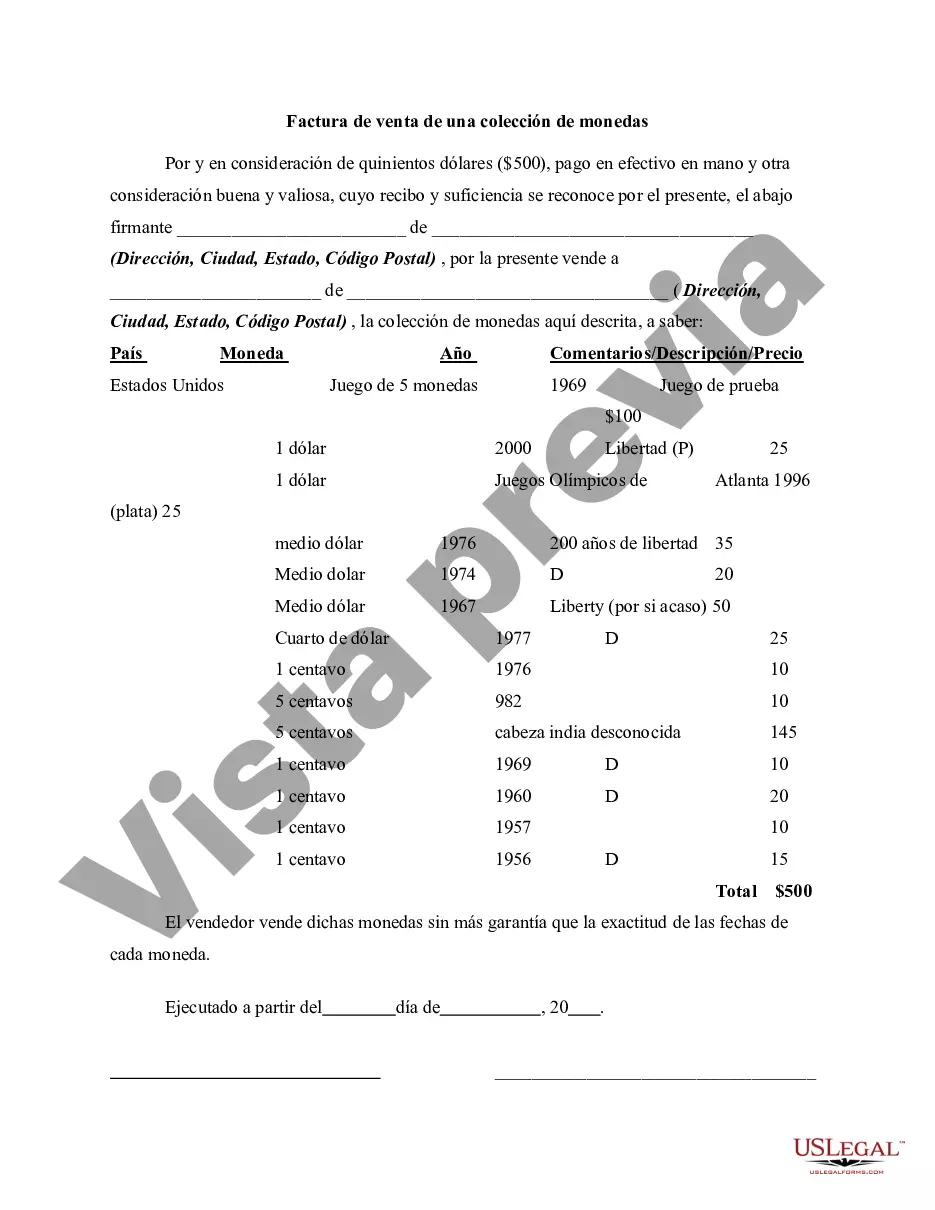

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Factura de venta de una colección de monedas - Bill of Sale for a Coin Collection

Description

How to fill out Connecticut Factura De Venta De Una Colección De Monedas?

Are you in a place in which you need files for either enterprise or person functions nearly every working day? There are tons of legitimate record themes accessible on the Internet, but locating ones you can rely is not straightforward. US Legal Forms offers 1000s of form themes, such as the Connecticut Bill of Sale for a Coin Collection, that are published to satisfy federal and state specifications.

If you are already acquainted with US Legal Forms website and possess your account, merely log in. After that, you may download the Connecticut Bill of Sale for a Coin Collection design.

Unless you come with an profile and want to start using US Legal Forms, adopt these measures:

- Get the form you need and ensure it is to the right city/area.

- Use the Preview button to analyze the shape.

- See the information to ensure that you have selected the proper form.

- In the event the form is not what you`re seeking, make use of the Look for discipline to get the form that meets your needs and specifications.

- If you get the right form, just click Get now.

- Pick the rates prepare you want, submit the specified details to produce your money, and pay money for an order utilizing your PayPal or charge card.

- Choose a convenient paper file format and download your version.

Find each of the record themes you possess purchased in the My Forms food selection. You can obtain a extra version of Connecticut Bill of Sale for a Coin Collection anytime, if needed. Just click on the necessary form to download or print out the record design.

Use US Legal Forms, one of the most extensive collection of legitimate forms, to save lots of time as well as steer clear of errors. The service offers expertly made legitimate record themes which can be used for a range of functions. Create your account on US Legal Forms and start creating your daily life a little easier.