Connecticut Shareholders Agreement — Short Form is a legally binding document designed to outline the rights, responsibilities, and obligations of shareholders within a company registered in the state of Connecticut. This agreement aims to provide clarity and protection to all parties involved, including shareholders, directors, and the company itself. The Connecticut Shareholders Agreement — Short Form covers a wide range of crucial aspects, such as share ownership, voting rights, dividend distributions, management decisions, conflict resolution, and restrictions on the sale or transfer of shares. This agreement serves as a foundational framework to ensure smooth operations within the company. Key terms and provisions commonly found within the Connecticut Shareholders Agreement — Short Form may include the following: 1. Share Ownership: This section clarifies the number and type of shares held by each shareholder, their respective voting rights, and the classes of shares issued. 2. Dividend Distribution: It outlines how and when dividends will be distributed to shareholders, taking into account any reinvestment options. 3. Management Decision-making: This clause defines the decision-making process within the company, such as the selection of directors, appointment of officers, and strategic decision authority. 4. Shareholder Obligations: It details the duties and obligations of each shareholder, including their roles, responsibilities, and time commitment to the company. 5. Sale and Transfer Restrictions: This section sets out the conditions and restrictions pertaining to the sale or transfer of shares, ensuring that shareholders cannot easily dispose of their shares without adhering to specific guidelines. 6. Non-competition and Non-disclosure: It may include provisions that prevent shareholders from engaging in activities that may compete with the company and restrict the sharing of confidential information. 7. Dispute Resolution: This clause identifies the methods of resolving disputes, such as arbitration or mediation, to avoid costly litigation. It is important to note that there aren't different types of Connecticut Shareholders Agreement — Short Form per se. However, customized versions may be tailored to suit the specific needs of different companies, industries, or shareholder arrangements. In summary, the Connecticut Shareholders Agreement — Short Form is a comprehensive legal document that outlines the rights and responsibilities of shareholders within a company. By clearly defining the terms and expectations, this agreement sets the foundation for fair and transparent business operations in accordance with Connecticut law.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Acuerdo de Accionistas - Forma Corta - Shareholders Agreement - Short Form

Description

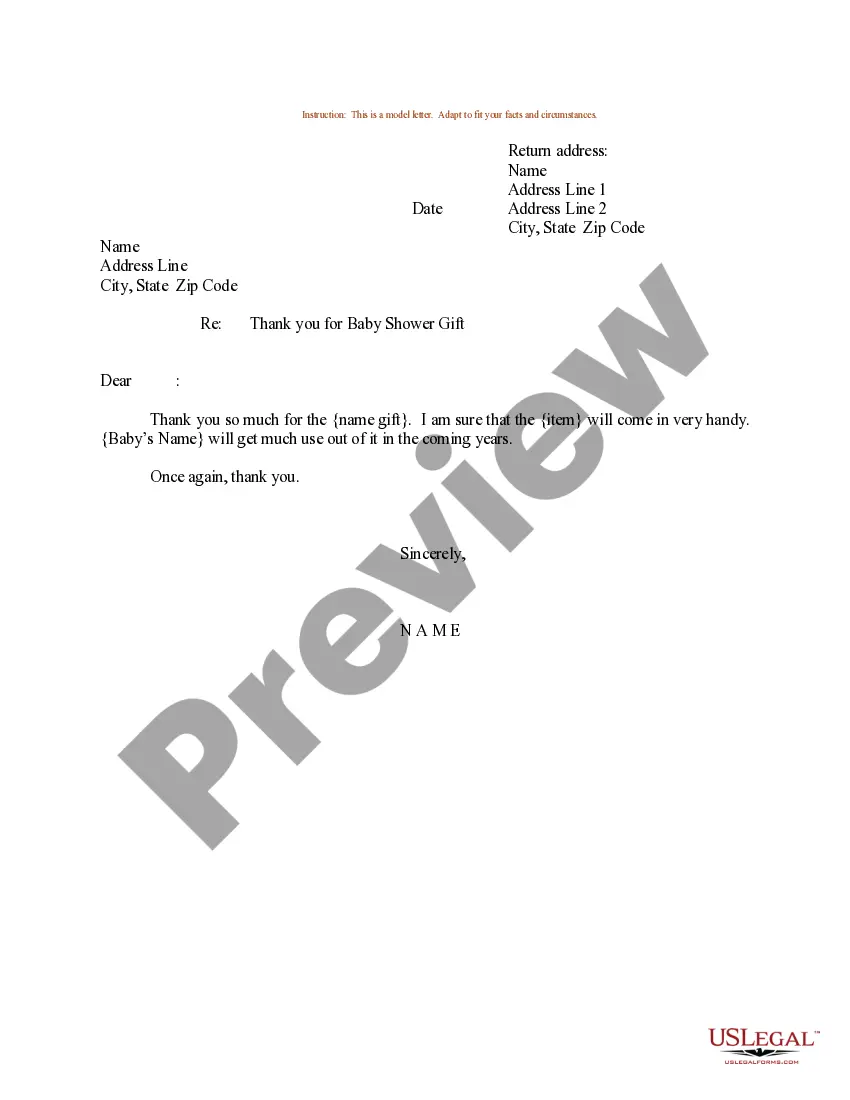

How to fill out Connecticut Acuerdo De Accionistas - Forma Corta?

Discovering the right lawful record template can be quite a have a problem. Needless to say, there are tons of templates available on the Internet, but how do you discover the lawful type you need? Take advantage of the US Legal Forms internet site. The service offers a huge number of templates, such as the Connecticut Shareholders Agreement - Short Form, that you can use for business and private demands. Each of the types are examined by specialists and meet federal and state demands.

Should you be already signed up, log in for your profile and then click the Acquire option to find the Connecticut Shareholders Agreement - Short Form. Make use of your profile to appear throughout the lawful types you might have purchased in the past. Check out the My Forms tab of the profile and obtain yet another duplicate from the record you need.

Should you be a fresh user of US Legal Forms, here are simple recommendations so that you can stick to:

- Initially, make certain you have selected the appropriate type for your city/county. You can examine the shape making use of the Review option and read the shape description to make sure this is basically the best for you.

- If the type does not meet your expectations, make use of the Seach discipline to discover the appropriate type.

- When you are sure that the shape would work, go through the Buy now option to find the type.

- Choose the costs program you would like and enter in the essential information. Build your profile and buy the transaction utilizing your PayPal profile or bank card.

- Select the file format and obtain the lawful record template for your system.

- Complete, revise and print out and signal the received Connecticut Shareholders Agreement - Short Form.

US Legal Forms is definitely the most significant collection of lawful types in which you will find various record templates. Take advantage of the service to obtain expertly-produced documents that stick to condition demands.