The following language is often referred to as the Fair Debt Collection Practices Act Validation Notice.

THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. Unless you contest the validity of this indebtedness in writing, I will assume that the debt is valid.

The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors.

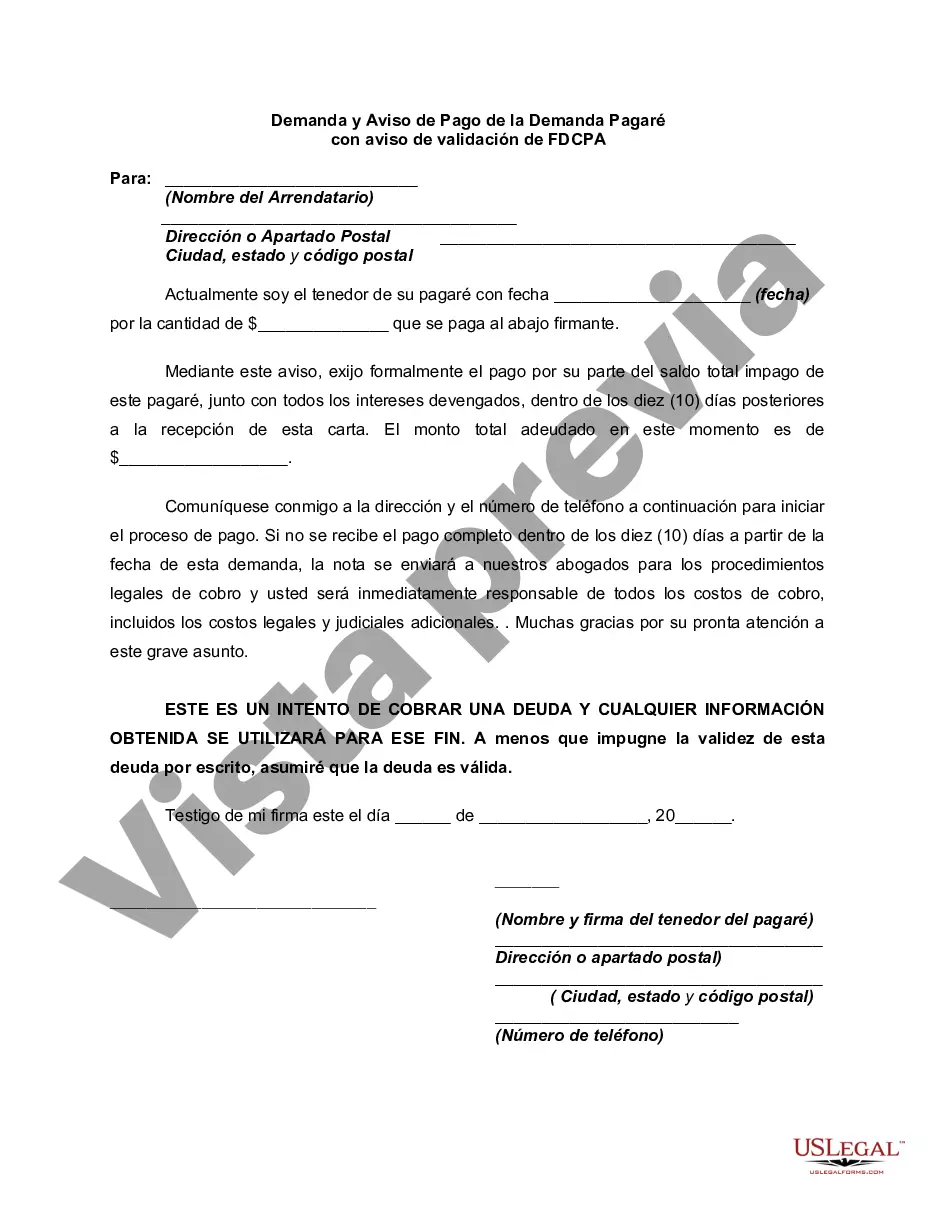

Connecticut Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a legal document used in the state of Connecticut to demand immediate payment on a demand promissory note. This notice also includes a validation notice as mandated by the Fair Debt Collection Practices Act (FD CPA) to ensure compliance with federal law. Key Features of Connecticut Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice: 1. Demand for Payment: This notice serves as a formal demand for the immediate repayment of the outstanding balance on a demand promissory note. It emphasizes the debtor's obligation to settle the debt promptly. 2. Delineation of Debt Details: The notice provides comprehensive information regarding the debt, including the original principal amount, the interest rate, the date of the promissory note, and any applicable fees or penalties. 3. Payment Instructions: The notice includes clear instructions on how the debtor should make the payment, including acceptable payment methods, the payee's name, and the designated payment address. 4. FD CPA Validation Notice: In compliance with the FD CPA, this document includes a validation notice that informs the debtor of their right to request validation of the debt within 30 days. It further outlines the debtor's rights, such as disputing the debt or requesting additional information. 5. Consequences of Non-Payment: The notice explicitly states the consequences of failing to make timely payment, which may include legal action, additional interest accrual, collection agency involvement, or negative credit reporting. Types of Connecticut Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice: 1. Individual Demand and Notice: This document is used when an individual is demanding payment on a demand promissory note. 2. Business Demand and Notice: This document is utilized when a business entity seeks immediate payment on a demand promissory note, outlining the business's details and contact information for payment. 3. Disputed Debt Demand and Notice: This notice is employed when the debtor disputes the validity or accuracy of the debt in question. It emphasizes the debtor's rights and acts as a means to resolve the dispute promptly. 4. Final Notice of Demand and Notice: This notice is sent as a final demand for payment, usually after previous attempts to collect the debt have been unsuccessful. It may include stronger language and a deadline for payment before pursuing legal action. Disclaimer: This description provides a general overview and should not be considered legal advice. It is advisable to consult with a qualified legal professional when drafting or utilizing legal documents.Connecticut Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a legal document used in the state of Connecticut to demand immediate payment on a demand promissory note. This notice also includes a validation notice as mandated by the Fair Debt Collection Practices Act (FD CPA) to ensure compliance with federal law. Key Features of Connecticut Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice: 1. Demand for Payment: This notice serves as a formal demand for the immediate repayment of the outstanding balance on a demand promissory note. It emphasizes the debtor's obligation to settle the debt promptly. 2. Delineation of Debt Details: The notice provides comprehensive information regarding the debt, including the original principal amount, the interest rate, the date of the promissory note, and any applicable fees or penalties. 3. Payment Instructions: The notice includes clear instructions on how the debtor should make the payment, including acceptable payment methods, the payee's name, and the designated payment address. 4. FD CPA Validation Notice: In compliance with the FD CPA, this document includes a validation notice that informs the debtor of their right to request validation of the debt within 30 days. It further outlines the debtor's rights, such as disputing the debt or requesting additional information. 5. Consequences of Non-Payment: The notice explicitly states the consequences of failing to make timely payment, which may include legal action, additional interest accrual, collection agency involvement, or negative credit reporting. Types of Connecticut Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice: 1. Individual Demand and Notice: This document is used when an individual is demanding payment on a demand promissory note. 2. Business Demand and Notice: This document is utilized when a business entity seeks immediate payment on a demand promissory note, outlining the business's details and contact information for payment. 3. Disputed Debt Demand and Notice: This notice is employed when the debtor disputes the validity or accuracy of the debt in question. It emphasizes the debtor's rights and acts as a means to resolve the dispute promptly. 4. Final Notice of Demand and Notice: This notice is sent as a final demand for payment, usually after previous attempts to collect the debt have been unsuccessful. It may include stronger language and a deadline for payment before pursuing legal action. Disclaimer: This description provides a general overview and should not be considered legal advice. It is advisable to consult with a qualified legal professional when drafting or utilizing legal documents.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.