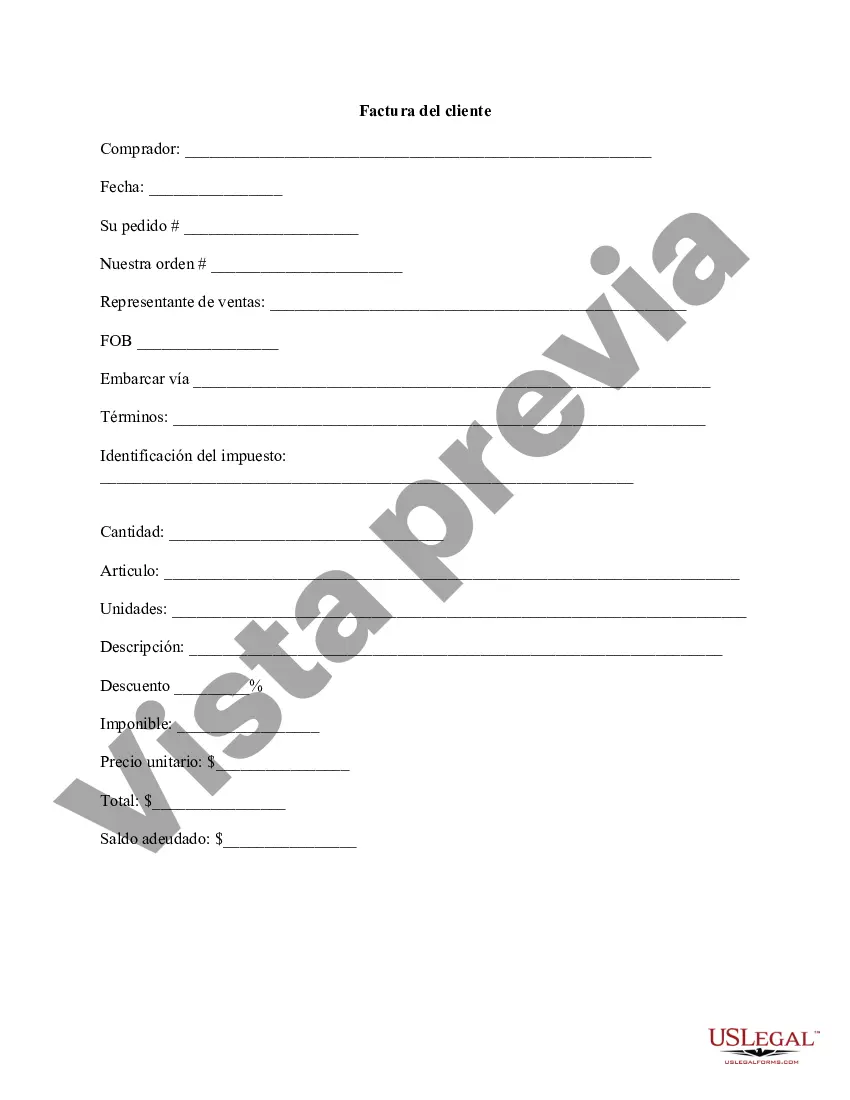

Connecticut Customer Invoice is an essential document used by businesses in Connecticut to provide a detailed breakdown of goods or services sold to their customers. It serves as a formal request for payment and includes pertinent information to ensure accurate billing and smooth transactions. The structure of a Connecticut Customer Invoice usually consists of specific sections. The header displays the word "Invoice" prominently, followed by the business name, address, contact details, and customer details, such as name, address, and contact information. This ensures both parties are clearly identified. The subsequent sections of a Connecticut Customer Invoice provide detailed information about the products or services purchased. This includes the item names, descriptions, quantities, unit prices, and total amounts. Additionally, any applicable taxes, discounts, or shipping charges are clearly mentioned. Connecticut Customer Invoices often include payment terms, such as the due date, accepted payment methods, and any associated fees for late payments. This helps set clear expectations for prompt payment and aids in maintaining strong customer relationships. If there are different types of Connecticut Customer Invoices, they could be categorized based on the type of business or industry. Some common variations include: 1. Retail Customer Invoice: These invoices are frequently used in retail settings where customers purchase goods directly from the seller. They typically include a comprehensive list of products, prices, applicable taxes, and any additional fees. 2. Service-Based Customer Invoice: Service-oriented businesses, such as consulting firms or freelancers, issue service-based customer invoices. These invoices outline the specific services provided, along with corresponding rates, hours logged, or project milestones. 3. Wholesale Customer Invoice: Wholesale businesses that sell products in bulk quantities often utilize wholesale customer invoices. This type of invoice typically includes item codes, quantities, wholesale prices, and any applicable discounts. It is crucial for maintaining accurate inventory management. 4. Subscription-Based Customer Invoice: Companies offering subscription-based services, such as software providers or membership organizations, often use recurring customer invoices. These invoices outline the subscription plan, billing cycles, and anticipated renewal dates. By using appropriate keywords like "Connecticut Customer Invoice," "invoice types," "retail invoices," "service-based invoices," "wholesale invoices," and "subscription-based invoices," this informative content aims to shed light on the purpose, structure, and different types of Connecticut Customer Invoices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Factura del cliente - Customer Invoice

Description

How to fill out Connecticut Factura Del Cliente?

Are you currently within a placement where you need to have paperwork for either enterprise or individual purposes just about every time? There are a lot of legal file themes available on the net, but discovering types you can rely is not easy. US Legal Forms provides a huge number of develop themes, just like the Connecticut Customer Invoice, which can be written to satisfy state and federal specifications.

If you are already familiar with US Legal Forms internet site and get a free account, basically log in. Afterward, you may down load the Connecticut Customer Invoice design.

Should you not come with an bank account and need to begin to use US Legal Forms, follow these steps:

- Obtain the develop you need and make sure it is for the right city/region.

- Utilize the Preview key to analyze the shape.

- Browse the description to actually have chosen the correct develop.

- If the develop is not what you`re searching for, take advantage of the Research industry to obtain the develop that meets your needs and specifications.

- If you find the right develop, click Acquire now.

- Select the costs strategy you want, submit the desired details to generate your bank account, and pay money for an order utilizing your PayPal or bank card.

- Decide on a hassle-free paper formatting and down load your copy.

Locate all the file themes you have bought in the My Forms food selection. You can obtain a additional copy of Connecticut Customer Invoice any time, if required. Just click the essential develop to down load or produce the file design.

Use US Legal Forms, one of the most considerable selection of legal kinds, to save some time and steer clear of mistakes. The assistance provides professionally created legal file themes that you can use for a range of purposes. Produce a free account on US Legal Forms and start making your daily life a little easier.