Connecticut Sample Letter for Request for Free Credit Report Allowed by Federal Law [Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Credit Reporting Agency Name] [Agency Address] [City, State, ZIP Code] Subject: Request for Free Credit Report allowed by Federal Law Dear [Credit Reporting Agency Name], I hope this letter finds you well. As a resident of Connecticut, I am exercising my right under the Fair Credit Reporting Act (FCRA), a federal law that allows consumers to obtain a free copy of their credit report once every 12 months from each of the nationwide credit reporting agencies. Hence, I kindly request you to provide me with a free copy of my credit report. Please find my personal information below for identification purposes: Full Name: [Your Full Name] Date of Birth: [Your Date of Birth] Social Security Number: [Your Social Security Number] Current Address: [Your Current Address] Previous Address (if applicable): [Your Previous Address] Phone Number: [Your Phone Number] Email Address: [Your Email Address] To support my request, I have enclosed a copy of my identification documents, as required by law. These documents include: 1. Proof of Identity: [e.g., Copy of Driver's License, Passport] 2. Proof of Address: [e.g., Utility Bill, Bank Statement] Kindly note that I am aware of the laws governing credit reporting agencies, such as the requirement to respond to my request within 30 days. If there are any complications or an extension is necessary, please inform me promptly in writing. Furthermore, I would like to ensure my credit information is accurate, complete, and up-to-date, in accordance with the FCRA. Should I find any discrepancies or errors, I kindly request you to investigate and rectify them as per the statutory guidelines. The free credit report should encompass all relevant information pertaining to my credit history, including but not limited to: 1. Personal Information: Full name, address, date of birth, social security number. 2. Summary of Accounts: Open and closed accounts, including credit cards, loans, and mortgages. 3. Payment History: Payment patterns, delinquencies, defaults, and bankruptcies. 4. Recent Credit Inquiries: List of entities who have reviewed my credit report within the last 12 months. 5. Public Records: Court records, tax liens, and judgments. If there are any additional disclosures or documents necessary to complete my request for a free credit report, kindly let me know immediately. Thank you for your prompt attention to this matter. Please ensure that the credit report is mailed to the address mentioned above. Should you have any questions or need further clarification, please do not hesitate to contact me directly. I deeply appreciate your assistance in this matter and look forward to receiving my credit report within the required timeframe. Yours sincerely, [Your Full Name]

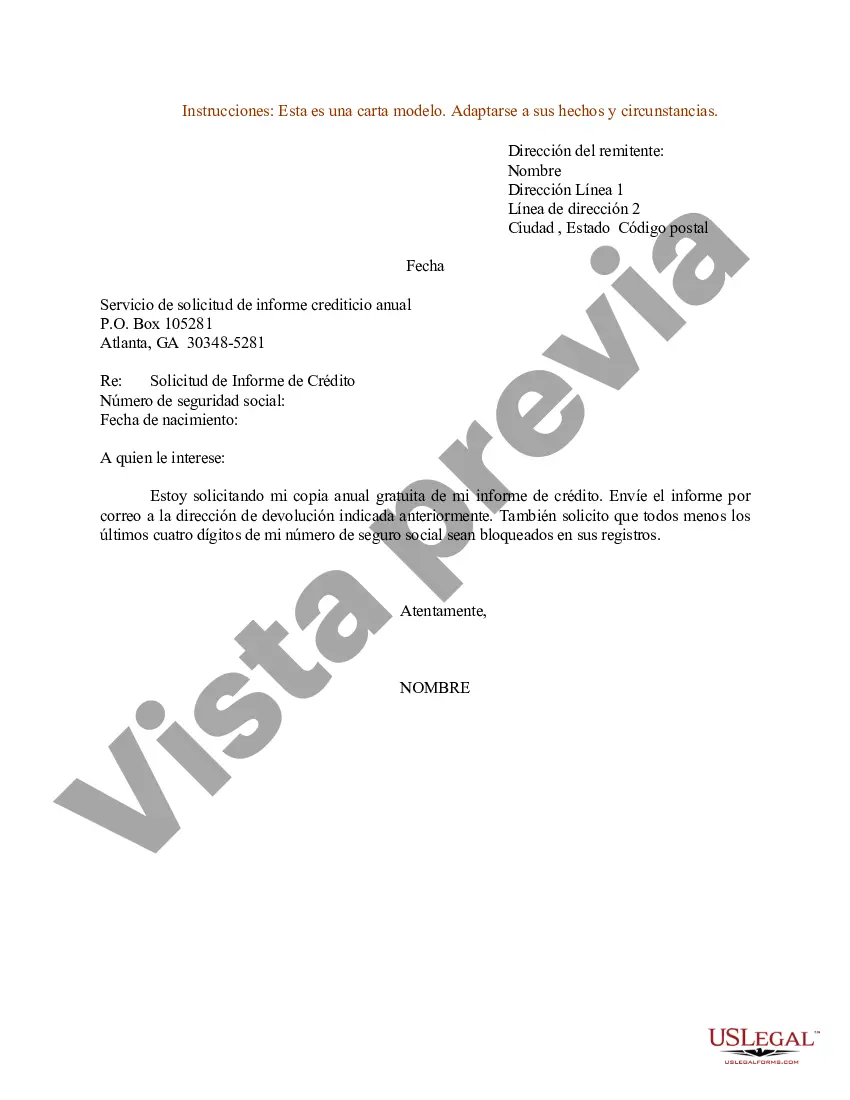

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Ejemplo de carta de solicitud de informe de crédito gratuito permitido por la ley federal - Sample Letter for Request for Free Credit Report Allowed by Federal Law

Description

How to fill out Connecticut Ejemplo De Carta De Solicitud De Informe De Crédito Gratuito Permitido Por La Ley Federal?

You are able to commit hrs online attempting to find the legal file format that suits the federal and state needs you want. US Legal Forms supplies thousands of legal types that are reviewed by experts. You can actually obtain or print the Connecticut Sample Letter for Request for Free Credit Report Allowed by Federal Law from your services.

If you already possess a US Legal Forms bank account, you may log in and then click the Download button. Following that, you may full, modify, print, or indication the Connecticut Sample Letter for Request for Free Credit Report Allowed by Federal Law. Each legal file format you acquire is the one you have forever. To get yet another duplicate associated with a purchased kind, visit the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms website the first time, stick to the easy instructions listed below:

- Initially, ensure that you have selected the proper file format for that state/area of your liking. Read the kind description to ensure you have picked the proper kind. If readily available, make use of the Review button to search throughout the file format too.

- If you wish to discover yet another model of your kind, make use of the Research area to obtain the format that meets your needs and needs.

- Upon having discovered the format you need, click on Purchase now to continue.

- Select the costs strategy you need, enter your accreditations, and register for a merchant account on US Legal Forms.

- Total the deal. You should use your credit card or PayPal bank account to cover the legal kind.

- Select the structure of your file and obtain it to your device.

- Make modifications to your file if necessary. You are able to full, modify and indication and print Connecticut Sample Letter for Request for Free Credit Report Allowed by Federal Law.

Download and print thousands of file templates making use of the US Legal Forms web site, which provides the most important variety of legal types. Use professional and express-distinct templates to tackle your business or individual requirements.