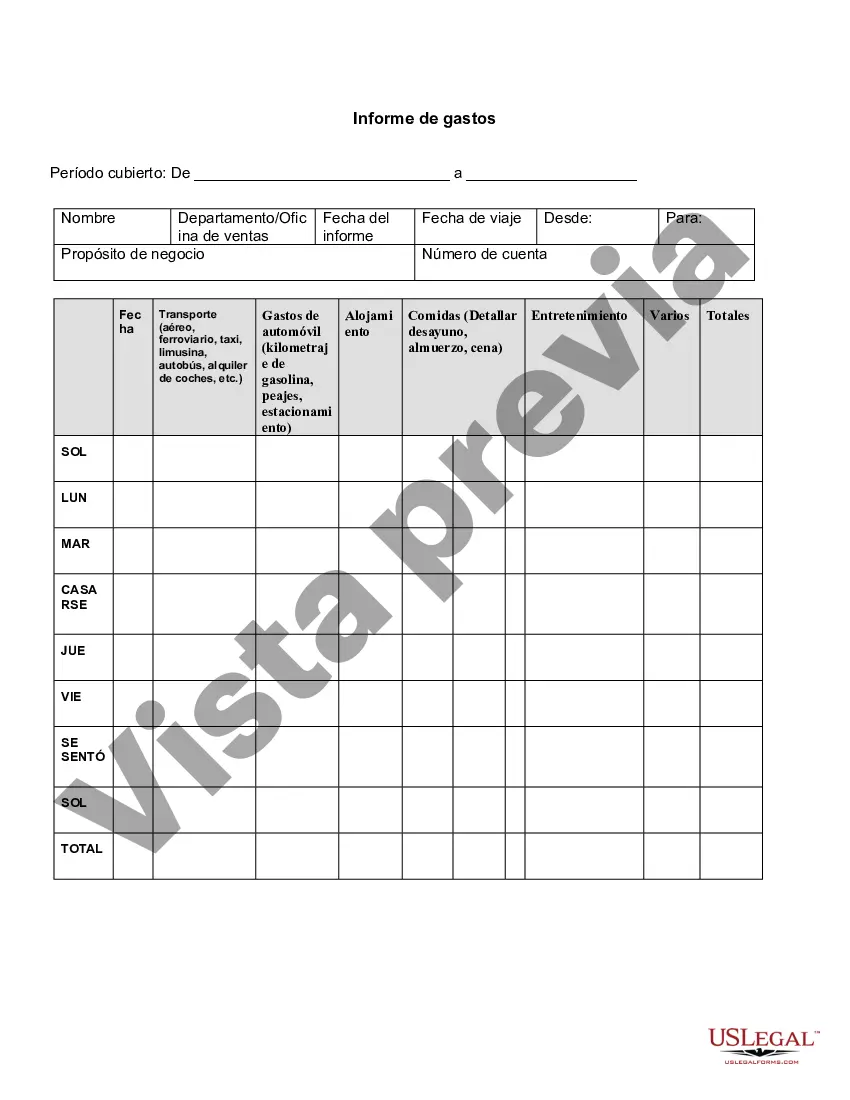

The Connecticut Expense Report is a comprehensive document used by individuals or organizations in Connecticut to record and track expenses incurred during a specific period. This report serves as a crucial tool for maintaining accurate financial records and ensuring transparency in expenditure management. One of the primary purposes of the Connecticut Expense Report is to monitor and control spending. By systematically recording each expense, individuals and organizations can analyze their financial activities and identify areas where budget adjustments may be necessary. This report includes various categories such as travel, accommodation, meals, transportation, supplies, and any other miscellaneous costs. Keywords: Connecticut Expense Report, financial records, expenditure management, spending control, budget adjustments, travel, accommodation, meals, transportation, supplies, miscellaneous costs. There are different types of Connecticut Expense Reports tailored to specific purposes and individuals/organizations. Let's explore some of these variations: 1. Individual Expense Report: This report is used by individuals residing in Connecticut to track personal expenses effectively. It helps individuals gain insights into their spending habits, set personal budgets, and manage their finances more efficiently. 2. Business Expense Report: Connecticut businesses use this report to monitor and reimburse expenses incurred by employees during work-related activities. It ensures that employees are appropriately reimbursed for business-related costs while adhering to the company's expense policies and guidelines. 3. Travel Expense Report: Specifically designed for individuals or organizations involved in frequent travel, this report focuses on recording travel-related expenses, including transportation costs, lodging, meals, and other expenses incurred during business trips or vacation. 4. Project Expense Report: This report is utilized by project managers, organizations, or government entities engaged in specific projects within Connecticut. It tracks project-related expenses, such as manpower costs, equipment purchases, subcontractor bills, training expenses, and any other costs related to the project's execution. 5. Educational Expense Report: This type of report is often used by educational institutions, scholarship programs, or students from Connecticut to document and claim educational expenses. It encompasses tuition fees, textbooks, stationery, transportation fees, and other costs incurred for educational purposes. Keywords: Individual Expense Report, Business Expense Report, Travel Expense Report, Project Expense Report, Educational Expense Report. In conclusion, the Connecticut Expense Report is a crucial tool for accurate expense tracking and financial management. Its various types cater to different needs, ensuring that individuals, businesses, and organizations in Connecticut can effectively monitor and control their expenses while maintaining transparency and compliance with relevant regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Informe de gastos - Expense Report

Description

How to fill out Connecticut Informe De Gastos?

You may devote time on the Internet attempting to find the lawful record design that fits the state and federal requirements you want. US Legal Forms gives a huge number of lawful kinds that happen to be reviewed by pros. You can actually obtain or printing the Connecticut Expense Report from the services.

If you currently have a US Legal Forms profile, you may log in and click the Down load switch. After that, you may comprehensive, modify, printing, or sign the Connecticut Expense Report. Each and every lawful record design you buy is the one you have permanently. To get yet another version of the bought form, go to the My Forms tab and click the related switch.

If you work with the US Legal Forms website the first time, stick to the basic directions below:

- Initial, make sure that you have selected the proper record design for the region/area of your liking. Look at the form explanation to ensure you have picked out the proper form. If readily available, utilize the Review switch to appear from the record design also.

- If you wish to locate yet another edition of the form, utilize the Search area to get the design that fits your needs and requirements.

- After you have located the design you want, click on Buy now to move forward.

- Select the prices prepare you want, type in your references, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You should use your charge card or PayPal profile to purchase the lawful form.

- Select the format of the record and obtain it to the product.

- Make adjustments to the record if required. You may comprehensive, modify and sign and printing Connecticut Expense Report.

Down load and printing a huge number of record layouts utilizing the US Legal Forms site, that provides the biggest assortment of lawful kinds. Use skilled and state-distinct layouts to tackle your company or person needs.