A stock subscription is an agreement to purchase, at a stated price, a stated number of shares of stock of a corporation which is to be formed. Unless some restriction appears in the enabling statute or in the articles or certificate of incorporation, any natural person, and any corporation with the appropriate power, may be a subscriber to corporate stock. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Stock Subscription Agreement Among Several Subscribers

Description

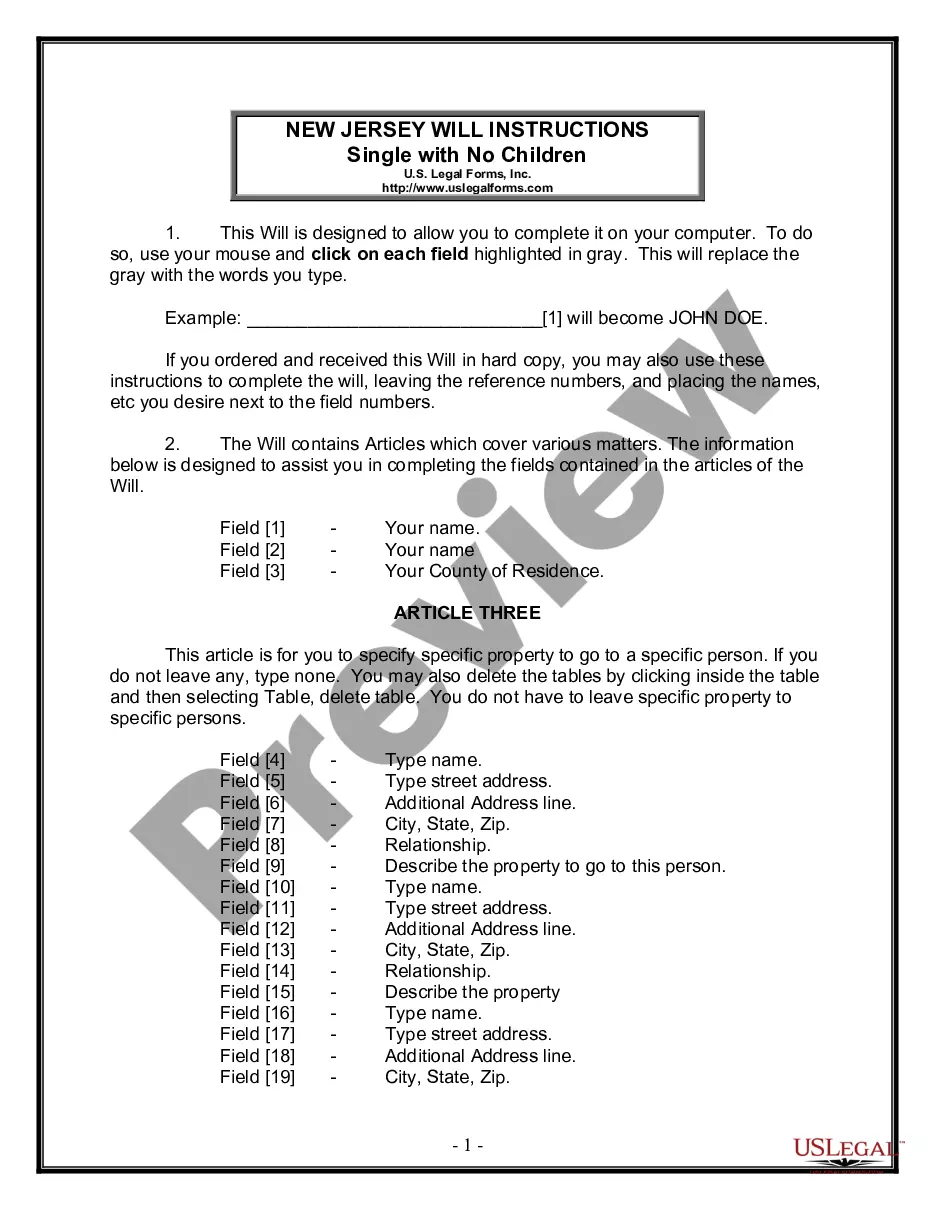

How to fill out Stock Subscription Agreement Among Several Subscribers?

Have you ever found yourself in a situation where you require documents for both business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides a vast array of form templates, such as the Connecticut Stock Subscription Agreement Among Several Subscribers, which are designed to comply with state and federal regulations.

Choose the subscription plan you prefer, fill in the necessary information to create your account, and pay for your order using PayPal or a credit card.

Select a convenient file format and download your version.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Connecticut Stock Subscription Agreement Among Several Subscribers template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these steps.

- Find the form you require and ensure it corresponds to the correct city/state.

- Use the Preview option to review the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search section to find the form that meets your requirements.

- Once you have located the appropriate form, click Purchase now.

Form popularity

FAQ

The main difference lies in their focus: a Limited Partnership Agreement (LPA) outlines terms for ongoing partnerships, while a subscription agreement details share purchases. The Connecticut Stock Subscription Agreement Among Several Subscribers specifically governs the acquisition of stock, providing clarity on investor rights. Recognizing these nuances aids in better navigating the legal landscape of investments.

A contract is a broad legal agreement that binds two or more parties to specified terms. A subscription agreement, specifically like the Connecticut Stock Subscription Agreement Among Several Subscribers, is a type of contract focused on the sale of shares. Understanding this distinction can greatly influence your investment decisions and legal obligations.

A subscription agreement, such as the Connecticut Stock Subscription Agreement Among Several Subscribers, is focused on share purchases, detailing buyer commitments. On the other hand, a limited partnership agreement revolves around the roles, responsibilities, and profit-sharing among partners in a business. Recognizing these variations clarifies your legal interactions in different business scenarios.

A subscription agreement is primarily used for acquiring shares in a company, while a Limited Partnership Agreement (LPA) is used to outline the terms between business partners. The Connecticut Stock Subscription Agreement Among Several Subscribers serves a specific purpose in equity investment, contrasting with the broader context of an LPA. Being aware of these distinctions helps in crafting precise documents.

Another common term used for a shareholder agreement is a stockholders' agreement. This document serves a similar purpose, outlining the rights and obligations of shareholders within a company. Familiarizing yourself with the Connecticut Stock Subscription Agreement Among Several Subscribers can give you insight into how these agreements can work together.

The parties to a subscription agreement typically include the investor or subscriber and the issuing company. In this agreement, the investor commits to purchasing shares, and the company agrees to issue those shares in return for the investment. The Connecticut Stock Subscription Agreement Among Several Subscribers clearly outlines the responsibilities and expectations of each party.

Yes, a subscription agreement is essential when issuing shares as it formalizes the agreement between the company and the subscribers. This document outlines the terms and conditions for the share issuance. When utilizing a Connecticut Stock Subscription Agreement Among Several Subscribers, you reinforce legal protections and establish clear expectations for all parties involved.