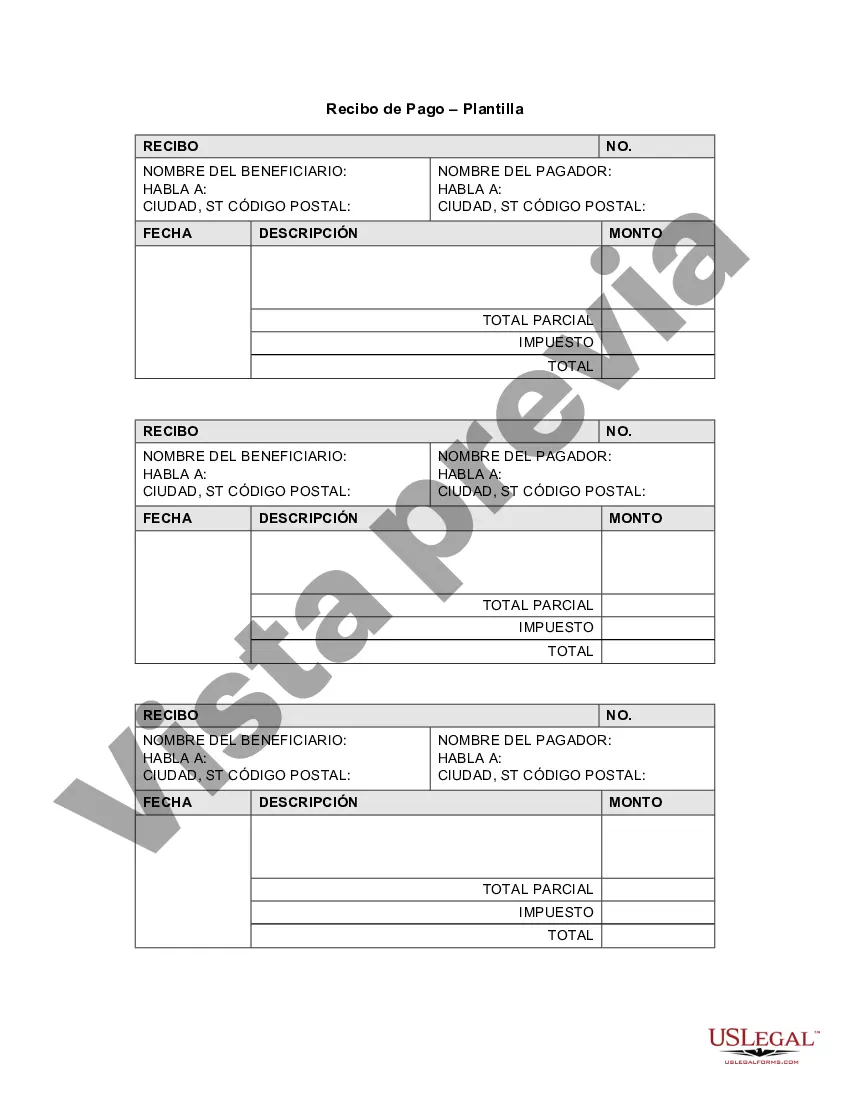

Connecticut Receipt Template for Small Business is a document that serves as a written proof of transaction or sale between a business and its customer in the state of Connecticut. It includes necessary information related to the exchanged goods or services, purchase amount, payment details, and other relevant details. Key features of a Connecticut Receipt Template for Small Business: 1. Header: The receipt template usually starts with a header section that includes the business name, logo, and contact information such as address, phone number, and website. 2. Receipt Number: Each receipt is uniquely identified by a receipt number, facilitating easy tracking and reference for future purposes. 3. Date and Time: The date and time of the transaction are mentioned on the receipt, enabling accurate record-keeping and verification. 4. Customer Details: The customer's name, address, and contact information are typically recorded on the receipt. This information helps in maintaining customer databases and contact for future communications. 5. Description of Goods/Services: The receipt template includes a detailed description of the goods or services purchased, including quantity, unit price, and any applicable taxes or discounts. 6. Subtotal, Taxes, and Discounts: The receipt provides a breakdown of the subtotal amount, any applicable taxes (such as sales tax in Connecticut), and any discounts applied. 7. Total Amount: The total amount to be paid, calculated after considering taxes and discounts, is prominently displayed on the receipt. It ensures transparency and clarity for the customer. 8. Payment Method: The receipt mentions the payment method used for the transaction, such as cash, credit card, debit card, or check. If applicable, the receipt may include further details like the last four digits of the card or check number. 9. Signature: A signature line is often included for both the customer and the authorized representative of the business to acknowledge the completion of the transaction. Types of Connecticut Receipt Templates for Small Business: 1. Standard Receipt Template: This type of template is suitable for general small businesses and covers the essentials required for a typical transaction. 2. Sales Receipt Template: A sales receipt template is specialized for businesses engaged in selling products. It includes specific fields to capture item details, quantity, price, and any discounts applied. 3. Service Receipt Template: Service-based businesses can use this template to provide receipts for their rendered services. It incorporates fields for describing the service provided, hours worked, rate, and any additional charges. 4. Rental Receipt Template: This template is useful for businesses engaged in offering rental services. It includes fields to capture rental period, deposit amount, late fee policy, and other rental-specific details. 5. e-Receipt Template: As businesses increasingly adopt digital transactions, e-receipt templates are becoming popular. These templates can be sent via email or generated electronically. They often include a barcode or QR code for efficient tracking and scanning. In conclusion, a Connecticut Receipt Template for Small Business is a crucial tool for maintaining accurate records of transactions while conducting business in Connecticut. It enables businesses to provide professional, organized, and legally compliant receipts to their customers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Plantilla de recibo para pequeñas empresas - Receipt Template for Small Business

Description

How to fill out Connecticut Plantilla De Recibo Para Pequeñas Empresas?

If you wish to comprehensive, obtain, or printing legitimate papers layouts, use US Legal Forms, the biggest variety of legitimate kinds, that can be found online. Utilize the site`s simple and easy hassle-free search to find the papers you will need. Numerous layouts for business and individual purposes are sorted by types and says, or key phrases. Use US Legal Forms to find the Connecticut Receipt Template for Small Business in a few mouse clicks.

If you are presently a US Legal Forms client, log in in your profile and click on the Down load option to find the Connecticut Receipt Template for Small Business. You can also access kinds you in the past saved inside the My Forms tab of the profile.

If you work with US Legal Forms initially, follow the instructions listed below:

- Step 1. Ensure you have chosen the form for that right area/country.

- Step 2. Make use of the Preview option to examine the form`s information. Do not neglect to see the outline.

- Step 3. If you are not happy using the develop, take advantage of the Lookup industry near the top of the display screen to locate other models from the legitimate develop web template.

- Step 4. After you have found the form you will need, go through the Buy now option. Pick the costs plan you prefer and put your qualifications to sign up for an profile.

- Step 5. Approach the financial transaction. You may use your Мisa or Ьastercard or PayPal profile to accomplish the financial transaction.

- Step 6. Choose the format from the legitimate develop and obtain it in your gadget.

- Step 7. Full, modify and printing or indication the Connecticut Receipt Template for Small Business.

Each legitimate papers web template you buy is your own property permanently. You possess acces to each and every develop you saved inside your acccount. Go through the My Forms portion and decide on a develop to printing or obtain once again.

Compete and obtain, and printing the Connecticut Receipt Template for Small Business with US Legal Forms. There are millions of specialist and express-specific kinds you may use for your business or individual needs.