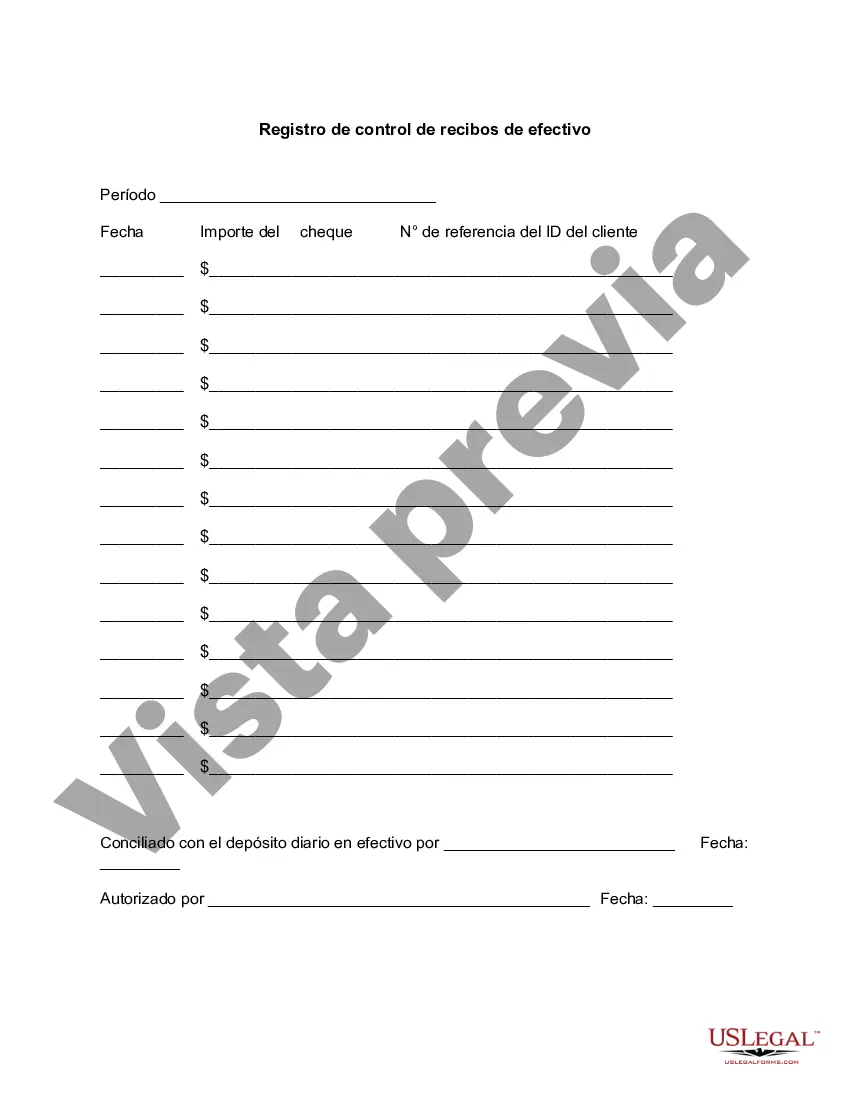

Connecticut Cash Receipts Control Log is a crucial financial document used by businesses and organizations in Connecticut to track and maintain records of cash receipts. This log helps ensure accuracy, transparency, and efficiency in managing cash transactions. It enables businesses to monitor and control the flow of cash within their operations, promoting financial accountability. The Connecticut Cash Receipts Control Log serves as a detailed record-keeping tool that captures various essential information pertaining to each cash receipt. It includes relevant keywords such as: 1. Date: The log records the date of the cash receipt, allowing for chronological organization and accurate tracking. 2. Reference/Receipt Number: Each cash receipt is assigned a unique identifier for easy identification and cross-referencing. 3. Customer/Client/Donor Information: The log captures the name, address, and contact details of the individual or organization from whom the cash is received. 4. Description/Source of Receipt: This section specifies the nature or source of the cash receipt, be it sales revenue, donation, rent payment, or any other relevant activity. 5. Amount: The log includes the monetary value of each cash receipt, ensuring a clear overview of the inflow of funds. 6. Mode of Payment: It records the method of payment, such as cash, check, credit card, wire transfer, or any other means used by the payer. 7. Deposited By: The name or initials of the individual responsible for depositing the cash to the designated bank account is logged. 8. Approval/Authorization: If there is a need for authorization or approval of the cash receipt, the relevant personnel's name or signature is documented. 9. Comments/Notes: A section for optional notes or comments can be added to record any additional relevant information not covered by the other fields. There are no specific different types of Connecticut Cash Receipts Control Logs. However, customized versions of the log may be developed to cater to specific industries, businesses, or organizations. These adaptations could include additional fields or data points relevant to the particular business type, such as specific industry codes, project names, or grant numbers. In conclusion, the Connecticut Cash Receipts Control Log is a crucial financial tool that helps businesses maintain accurate records of cash transactions. By using this log, businesses in Connecticut can effectively monitor and control their cash flow, ensuring transparency and financial accountability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out Connecticut Registro De Control De Recibos De Efectivo?

If you need to complete, down load, or print out authorized papers layouts, use US Legal Forms, the greatest variety of authorized varieties, that can be found on the web. Take advantage of the site`s easy and hassle-free lookup to discover the files you want. Different layouts for organization and individual functions are sorted by classes and says, or key phrases. Use US Legal Forms to discover the Connecticut Cash Receipts Control Log in a handful of mouse clicks.

Should you be currently a US Legal Forms customer, log in for your account and click on the Acquire switch to obtain the Connecticut Cash Receipts Control Log. You can also entry varieties you formerly downloaded inside the My Forms tab of the account.

If you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the shape for the proper metropolis/land.

- Step 2. Make use of the Preview method to look over the form`s articles. Do not neglect to learn the information.

- Step 3. Should you be unsatisfied together with the form, take advantage of the Research area on top of the screen to discover other versions of your authorized form design.

- Step 4. After you have found the shape you want, go through the Buy now switch. Choose the pricing strategy you favor and add your references to register for an account.

- Step 5. Method the deal. You can utilize your charge card or PayPal account to complete the deal.

- Step 6. Choose the file format of your authorized form and down load it on your gadget.

- Step 7. Complete, edit and print out or signal the Connecticut Cash Receipts Control Log.

Each and every authorized papers design you acquire is yours eternally. You have acces to each and every form you downloaded within your acccount. Click on the My Forms segment and decide on a form to print out or down load once again.

Be competitive and down load, and print out the Connecticut Cash Receipts Control Log with US Legal Forms. There are millions of skilled and state-particular varieties you may use to your organization or individual requirements.