Connecticut Assignment of Debt is a legal process where the rights and obligations of a debt are transferred from one party to another. In this context, the party transferring the debt is known as the assignor, while the party receiving the debt is referred to as the assignee. Assignment of debt can occur for various purposes such as debt collection, consolidation, or as part of a business transaction. In Connecticut, there are different types of Assignment of Debt that serve specific purposes and are governed by specific laws and regulations. These include: 1. Commercial Assignment of Debt: This type of assignment involves the transfer of a debt owed by one business entity to another. It can occur when a company sells its outstanding accounts receivable to a debt buyer or assigns its debt to a collection agency for recovery. 2. Personal Assignment of Debt: This form of assignment involves the transfer of an individual's debt obligations from one person to another. It can occur when an individual assigns their debt to a debt consolidation company, allowing the company to negotiate on their behalf with creditors. 3. Mortgage Assignment of Debt: This type of assignment specifically applies to real estate transactions. It involves the transfer of a mortgage debt from the original lender (assignor) to another party (assignee), typically in cases where mortgages are bundled and sold to investors. 4. Student Loan Assignment of Debt: This pertains to the transfer of student loan debt from one lender to another. It commonly occurs when a lender sells a portfolio of student loans to another financial institution or when a loan is refinanced with a different lender. It is essential to note that Connecticut Assignment of Debt is subject to specific laws and regulations, including the Connecticut Uniform Commercial Code (UCC) and the Fair Debt Collection Practices Act (FD CPA). The UCC provides guidelines for the assignment process, ensuring that there is proper documentation and consent from all parties involved. The FD CPA protects consumers from unfair debt collection practices and regulates the activities of debt collectors. In conclusion, Connecticut Assignment of Debt involves the transfer of debt rights and obligations from one party to another. It encompasses various types, such as commercial, personal, mortgage, and student loan assignment, each serving different purposes. Understanding the specific laws and regulations governing these assignments is crucial for both assignors and assignees to ensure a legally binding and fair transaction.

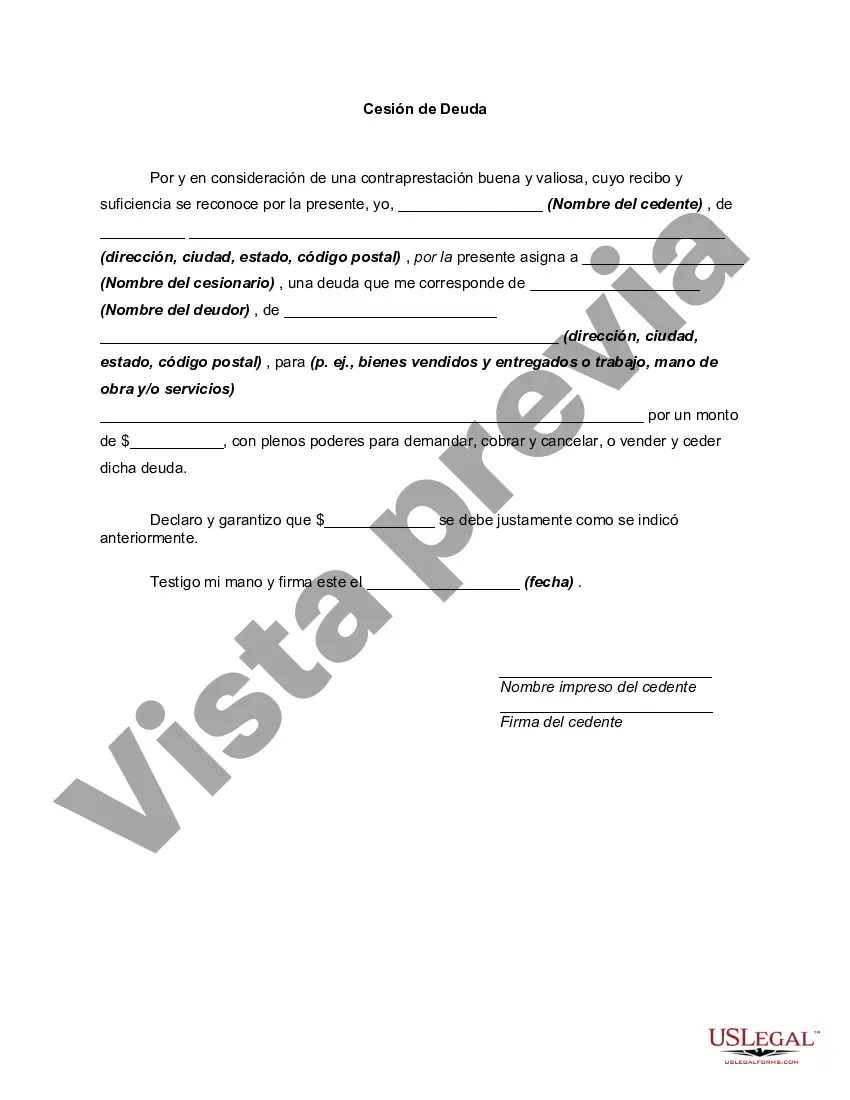

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Cesión de Deuda - Assignment of Debt

Description

How to fill out Connecticut Cesión De Deuda?

US Legal Forms - one of the largest libraries of lawful types in America - provides an array of lawful record templates you are able to acquire or printing. Making use of the web site, you can get thousands of types for enterprise and personal uses, sorted by classes, claims, or search phrases.You can get the newest models of types like the Connecticut Assignment of Debt within minutes.

If you already possess a monthly subscription, log in and acquire Connecticut Assignment of Debt in the US Legal Forms collection. The Download button will appear on every develop you perspective. You have accessibility to all formerly saved types in the My Forms tab of your respective accounts.

In order to use US Legal Forms for the first time, listed below are straightforward recommendations to obtain started off:

- Be sure you have picked the best develop for the metropolis/state. Click on the Preview button to check the form`s content material. Browse the develop description to actually have chosen the right develop.

- When the develop doesn`t fit your needs, utilize the Lookup discipline at the top of the display screen to get the one who does.

- In case you are content with the form, verify your choice by clicking on the Purchase now button. Then, opt for the costs program you prefer and offer your qualifications to register for an accounts.

- Method the transaction. Make use of your Visa or Mastercard or PayPal accounts to accomplish the transaction.

- Find the structure and acquire the form on your own product.

- Make changes. Fill out, edit and printing and sign the saved Connecticut Assignment of Debt.

Every single template you put into your bank account lacks an expiry particular date and is your own eternally. So, if you wish to acquire or printing an additional duplicate, just proceed to the My Forms section and click on about the develop you want.

Gain access to the Connecticut Assignment of Debt with US Legal Forms, one of the most substantial collection of lawful record templates. Use thousands of skilled and express-specific templates that meet your company or personal needs and needs.