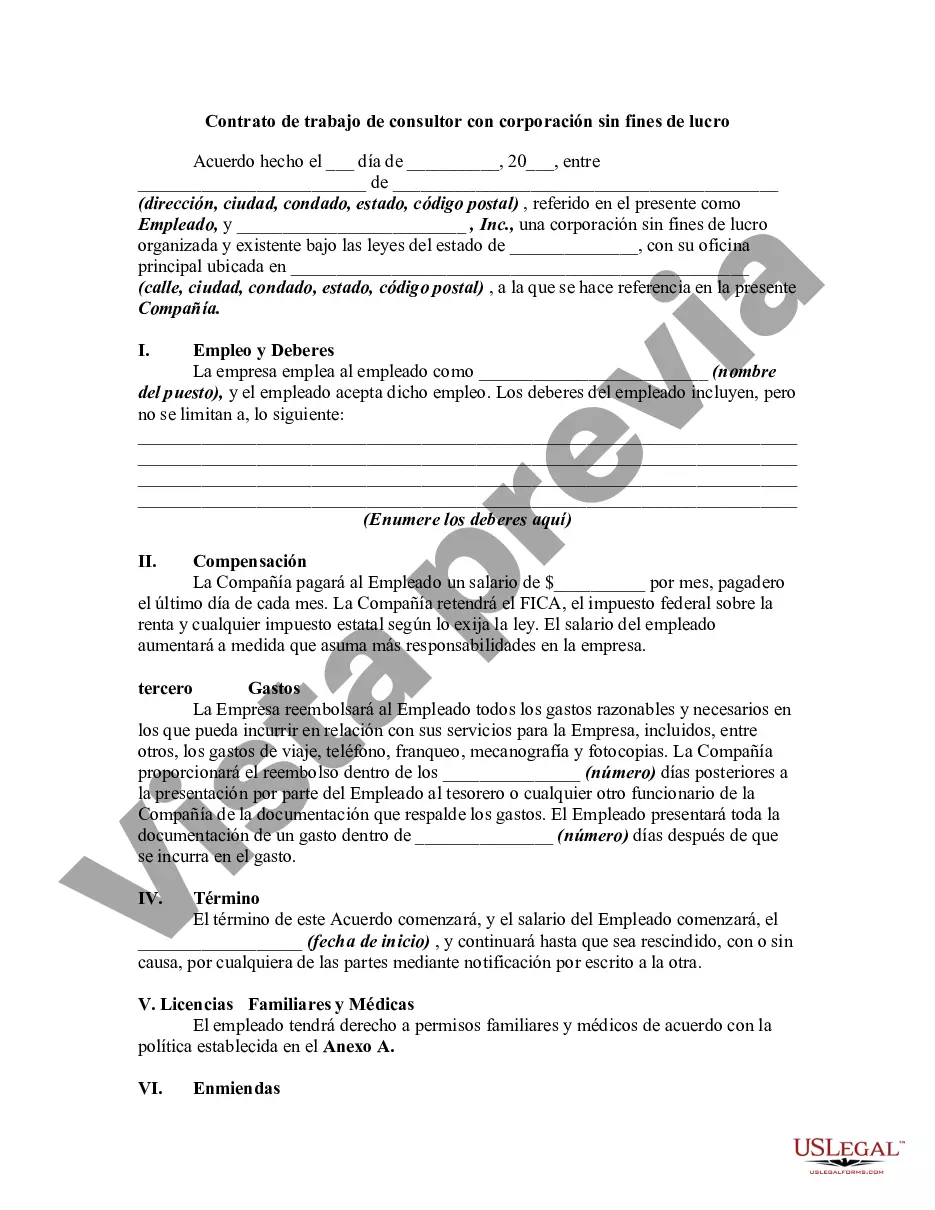

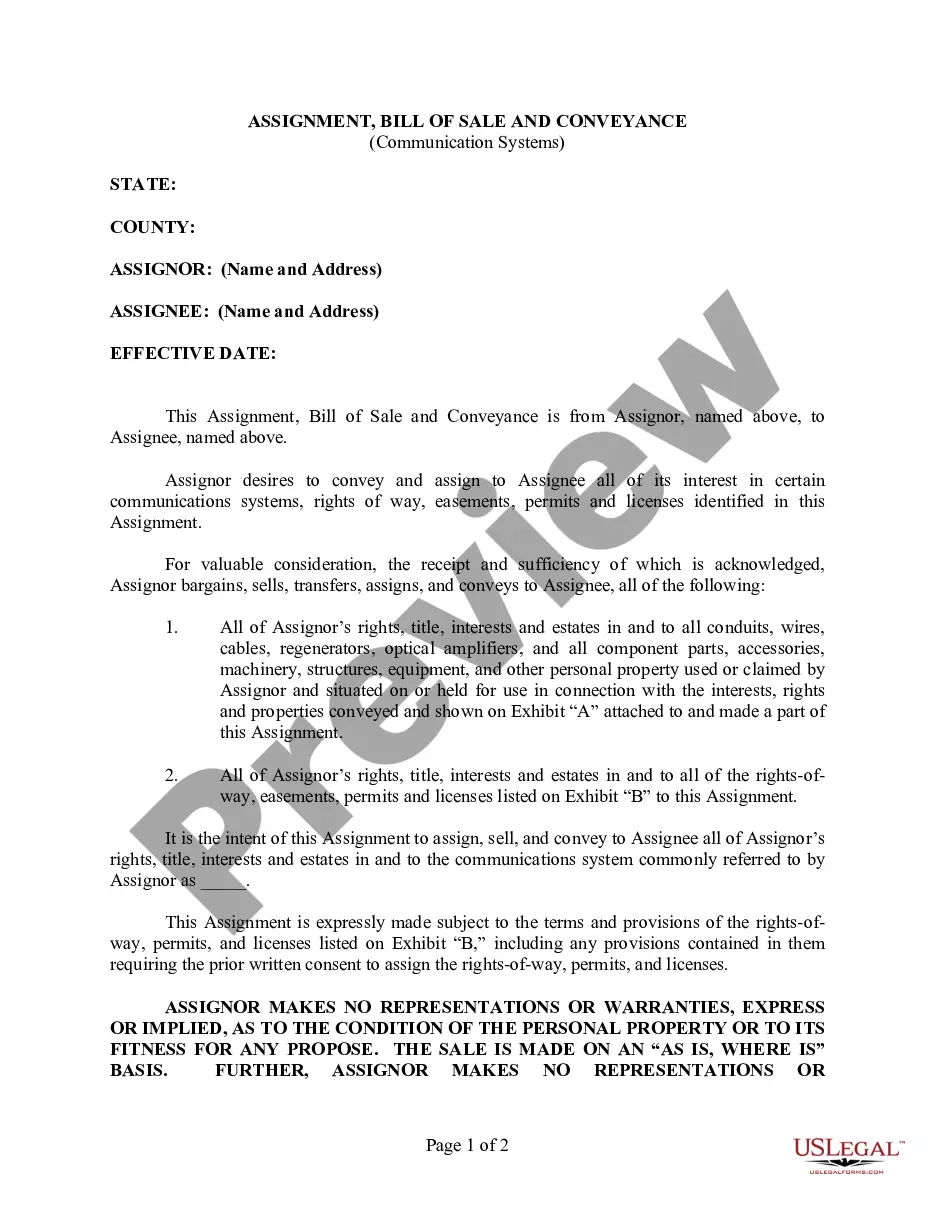

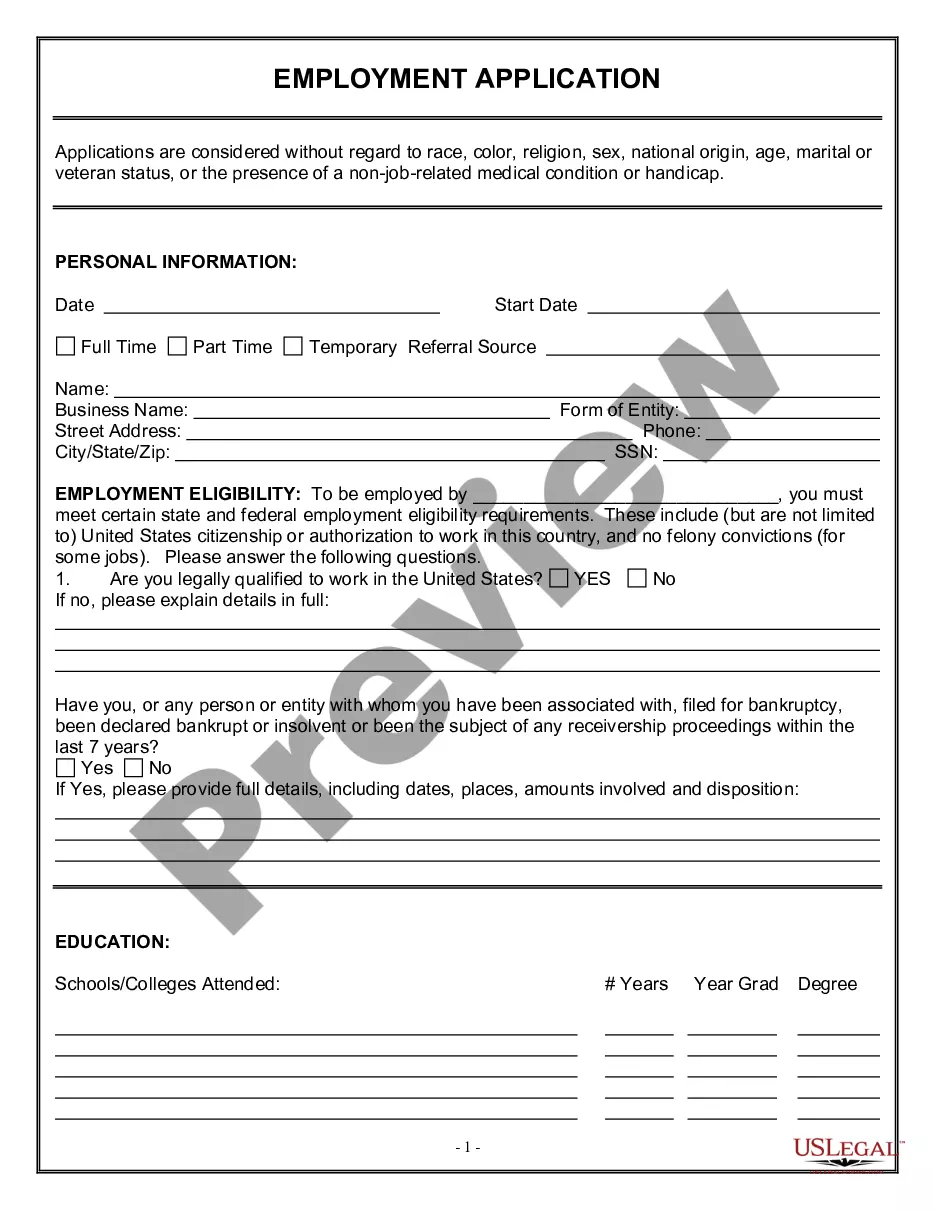

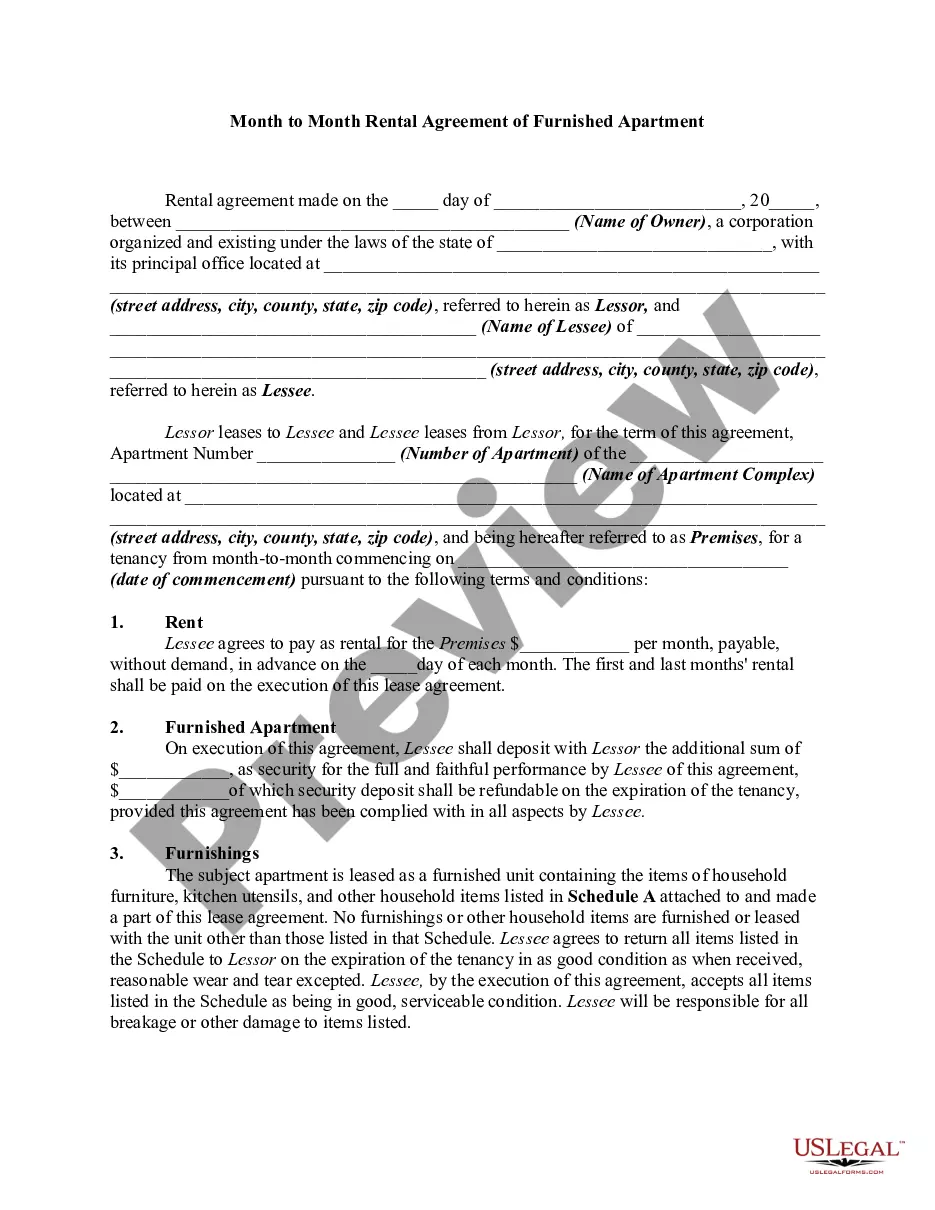

Connecticut Employment Contract of Consultant with Nonprofit Corporation serves as a legal agreement between a nonprofit corporation and a consultant hired for a specific project or task. This contract outlines the terms and conditions of employment, ensuring clarity and protection for both parties involved. Various types of Connecticut Employment Contract of Consultant with Nonprofit Corporation include: 1. General Consultant Employment Contract: This type of contract applies to consultants who provide their expertise and advice on various areas such as fundraising, marketing, program development, or strategic planning. It covers the consultant's roles, responsibilities, compensation, and duration of engagement. 2. Project-based Consultant Employment Contract: This contract is specifically tailored for consultants hired for a specific project or task. It defines the scope of work, project objectives, timelines, deliverables, and project-based compensation. 3. Independent Contractor Agreement: This type of contract applies to consultants who work independently and are not considered employees of the nonprofit corporation. Independent contractors have more autonomy in their work, manage their own taxes, and provide their own equipment. Key elements typically included in a Connecticut Employment Contract of Consultant with Nonprofit Corporation are: 1. Identification of Parties: The contract identifies the nonprofit corporation and the consultant, ensuring both parties' full legal names and addresses are provided. 2. Scope of Work: The contract outlines the specific services the consultant will provide, ensuring clarity on the expected deliverables and the scope of the project. 3. Compensation and Payment Terms: This section defines how and when the consultant will be paid, including details about the hourly rate, flat fee, or the agreed-upon compensation structure. 4. Confidentiality and Non-Disclosure: Consultants often have access to sensitive information regarding the nonprofit's operations, finances, or future plans. This clause protects this information and ensures it remains confidential even after the contract is terminated. 5. Termination Clause: This outlines the circumstances under which either party can terminate the contract, including notice periods and any associated penalties or obligations. 6. Intellectual Property Rights: If the consultant is creating any intellectual property during their engagement with the nonprofit corporation, such as reports, designs, or software, this clause determines ownership and usage rights. 7. Indemnification and Liability: These terms specify the consultant's liability, ensuring they are responsible for any legal claims arising out of their actions or advice during the project. It also addresses any insurance requirements or indemnification obligations. 8. Governing Law and Jurisdiction: This section determines which state laws apply to the contract and which courts have jurisdiction in the event of a dispute. It's important to note that while this description provides a general overview, it is crucial for both the nonprofit corporation and the consultant to seek legal advice to ensure compliance with specific Connecticut labor laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Contrato de trabajo de consultor con corporación sin fines de lucro - Employment Contract of Consultant with Nonprofit Corporation

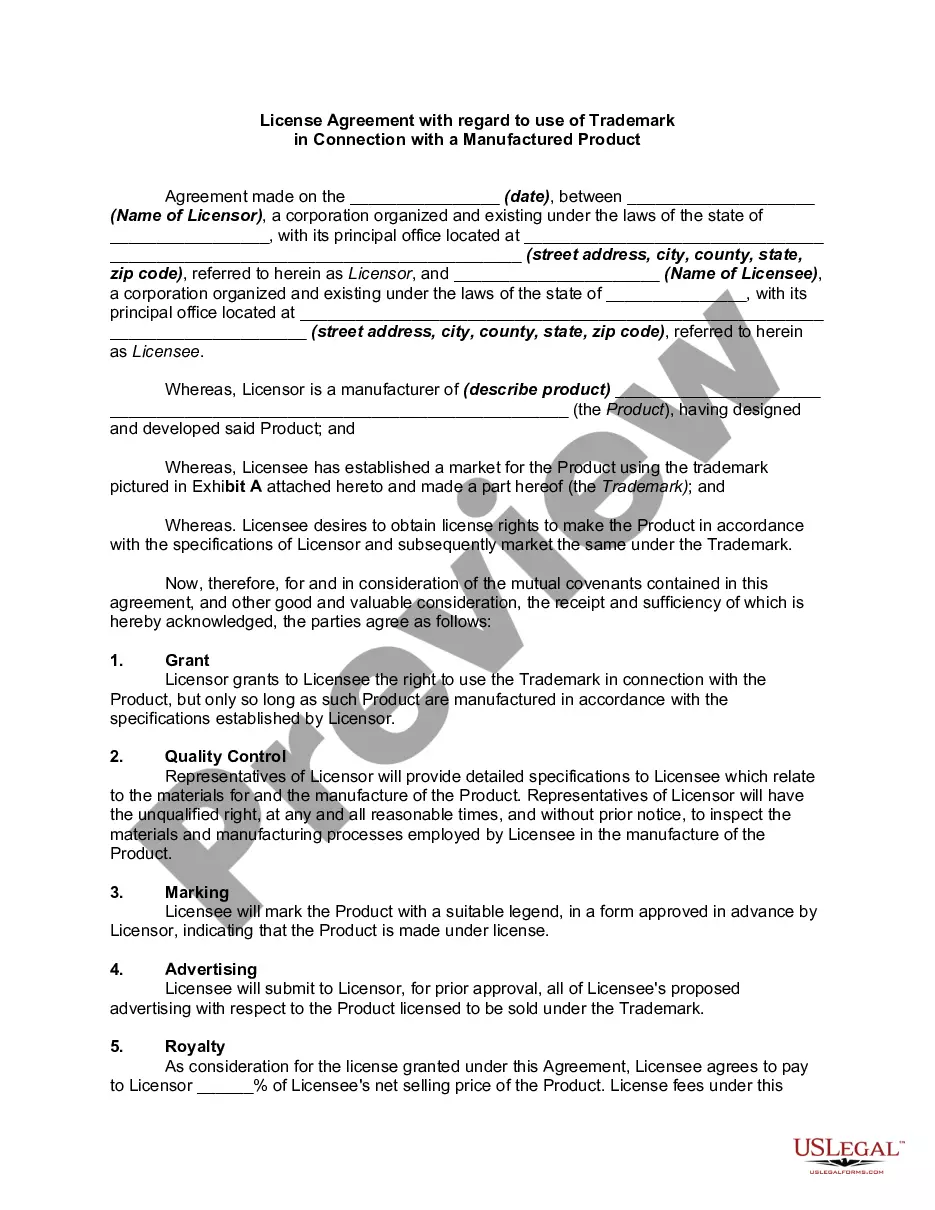

Description

How to fill out Connecticut Contrato De Trabajo De Consultor Con Corporación Sin Fines De Lucro?

Are you within a position in which you require paperwork for sometimes company or personal uses just about every time? There are tons of lawful document templates available online, but getting versions you can trust isn`t simple. US Legal Forms delivers a large number of develop templates, such as the Connecticut Employment Contract of Consultant with Nonprofit Corporation, which are published to fulfill federal and state needs.

Should you be previously informed about US Legal Forms internet site and possess a merchant account, basically log in. Next, you are able to acquire the Connecticut Employment Contract of Consultant with Nonprofit Corporation web template.

Should you not provide an profile and wish to begin using US Legal Forms, adopt these measures:

- Obtain the develop you require and ensure it is for the proper metropolis/region.

- Take advantage of the Review option to check the form.

- See the information to ensure that you have selected the proper develop.

- If the develop isn`t what you are searching for, use the Look for discipline to find the develop that meets your needs and needs.

- Once you get the proper develop, simply click Buy now.

- Pick the prices plan you want, complete the required information and facts to generate your account, and buy an order utilizing your PayPal or credit card.

- Pick a hassle-free data file structure and acquire your version.

Find all the document templates you may have bought in the My Forms menu. You can aquire a extra version of Connecticut Employment Contract of Consultant with Nonprofit Corporation anytime, if needed. Just click on the essential develop to acquire or print out the document web template.

Use US Legal Forms, the most extensive collection of lawful varieties, to conserve efforts and stay away from errors. The assistance delivers expertly manufactured lawful document templates that you can use for a variety of uses. Make a merchant account on US Legal Forms and begin creating your daily life easier.