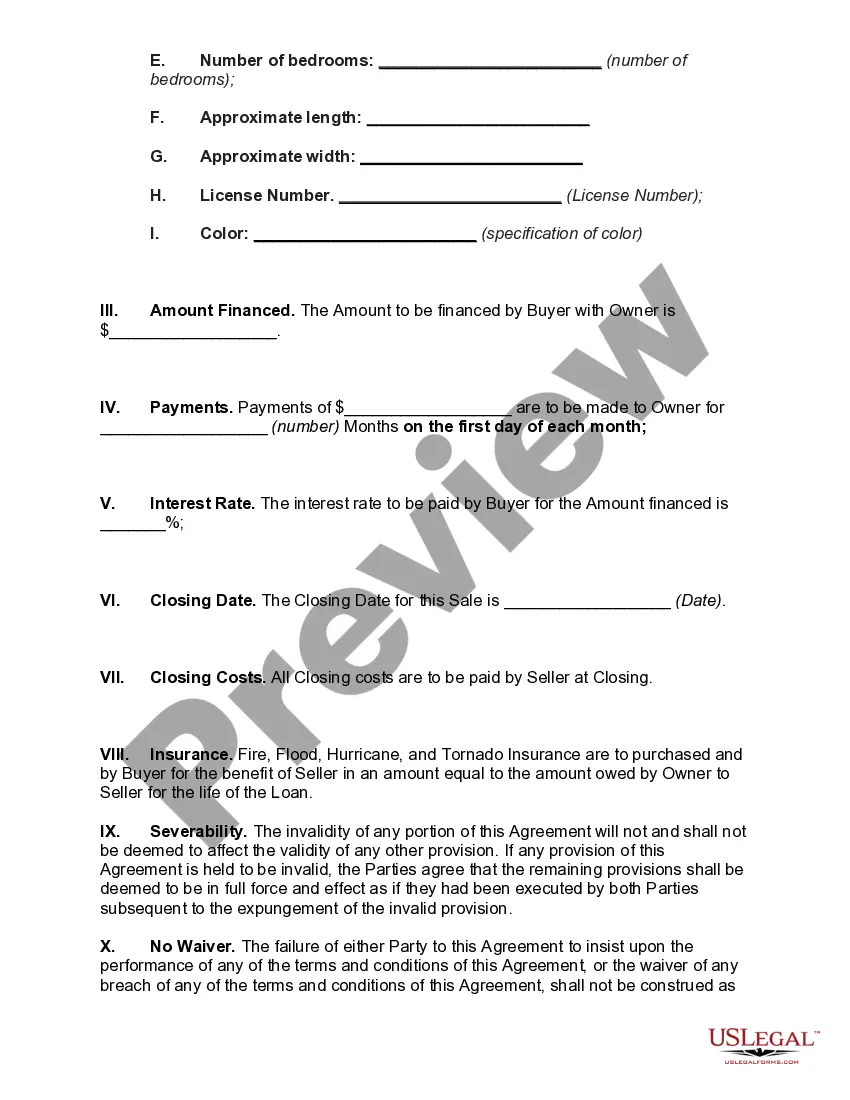

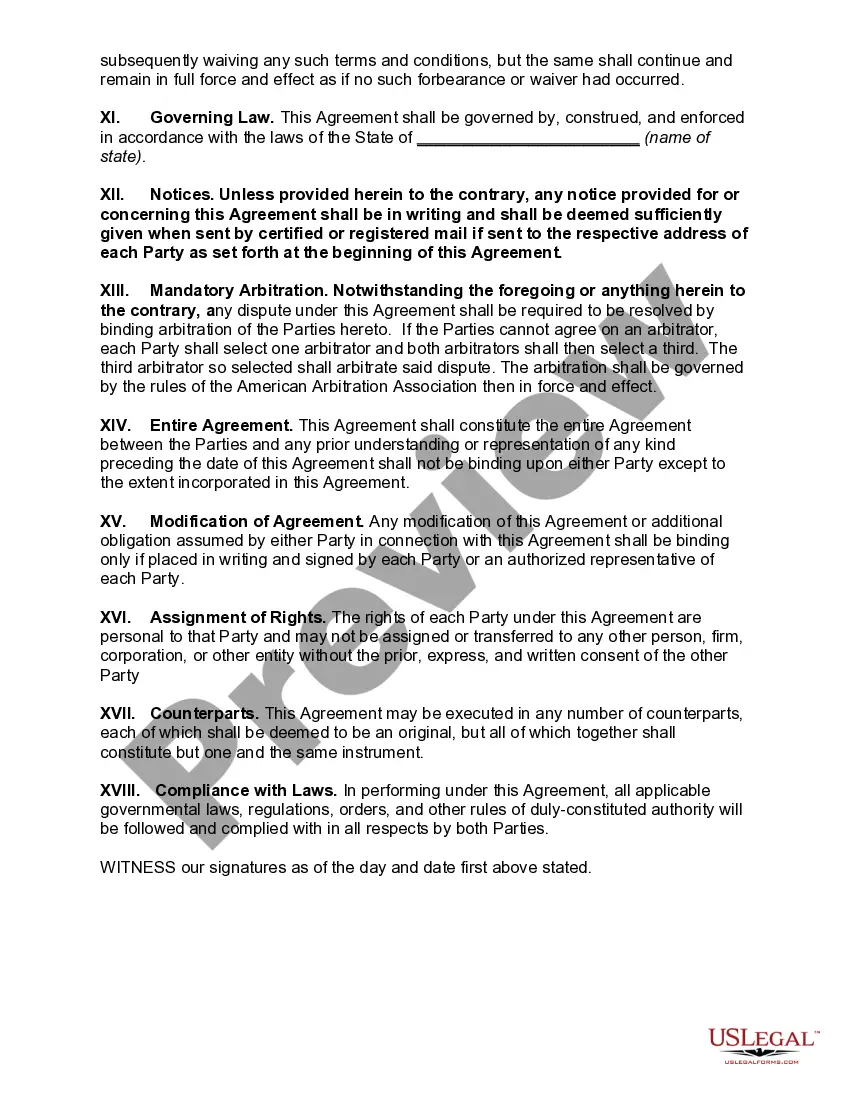

Connecticut Owner Financing Contract for Moblie Home

Description

How to fill out Owner Financing Contract For Moblie Home?

Should you want to obtain, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site's straightforward and user-friendly search function to find the documents you need. Various templates for commercial and personal use are categorized by groups and states, or keywords.

Utilize US Legal Forms to locate the Connecticut Owner Financing Contract for Mobile Home in just a few clicks.

Every legal document template you download is yours indefinitely. You will have access to every form you downloaded through your account. Visit the My documents section and select a form to print or download again.

Be proactive and obtain, and print the Connecticut Owner Financing Contract for Mobile Home with US Legal Forms. There are millions of professional and jurisdiction-specific templates available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Connecticut Owner Financing Contract for Mobile Home.

- You can also access forms you previously downloaded from the My documents section of your account.

- If this is your initial experience with US Legal Forms, follow the steps outlined below.

- Step 1. Confirm you have selected the form for the appropriate city/region.

- Step 2. Utilize the Review feature to examine the form's content. Be sure to read the details carefully.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your information to create an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Step 6. Select the file format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Connecticut Owner Financing Contract for Mobile Home.

Form popularity

FAQ

The average credit score needed to buy a mobile home can vary, but many lenders look for a score of at least 620. However, owner financing options can sometimes offer more flexibility for those with lower credit scores. By considering a Connecticut Owner Financing Contract for Mobile Home, you may find that you can negotiate terms directly without the stringent credit requirements of traditional lenders.

Yes, you can owner finance a mobile home, making it an appealing option for buyers who may have difficulty securing traditional financing. Seller financing allows you to set the terms and conditions, making it flexible for both parties. Additionally, a Connecticut Owner Financing Contract for Mobile Home can provide a clear framework for the transaction.

Owner financing can be a smart strategy for selling land, especially in competitive markets where buyers seek flexibility. It opens doors for buyers who might not qualify for traditional loans. By using the Connecticut Owner Financing Contract for Mobile Homes, sellers can create appealing terms that attract interested buyers while protecting their investment.

Seller financing can present several risks, including the potential for buyer default. If a buyer fails to make payments, the seller may have to navigate the lengthy process of foreclosure. Understanding the terms of the Connecticut Owner Financing Contract for Mobile Homes can help mitigate these risks and establish a clear agreement.

Yes, securing a mortgage for a mobile home in Connecticut is possible, though it may differ from traditional home financing. Many lenders offer specific loans designed for mobile homes, but you may need to meet certain criteria. Consulting the Connecticut Owner Financing Contract for Mobile Homes can help clarify options available to you.

Owner financing can be a viable option for acquiring land, especially for those who may struggle with traditional financing methods. It allows buyers to negotiate flexible terms that suit their financial situation. However, it is crucial to understand the details of the Connecticut Owner Financing Contract for Mobile Homes to ensure a fair and beneficial arrangement.

Owner financing can carry risks for both buyers and sellers. One potential downside is that sellers may not receive as much equity as they would with a traditional sale. Additionally, buyers might face higher interest rates or less favorable terms, making the Connecticut Owner Financing Contract for Mobile Homes less advantageous in some cases.

Typical terms for owner financing in Connecticut may include a down payment of 5% to 20%, an interest rate of 5% to 10%, and repayment terms ranging from 5 to 30 years. Some sellers might choose a balloon payment structure where a larger final payment is required after a few years. It's essential to draft these details in your Connecticut Owner Financing Contract for Mobile Home to keep everyone aligned. Always make sure you understand your obligations under these terms.

To finance a mobile home in Connecticut with owner financing, most sellers look for a credit score of at least 580. However, some might be flexible if you can demonstrate stable income or other strong financial qualities. It's important to communicate openly with your seller about your financial situation. Consider using a Connecticut Owner Financing Contract for Mobile Home to clarify terms and conditions.