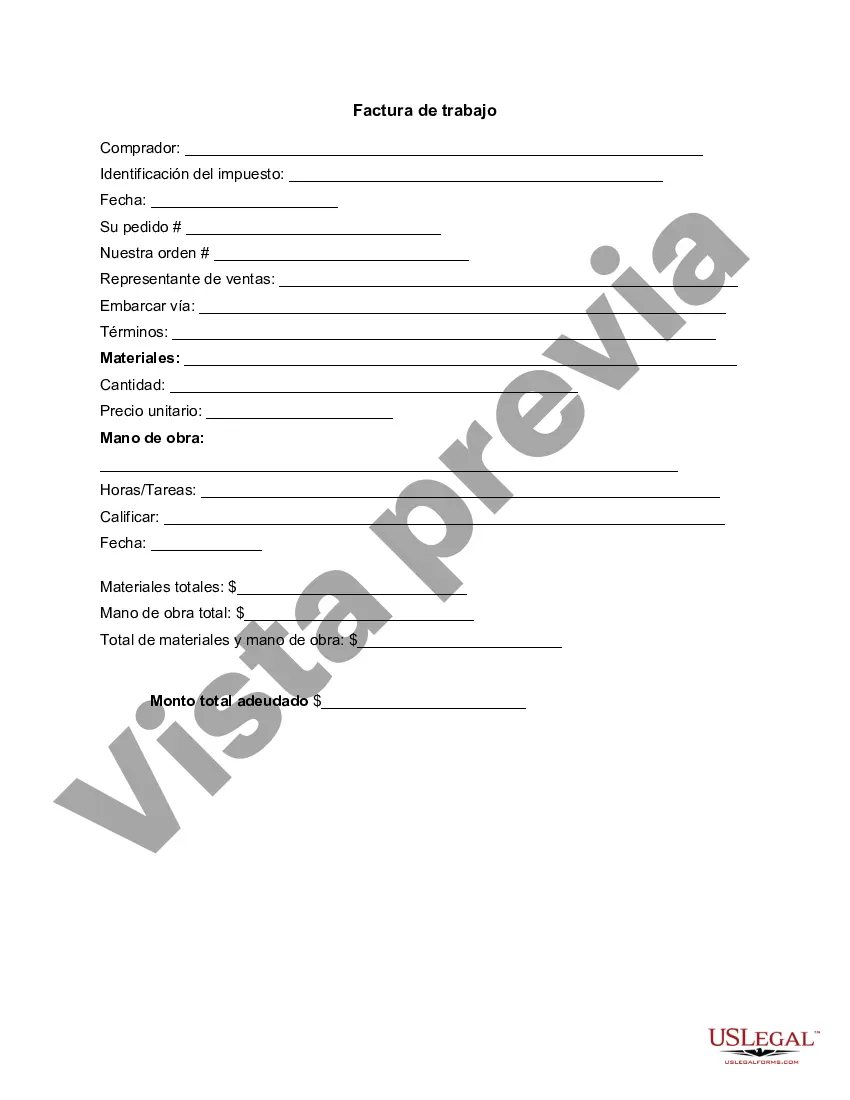

Connecticut Invoice Template for HR Assistant is a pre-designed document used by human resources professionals in the state of Connecticut to streamline their invoice creation process. This template is specifically tailored to cater to the needs of HR assistants, ensuring accuracy, professionalism, and compliance with the local regulations. The Connecticut Invoice Template for HR Assistant is designed to assist in billing clients or departments for HR-related services provided, such as recruitment, employee onboarding, training, and other administrative duties. With this template, HR assistants can easily create and customize invoices to reflect their specific services and rates, helping them maintain precise records of their financial transactions. This carefully crafted Connecticut Invoice Template eliminates the need to start from scratch, saving time and effort. It includes all the essential components necessary for a comprehensive invoice, such as: 1. Company Information: An HR assistant can include the company's name, address, email, and contact details at the top of the invoice for identification purposes. 2. Client Information: The template offers a designated section to input client details, including their name, company name, address, and contact information. This helps in accurately identifying the recipient of the invoice. 3. Invoice Number and Date: Each invoice created using this template will have a unique invoice number and date, ensuring proper record-keeping and chronological organization of invoices. 4. Itemized Description: The Connecticut Invoice Template for HR Assistant allows for a detailed breakdown of the services provided. HR assistants can list each service or task separately, along with the quantity, rate, and total cost, giving a clear overview to clients or departments. 5. Tax Information: Connecticut's tax regulations require businesses to include relevant tax information on invoices. Therefore, this template incorporates a section for HR assistants to enter the applicable tax rates and indicate whether the tax is included or excluded. 6. Total Amount Due: The template automatically calculates the total amount due based on the provided itemized description, including taxes if applicable. Clients or departments can easily identify the final amount they need to pay. Some variations or types of Connecticut Invoice Templates for HR Assistants may include: 1. Basic Connecticut Invoice Template: This version offers a simple, no-frills design with essential sections for company information, client information, itemized description, tax information, and total amount due. 2. Customizable Connecticut Invoice Template: This variation provides additional flexibility, allowing HR assistants to modify the design, add company logos or branding elements, and customize the sections according to their specific preferences or requirements. 3. Monthly Retainer Connecticut Invoice Template: This template is designed for HR assistants who provide ongoing services to clients or departments on a retainer basis. It includes sections to specify the retainer fee, agreed-upon hours, and any additional charges based on extra work performed. In conclusion, the Connecticut Invoice Template for HR Assistant is a vital tool that simplifies the invoicing process, ensures compliance with local regulations, and helps HR professionals maintain accurate financial records. Whether it's a basic template or a customized version, HR assistants can efficiently create professional invoices, enhancing their professionalism and organization.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Plantilla de factura para asistente de recursos humanos - Invoice Template for HR Assistant

Description

How to fill out Connecticut Plantilla De Factura Para Asistente De Recursos Humanos?

Finding the right legal file design can be a struggle. Of course, there are tons of web templates accessible on the Internet, but how can you obtain the legal develop you want? Use the US Legal Forms web site. The service provides 1000s of web templates, including the Connecticut Invoice Template for HR Assistant, that you can use for organization and private needs. All the types are checked by specialists and meet up with state and federal requirements.

When you are currently authorized, log in to the profile and then click the Download key to have the Connecticut Invoice Template for HR Assistant. Utilize your profile to look from the legal types you possess acquired previously. Proceed to the My Forms tab of your respective profile and get yet another version of your file you want.

When you are a new customer of US Legal Forms, listed here are basic instructions so that you can comply with:

- Initially, make certain you have selected the right develop to your town/county. You can check out the shape using the Review key and study the shape explanation to make sure this is basically the right one for you.

- If the develop fails to meet up with your requirements, make use of the Seach industry to discover the proper develop.

- When you are positive that the shape would work, click on the Purchase now key to have the develop.

- Opt for the pricing program you want and enter the essential details. Build your profile and pay money for the order with your PayPal profile or bank card.

- Choose the file format and acquire the legal file design to the system.

- Comprehensive, revise and print and indication the obtained Connecticut Invoice Template for HR Assistant.

US Legal Forms is the most significant collection of legal types in which you can discover various file web templates. Use the service to acquire skillfully-created paperwork that comply with condition requirements.