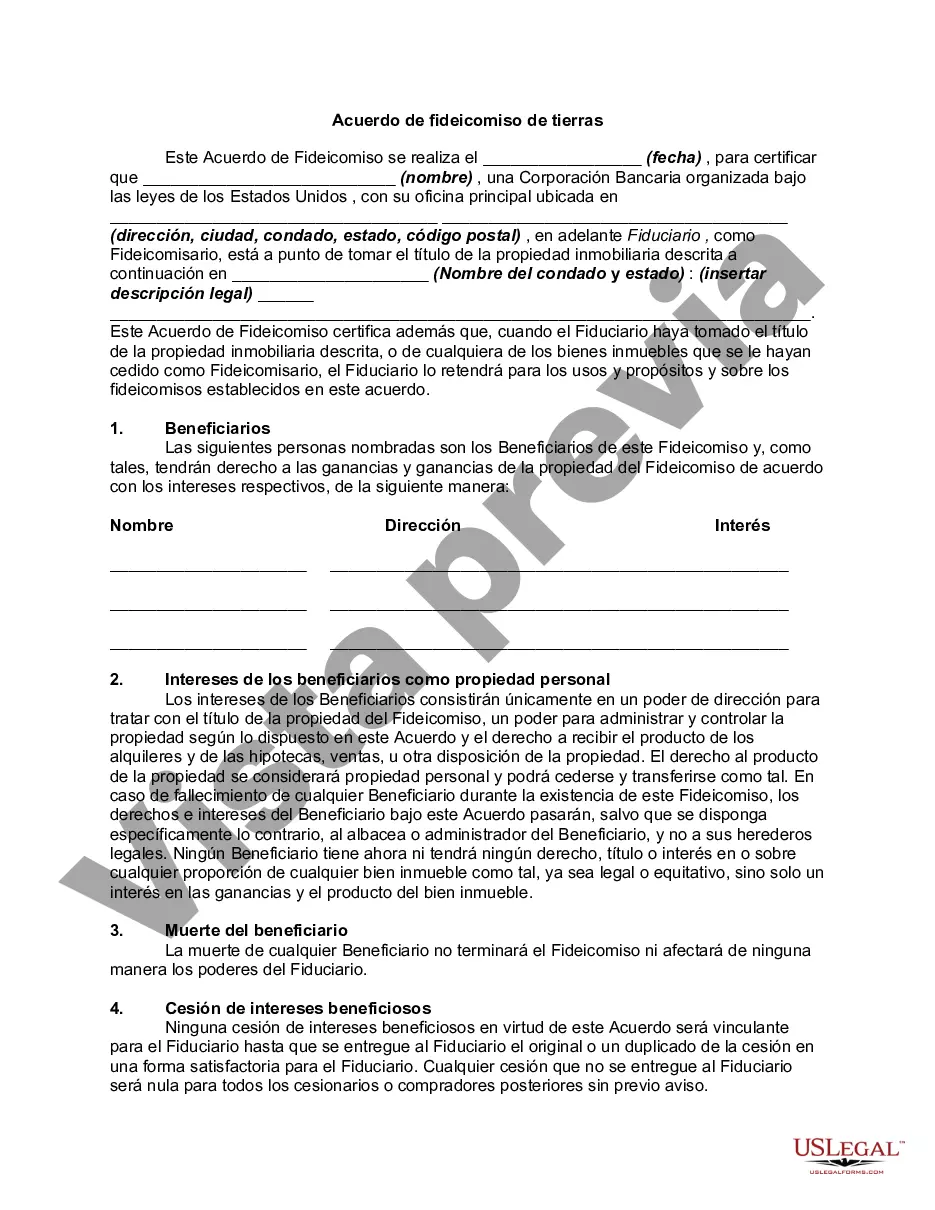

There are two basic instruments required to establish a land trust. One is a deed in trust conveying the real estate to a trustee. The other is a trust agreement defining the rights and duties of the trustee and the beneficiaries, which is mentioned in the deed of trust but is not recorded. The deed in trust should convey title to real property to a trustee and confer complete trust powers on the trustee so that the trustee can deal with third parties without reference to the trust agreement. Restrictions on the trustee's powers should be set forth in the trust agreement.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Land Trust Agreement refers to a legally binding document entered into between a landowner and a land trust organization in Connecticut, which aims to protect and preserve the natural resources, agricultural productivity, scenic beauty, and historical or cultural significance of certain lands. This agreement is designed to ensure the perpetual conservation of these lands, preventing them from being developed or otherwise altered in a manner that would compromise their conservation values. The Connecticut Land Trust Agreement typically involves the transfer of certain property rights from the landowner to the land trust organization, which becomes responsible for the long-term stewardship of the land. While specific details may vary depending on the terms agreed upon between the landowner and the land trust, key elements of this agreement often include: 1. Conservation Restrictions: The agreement usually imposes permanent restrictions on the use and development of the land, which are designed to safeguard its natural and cultural resources. These restrictions may include limitations on construction, subdivision, mining, logging, or the introduction of non-native species. 2. Land Management: The agreement often outlines the responsibilities of both the landowner and the land trust regarding the management and maintenance of the property. This may include activities such as invasive species control, wildlife habitat restoration, agricultural practices, or public access provisions. 3. Monitoring and Enforcement: The land trust is typically responsible for regularly monitoring and ensuring compliance with the terms of the agreement. This may involve periodic inspections, reporting requirements, and the right to take legal action if violations occur. 4. Tax Benefits: Connecticut Land Trust Agreements can provide certain tax benefits for landowners who choose to protect their land. These may include eligibility for federal tax deductions, property tax reductions, or estate tax benefits. In Connecticut, there are various types of land trust agreements based on the specific objectives and characteristics of the land. Some common types include: 1. Natural Area Agreement: Focused on the protection of critical habitats, wetlands, forests, or other significant natural features, these agreements prioritize the conservation of wildlife and plant species, as well as the maintenance of ecological processes. 2. Agricultural Conservation Easement: Geared towards protecting farmland and promoting agricultural practices, these agreements ensure that designated lands remain available for farming and prevent their conversion to non-agricultural uses. 3. Historic Preservation Agreement: Aimed at safeguarding historically significant sites, structures, or landscapes, these agreements seek to maintain the architectural, archaeological, or cultural integrity of properties with historical importance. 4. Recreational Conservation Agreement: Emphasizing public access and recreational opportunities, these agreements focus on preserving open spaces, trails, or scenic landscapes to benefit the community and provide opportunities for outdoor enjoyment. In summary, Connecticut Land Trust Agreements are essential tools for conserving and preserving the natural, cultural, and agricultural heritage of the state. Through the creation of these agreements, landowners and land trust organizations work together to protect valuable resources and ensure their sustainable use for present and future generations.Connecticut Land Trust Agreement refers to a legally binding document entered into between a landowner and a land trust organization in Connecticut, which aims to protect and preserve the natural resources, agricultural productivity, scenic beauty, and historical or cultural significance of certain lands. This agreement is designed to ensure the perpetual conservation of these lands, preventing them from being developed or otherwise altered in a manner that would compromise their conservation values. The Connecticut Land Trust Agreement typically involves the transfer of certain property rights from the landowner to the land trust organization, which becomes responsible for the long-term stewardship of the land. While specific details may vary depending on the terms agreed upon between the landowner and the land trust, key elements of this agreement often include: 1. Conservation Restrictions: The agreement usually imposes permanent restrictions on the use and development of the land, which are designed to safeguard its natural and cultural resources. These restrictions may include limitations on construction, subdivision, mining, logging, or the introduction of non-native species. 2. Land Management: The agreement often outlines the responsibilities of both the landowner and the land trust regarding the management and maintenance of the property. This may include activities such as invasive species control, wildlife habitat restoration, agricultural practices, or public access provisions. 3. Monitoring and Enforcement: The land trust is typically responsible for regularly monitoring and ensuring compliance with the terms of the agreement. This may involve periodic inspections, reporting requirements, and the right to take legal action if violations occur. 4. Tax Benefits: Connecticut Land Trust Agreements can provide certain tax benefits for landowners who choose to protect their land. These may include eligibility for federal tax deductions, property tax reductions, or estate tax benefits. In Connecticut, there are various types of land trust agreements based on the specific objectives and characteristics of the land. Some common types include: 1. Natural Area Agreement: Focused on the protection of critical habitats, wetlands, forests, or other significant natural features, these agreements prioritize the conservation of wildlife and plant species, as well as the maintenance of ecological processes. 2. Agricultural Conservation Easement: Geared towards protecting farmland and promoting agricultural practices, these agreements ensure that designated lands remain available for farming and prevent their conversion to non-agricultural uses. 3. Historic Preservation Agreement: Aimed at safeguarding historically significant sites, structures, or landscapes, these agreements seek to maintain the architectural, archaeological, or cultural integrity of properties with historical importance. 4. Recreational Conservation Agreement: Emphasizing public access and recreational opportunities, these agreements focus on preserving open spaces, trails, or scenic landscapes to benefit the community and provide opportunities for outdoor enjoyment. In summary, Connecticut Land Trust Agreements are essential tools for conserving and preserving the natural, cultural, and agricultural heritage of the state. Through the creation of these agreements, landowners and land trust organizations work together to protect valuable resources and ensure their sustainable use for present and future generations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.