Connecticut Limited Liability Partnership Agreement: A Detailed Description A Connecticut Limited Liability Partnership (LLP) Agreement is a legal document that establishes the rights, responsibilities, and obligations of partners in a limited liability partnership in the state of Connecticut. This agreement is crucial for formalizing the relationship between partners and ensuring the smooth functioning and governance of the LLP. Key Elements of a Connecticut Limited Liability Partnership Agreement: 1. Name and Purpose: The agreement begins by stating the LLP's name and purpose, outlining the primary objectives and activities in which the partnership will engage. 2. Partnership Contributions: It defines the partners' capital contributions, specifying the monetary value, assets, or services that each partner brings to the LLP. 3. Profit and Loss Allocation: This section outlines how profits and losses will be shared among the partners. It may be based on the amount of capital contribution or other agreed-upon criteria. 4. Management and Decision-Making: The agreement clearly defines the decision-making process within the LLP, covering areas such as voting rights, decision-making authority, management roles, and procedures for resolving disputes. 5. Partner Withdrawal or Admission: The agreement outlines the procedures and conditions for admitting new partners or removing existing ones. It may cover aspects like partner retirement, resignation, death, or any transfer of partnership interests. 6. Dissolution and Liquidation: It provides guidelines for the dissolution of the LLP, specifying the events or circumstances that may trigger it. Additionally, it covers the procedures for distributing the assets and liabilities among the partners during the liquidation process. Types of Connecticut Limited Liability Partnership Agreements: 1. General Connecticut LLP Agreement: This is the standard agreement used by most Connecticut Laps, covering all essential elements outlined above. 2. Connecticut LLP Agreement for Professional Service Providers: This specific agreement is designed for professional firms such as lawyers, accountants, architects, and engineers. It takes into account the regulations and requirements specific to these industries. 3. Connecticut LLP Agreement with Capital Contributions: This agreement is suitable when partners contribute capital to the LLP. It details the terms and conditions of these contributions and their impact on profit and loss allocations. 4. Connecticut LLP Agreement with Equal Sharing: In cases where partners agree to an equal sharing of both profits and losses, this agreement provides the necessary framework for such arrangements. It's important to note that although these are common types of Connecticut LLP agreements, the specific agreement used by a partnership can be customized to meet the unique needs and preferences of the partners involved. Creating a comprehensive Connecticut Limited Liability Partnership Agreement is crucial for establishing a strong foundation and ensuring a fair and transparent operational structure within the LLP. Seeking legal counsel is highly recommended drafting an agreement tailored to the specific objectives and requirements of the partnership.

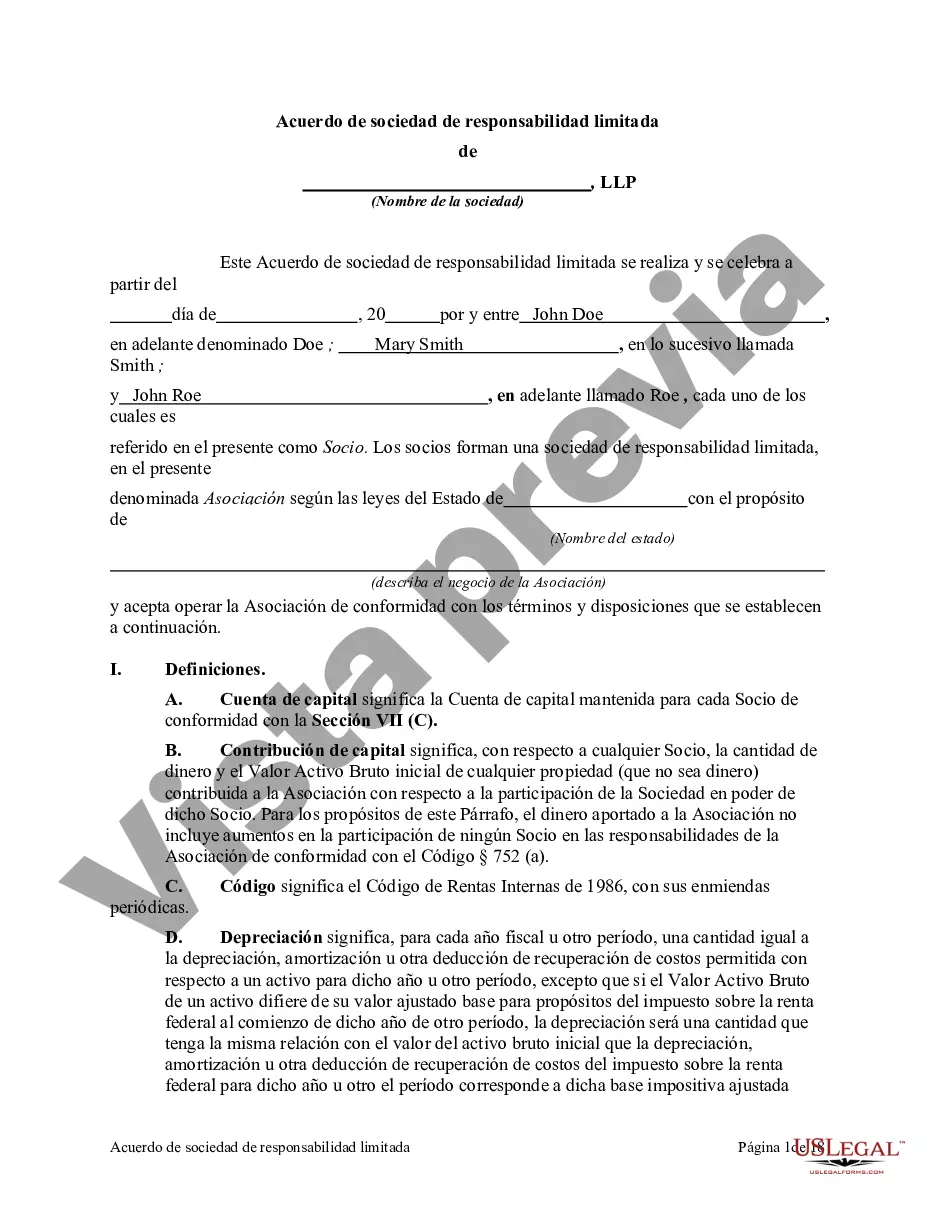

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Acuerdo de sociedad de responsabilidad limitada - Limited Liability Partnership Agreement

Description

How to fill out Connecticut Acuerdo De Sociedad De Responsabilidad Limitada?

Choosing the best authorized papers web template could be a struggle. Naturally, there are a variety of web templates accessible on the Internet, but how will you find the authorized develop you will need? Make use of the US Legal Forms site. The service gives a huge number of web templates, for example the Connecticut Limited Liability Partnership Agreement, that can be used for enterprise and private requires. Every one of the types are checked out by specialists and fulfill state and federal specifications.

In case you are presently signed up, log in in your accounts and click on the Acquire key to obtain the Connecticut Limited Liability Partnership Agreement. Make use of accounts to appear with the authorized types you might have ordered previously. Check out the My Forms tab of your own accounts and obtain another copy in the papers you will need.

In case you are a brand new consumer of US Legal Forms, listed here are simple guidelines for you to comply with:

- Very first, be sure you have chosen the correct develop for your town/area. You can look over the form while using Preview key and look at the form description to ensure it is the right one for you.

- In case the develop does not fulfill your preferences, use the Seach field to discover the appropriate develop.

- When you are positive that the form is suitable, click on the Buy now key to obtain the develop.

- Select the prices prepare you need and enter the essential information and facts. Create your accounts and buy an order utilizing your PayPal accounts or charge card.

- Opt for the document structure and obtain the authorized papers web template in your device.

- Total, modify and produce and indication the attained Connecticut Limited Liability Partnership Agreement.

US Legal Forms is the most significant local library of authorized types for which you will find a variety of papers web templates. Make use of the company to obtain professionally-manufactured paperwork that comply with state specifications.