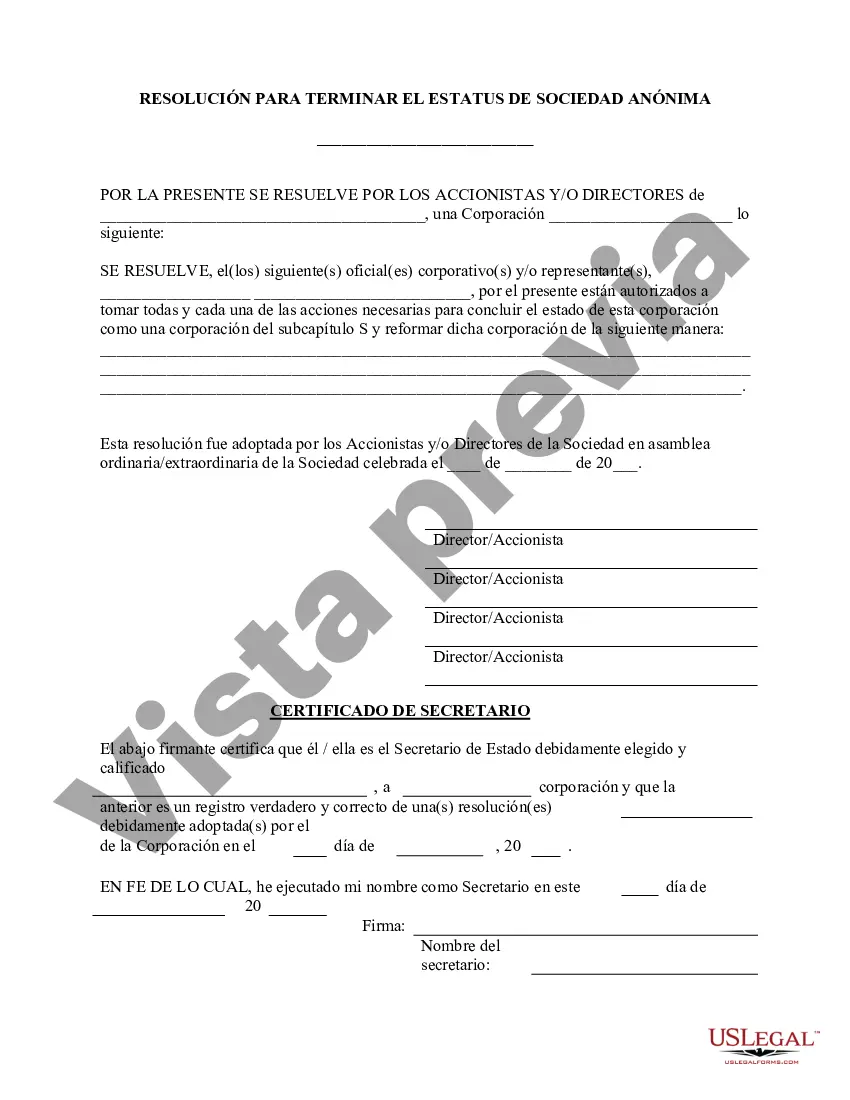

Connecticut Terminate S Corporation Status — Resolution For— - Corporate Resolutions Connecticut Terminate S Corporation Status — Resolution Form is an essential document used by businesses operating as S Corporations in Connecticut to formally terminate their S Corporation status. Termination of S Corporation status may be necessary for various reasons, such as a change in business structure, shifts in ownership, or changes in the company's overall strategy. By filing the Terminate S Corporation Status — Resolution Form, the S Corporation effectively ends its status as an S Corporation, resulting in a shift to a regular C Corporation or other business entity. This form is required to be filed with the Connecticut Secretary of the State to ensure compliance with state regulations. The Terminate S Corporation Status — Resolution Form contains key details that must be provided accurately to complete the process. The document typically includes essential information such as the S Corporation's name, the date of termination, reasons for termination, and the effective date of termination. The form may also require details regarding the distribution of assets and liabilities among shareholders and any necessary amendments to the company's bylaws or operating agreements. It is important to note that different types of Terminate S Corporation Status — Resolution Forms may exist, depending on the specific circumstances of the S Corporation. For example, some forms may cater to small businesses with a limited number of shareholders, while others may accommodate larger corporations with complex ownership structures. The termination process for S Corporations may involve additional steps, such as filing final tax returns or submitting dissolution documents. It is advisable for businesses considering terminating their S Corporation status in Connecticut to consult with legal and tax professionals to ensure compliance with all necessary regulations and obligations. In conclusion, the Connecticut Terminate S Corporation Status — Resolution Form plays a crucial role in officially terminating the S Corporation status of a business. This form allows businesses to transition to a different business structure or entity and should be filed with the Connecticut Secretary of the State. Seeking professional guidance is recommended to navigate the termination process successfully.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Terminar el estado de la corporación S - Formulario de resolución - Resoluciones corporativas - Terminate S Corporation Status - Resolution Form - Corporate Resolutions

Description

How to fill out Connecticut Terminar El Estado De La Corporación S - Formulario De Resolución - Resoluciones Corporativas?

If you wish to comprehensive, obtain, or print out legitimate record layouts, use US Legal Forms, the most important collection of legitimate forms, that can be found on the Internet. Make use of the site`s basic and handy lookup to find the documents you want. A variety of layouts for business and person purposes are categorized by types and states, or search phrases. Use US Legal Forms to find the Connecticut Terminate S Corporation Status - Resolution Form - Corporate Resolutions with a number of click throughs.

When you are previously a US Legal Forms customer, log in to your accounts and click the Down load switch to find the Connecticut Terminate S Corporation Status - Resolution Form - Corporate Resolutions. You can even gain access to forms you previously saved in the My Forms tab of your own accounts.

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for your correct town/country.

- Step 2. Make use of the Preview choice to examine the form`s articles. Never neglect to read the description.

- Step 3. When you are unhappy using the form, take advantage of the Look for industry towards the top of the display screen to find other models of the legitimate form format.

- Step 4. Upon having found the form you want, click on the Acquire now switch. Opt for the costs prepare you choose and put your qualifications to register for an accounts.

- Step 5. Process the purchase. You can utilize your credit card or PayPal accounts to finish the purchase.

- Step 6. Choose the formatting of the legitimate form and obtain it on your product.

- Step 7. Full, edit and print out or sign the Connecticut Terminate S Corporation Status - Resolution Form - Corporate Resolutions.

Every legitimate record format you get is yours eternally. You have acces to each and every form you saved in your acccount. Click on the My Forms portion and choose a form to print out or obtain once more.

Remain competitive and obtain, and print out the Connecticut Terminate S Corporation Status - Resolution Form - Corporate Resolutions with US Legal Forms. There are many professional and status-specific forms you can use for your business or person needs.