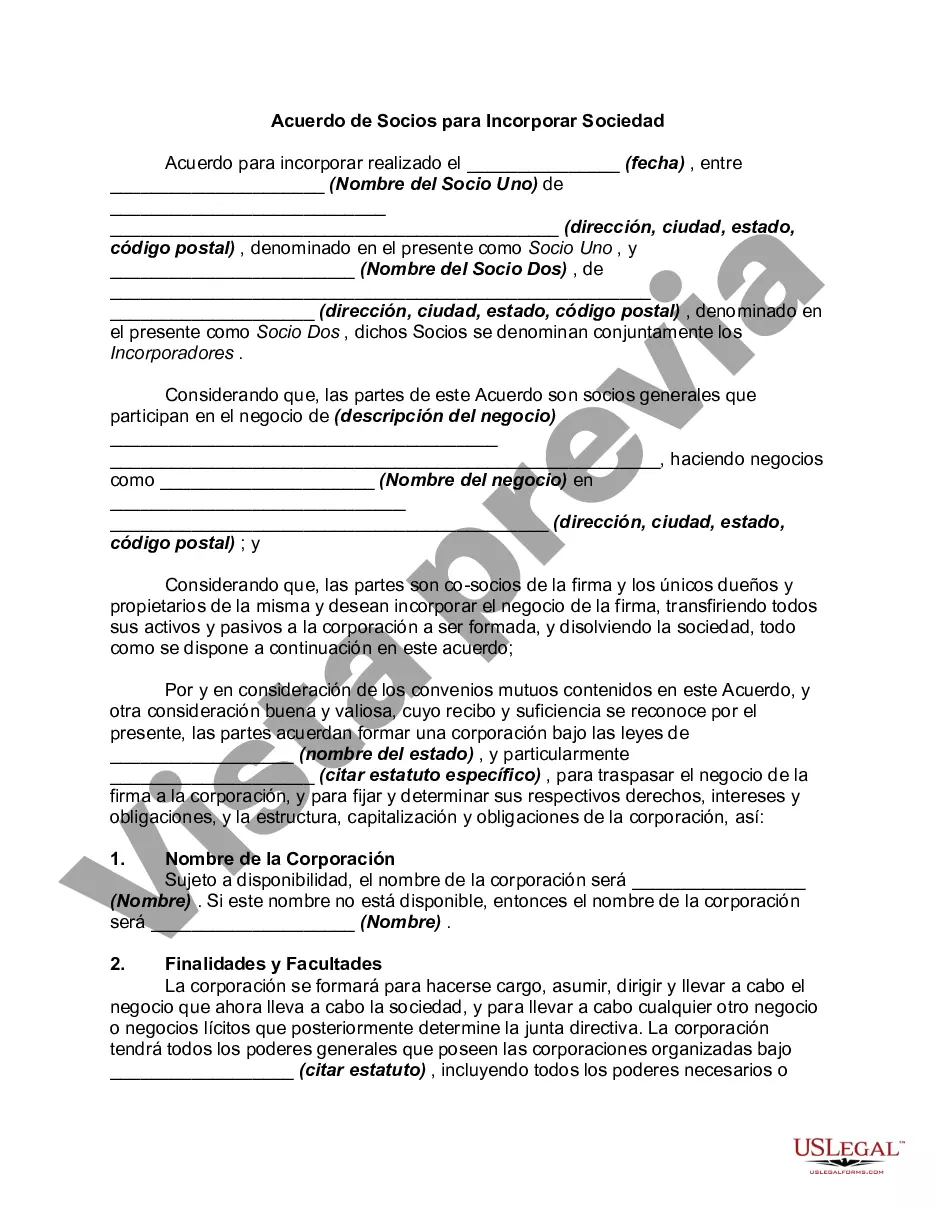

Connecticut Agreement to Partners to Incorporate Partnership The Connecticut Agreement to Partners to Incorporate Partnership is a legal document that outlines the terms and conditions for the incorporation of a partnership in the state of Connecticut. This agreement serves as a blueprint for partners looking to establish a formal business structure while enjoying the benefits of incorporation. Incorporating a partnership in Connecticut offers numerous advantages, including limited liability protection for partners, potential tax benefits, and credibility in the eyes of clients and investors. The Agreement to Partners to Incorporate Partnership lays out the specific details required to navigate this process smoothly. The document begins by stating the names and addresses of each partner involved, along with their respective ownership percentages in the newly formed corporation. It also specifies the proposed name of the partnership and confirms its compliance with the relevant state regulations. Additional provisions may need to be added if the partnership desires a specialized entity, such as an LLC or LLP (Limited Liability Partnership). The Connecticut Agreement to Partners to Incorporate Partnership addresses various crucial aspects, such as the duration of the partnership, its purpose, and the scope of its activities. It establishes the financial and management structure, detailing the capital contributions made by each partner, profit-sharing ratios, and decision-making processes within the corporation. Furthermore, the agreement outlines the rights and responsibilities of each partner, including their roles, duties, and obligations. It covers important matters such as partner meetings, voting mechanisms, and procedures for admitting or excluding new partners. In cases of dispute resolution or dissolution of the partnership, it also discusses the protocol to be followed. Different types of Connecticut Agreements to Partners to Incorporate Partnership may include: 1. General Partnership Agreement: This is the most common type of partnership agreement, where all partners have equal rights and responsibilities. They share profits, losses, and participate in the management of the partnership on an equal footing. 2. Limited Partnership Agreement: This agreement involves at least one general partner who assumes full liability for the partnership's debts and obligations, alongside one or more limited partners who have limited liability and typically serve as silent investors. 3. Limited Liability Partnership (LLP) Agreement: An LLP agreement is suitable for professional service-based partnerships formed by licensed professionals, such as lawyers, accountants, or doctors. It offers partners limited personal liability protection against the malpractice of other partners. In conclusion, the Connecticut Agreement to Partners to Incorporate Partnership is a comprehensive legal document that enables partners to establish and formalize a partnership while incorporating it in Connecticut. By clearly defining the rights, responsibilities, and governing principles of the partnership, this agreement provides a solid foundation for successful collaboration and business growth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Acuerdo de Socios para Incorporar Sociedad - Agreement to Partners to Incorporate Partnership

Description

How to fill out Connecticut Acuerdo De Socios Para Incorporar Sociedad?

If you need to comprehensive, down load, or printing legitimate papers templates, use US Legal Forms, the biggest collection of legitimate varieties, which can be found online. Utilize the site`s simple and easy hassle-free research to discover the files you want. A variety of templates for organization and specific reasons are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to discover the Connecticut Agreement to Partners to Incorporate Partnership with a number of clicks.

Should you be previously a US Legal Forms buyer, log in for your account and click on the Obtain switch to find the Connecticut Agreement to Partners to Incorporate Partnership. You may also gain access to varieties you in the past delivered electronically in the My Forms tab of your own account.

If you work with US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have selected the shape for the proper town/nation.

- Step 2. Take advantage of the Review method to look through the form`s content material. Do not forget to learn the description.

- Step 3. Should you be unsatisfied together with the develop, use the Lookup industry on top of the display to get other models in the legitimate develop template.

- Step 4. Once you have found the shape you want, click the Buy now switch. Choose the costs strategy you prefer and put your accreditations to register for the account.

- Step 5. Process the financial transaction. You can use your Мisa or Ьastercard or PayPal account to complete the financial transaction.

- Step 6. Choose the structure in the legitimate develop and down load it in your system.

- Step 7. Complete, modify and printing or indicator the Connecticut Agreement to Partners to Incorporate Partnership.

Each legitimate papers template you get is your own forever. You may have acces to every single develop you delivered electronically with your acccount. Click the My Forms segment and decide on a develop to printing or down load again.

Contend and down load, and printing the Connecticut Agreement to Partners to Incorporate Partnership with US Legal Forms. There are thousands of expert and state-distinct varieties you can utilize for your personal organization or specific demands.