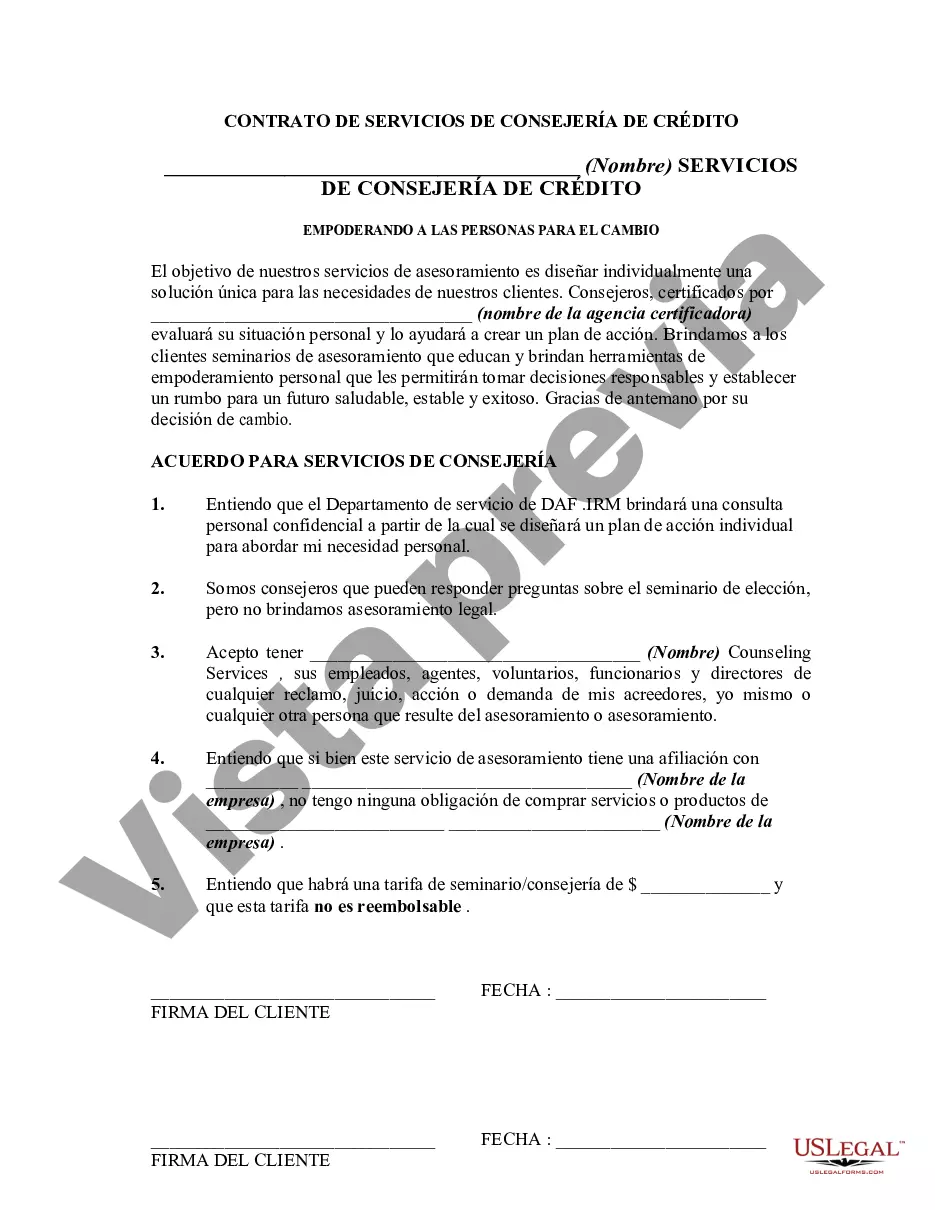

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Agreement for Credit Counseling Services is a legally binding contract that outlines the terms and conditions between a credit counseling agency and a consumer seeking help to manage their debts. It provides a framework for the credit counseling process in Connecticut and protects the rights and interests of both parties involved. Credit counseling services aim to assist individuals who are facing financial difficulties by providing them with guidance and support to effectively manage their debts. These services may encompass debt consolidation, budgeting assistance, financial education, and negotiation with creditors to establish a feasible repayment plan. The Connecticut Agreement for Credit Counseling Services sets forth the responsibilities of the credit counseling agency, as well as the obligations of the consumer. It typically covers important aspects such as the scope of services provided, fees and charges, confidentiality clauses, dispute resolution mechanisms, and termination procedures. To ensure complete transparency and understanding, relevant keywords that might be included in a Connecticut Agreement for Credit Counseling Services are: 1. Credit counseling agency: The organization or entity providing credit counseling services in accordance with Connecticut laws and regulations. 2. Consumer: The individual seeking credit counseling assistance and entering into an agreement with the agency. 3. Debt management plan (DMP): A customized plan that consolidates the consumer's debts into one monthly payment, which is distributed among their creditors based on an agreed-upon repayment schedule. 4. Financial assessment: The evaluation of the consumer's financial situation, including income, expenses, assets, and debts, to determine the most suitable methods for debt management. 5. Counseling sessions: Regular meetings or consultations between the consumer and a credit counselor to address financial concerns, discuss progress, and develop strategies to improve their financial well-being. 6. Creditor negotiation: The process of contacting creditors on the consumer's behalf to negotiate lower interest rates, reduced fees, or revised payment terms. 7. Client fees: The charges associated with credit counseling services, which may include setup fees, monthly maintenance fees, or other service-related expenses. 8. Confidentiality: The assurance that all personal and financial information shared during the credit counseling process will be kept secure and protected from unauthorized disclosure. 9. Termination and withdrawal: The procedures for either party to end the agreement, outlining any required notice periods or potential penalties. 10. Non-profit status: If the credit counseling agency operates as a non-profit organization, it denotes their commitment to providing affordable services and helping consumers without focusing on profit accumulation. Different types of Connecticut Agreements for Credit Counseling Services may exist, such as agreements tailored to specific populations, organizations, or circumstances. For example, specialized agreements might be available for senior citizens, military personnel, or individuals experiencing severe financial hardship. It is crucial for consumers to carefully review and understand the terms of any Connecticut Agreement for Credit Counseling Services before signing, as it governs the relationship between the credit counseling agency and the individual seeking assistance in managing their debts.Connecticut Agreement for Credit Counseling Services is a legally binding contract that outlines the terms and conditions between a credit counseling agency and a consumer seeking help to manage their debts. It provides a framework for the credit counseling process in Connecticut and protects the rights and interests of both parties involved. Credit counseling services aim to assist individuals who are facing financial difficulties by providing them with guidance and support to effectively manage their debts. These services may encompass debt consolidation, budgeting assistance, financial education, and negotiation with creditors to establish a feasible repayment plan. The Connecticut Agreement for Credit Counseling Services sets forth the responsibilities of the credit counseling agency, as well as the obligations of the consumer. It typically covers important aspects such as the scope of services provided, fees and charges, confidentiality clauses, dispute resolution mechanisms, and termination procedures. To ensure complete transparency and understanding, relevant keywords that might be included in a Connecticut Agreement for Credit Counseling Services are: 1. Credit counseling agency: The organization or entity providing credit counseling services in accordance with Connecticut laws and regulations. 2. Consumer: The individual seeking credit counseling assistance and entering into an agreement with the agency. 3. Debt management plan (DMP): A customized plan that consolidates the consumer's debts into one monthly payment, which is distributed among their creditors based on an agreed-upon repayment schedule. 4. Financial assessment: The evaluation of the consumer's financial situation, including income, expenses, assets, and debts, to determine the most suitable methods for debt management. 5. Counseling sessions: Regular meetings or consultations between the consumer and a credit counselor to address financial concerns, discuss progress, and develop strategies to improve their financial well-being. 6. Creditor negotiation: The process of contacting creditors on the consumer's behalf to negotiate lower interest rates, reduced fees, or revised payment terms. 7. Client fees: The charges associated with credit counseling services, which may include setup fees, monthly maintenance fees, or other service-related expenses. 8. Confidentiality: The assurance that all personal and financial information shared during the credit counseling process will be kept secure and protected from unauthorized disclosure. 9. Termination and withdrawal: The procedures for either party to end the agreement, outlining any required notice periods or potential penalties. 10. Non-profit status: If the credit counseling agency operates as a non-profit organization, it denotes their commitment to providing affordable services and helping consumers without focusing on profit accumulation. Different types of Connecticut Agreements for Credit Counseling Services may exist, such as agreements tailored to specific populations, organizations, or circumstances. For example, specialized agreements might be available for senior citizens, military personnel, or individuals experiencing severe financial hardship. It is crucial for consumers to carefully review and understand the terms of any Connecticut Agreement for Credit Counseling Services before signing, as it governs the relationship between the credit counseling agency and the individual seeking assistance in managing their debts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.