Connecticut Estate Planning Data Letter and Employment Agreement with Client

Description

How to fill out Estate Planning Data Letter And Employment Agreement With Client?

US Legal Forms - among the most prominent collections of legal documents in the United States - provides a variety of legal form templates that you can download or print.

Utilizing the website, you can access thousands of forms for commercial and individual purposes, organized by types, states, or keywords. You can find the most recent forms, including the Connecticut Estate Planning Data Letter and Employment Agreement with Client, in just minutes.

If you already have a subscription, Log In to download the Connecticut Estate Planning Data Letter and Employment Agreement with Client from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form onto your device. Make modifications. Fill out, modify, print, and sign the downloaded Connecticut Estate Planning Data Letter and Employment Agreement with Client.

Each template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you need to download or print another copy, simply navigate to the My documents section and click on the form you require.

Access the Connecticut Estate Planning Data Letter and Employment Agreement with Client through US Legal Forms, the most extensive library of legal form templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- Ensure you have selected the correct form for your region/state.

- Click the Review option to examine the content of the form.

- Read the form summary to confirm that you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, select your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

Yes, a hand-written will, or holographic will, can be valid in Connecticut as long as it is signed by the testator and reflects their intent. While it lacks the formality of a properly witnessed will, it can still convey your wishes. A structured Connecticut Estate Planning Data Letter and Employment Agreement with Client can help ensure your hand-written will meets necessary legal standards.

In Connecticut, a will does not need to be notarized if it is properly witnessed. The presence of two witnesses at the signing creates a legally valid will without a notary. However, a Connecticut Estate Planning Data Letter and Employment Agreement with Client can provide you with templates and guidance to support your will's legal standing.

Rule 4.2 in Connecticut prohibits attorneys from communicating directly with a party known to be represented by another lawyer. This rule aims to maintain ethical boundaries and protect the interests of all clients. When preparing a Connecticut Estate Planning Data Letter and Employment Agreement with Client, being aware of this rule can help ensure proper procedures are followed.

Rule 1.6 of the Connecticut Rules of Professional Conduct governs a lawyer's confidentiality obligations. It requires attorneys to protect a client's information unless consent is given or legal exceptions apply. Understanding this rule is essential when discussing matters related to your Connecticut Estate Planning Data Letter and Employment Agreement with Client, as it ensures your information remains confidential.

In Connecticut, a valid will must be in writing, signed by the testator, and witnessed by two individuals. These witnesses should not be beneficiaries to prevent conflicts of interest. Using a Connecticut Estate Planning Data Letter and Employment Agreement with Client can provide clarity and assistance to ensure your will meets all legal requirements.

A copy of a notarized will can be valid under certain circumstances, but it's best to rely on the original document. Connecticut law emphasizes the importance of having the original will during probate. Employing a Connecticut Estate Planning Data Letter and Employment Agreement with Client can simplify the documentation process by guiding you through necessary legalities.

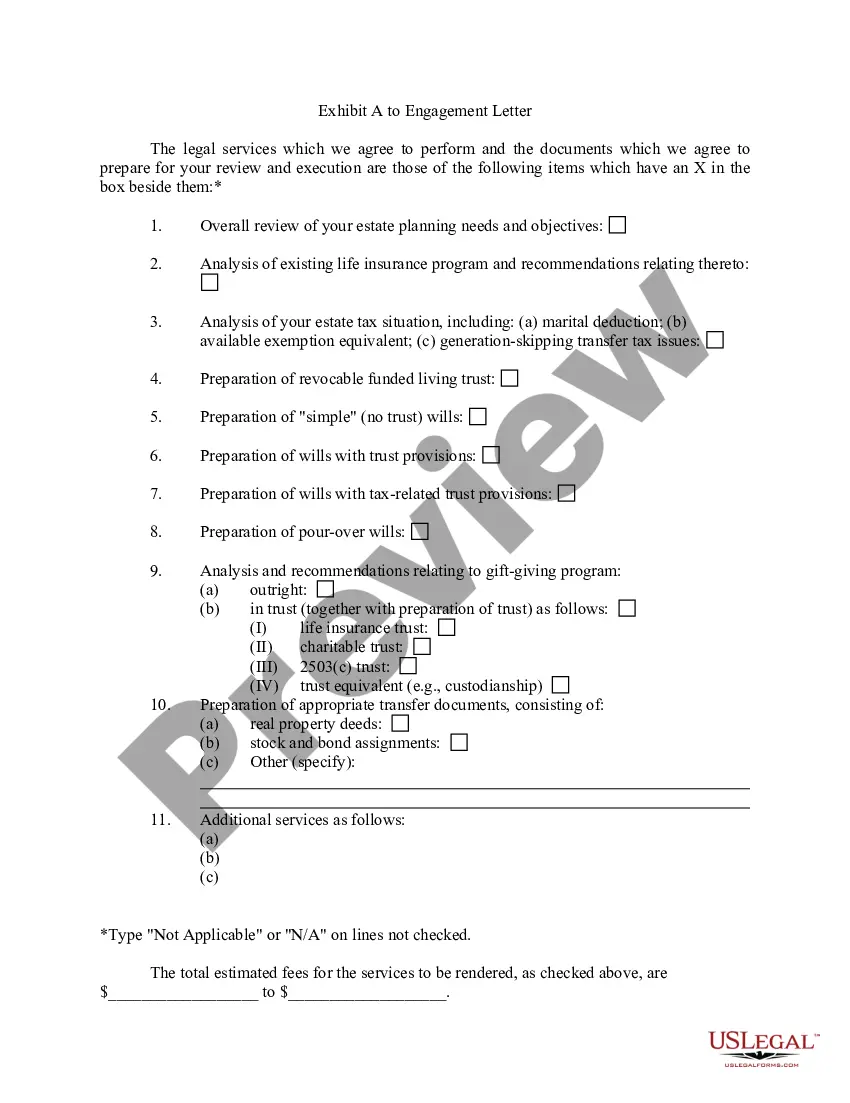

Effective estate planning requires various key pieces of information, including personal identification, a list of assets, and any existing wills or trusts. Additionally, you should consider your desired heirs and any specific instructions regarding your estate. An organized Connecticut Estate Planning Data Letter and Employment Agreement with Client can facilitate this process smoothly.

To create a valid will in Connecticut, you must be at least 18 years old, be of sound mind, and sign your will in front of two witnesses. These witnesses must also sign the document to confirm they saw you sign it. Utilizing a Connecticut Estate Planning Data Letter and Employment Agreement with Client can help ensure you meet all legal criteria.

To file a will in Connecticut, you need to prepare the will itself, a PC 201 form to commence probate, and any additional supporting documents that pertain to assets of the estate. It's also important to have proof of death and personal identification available. Proper documentation ensures a smooth probate process. A well-crafted Connecticut Estate Planning Data Letter and Employment Agreement with Client can help organize these essential documents.

Rule of Professional Conduct 4.2 in Connecticut addresses communications with parties who are represented by an attorney. It ensures that attorneys do not speak directly to an opposing party without their attorney’s consent. Understanding this rule is vital for anyone involved in legal matters, especially for clients active in establishing their Connecticut Estate Planning Data Letter and Employment Agreement with Client.