Connecticut Installment Promissory Note with Bank Deposit as Collateral is a legally binding document that outlines the terms and conditions of a loan agreement in the state of Connecticut. This type of promissory note includes a specific collateral arrangement, where the borrower pledges a bank deposit as security for the loan. The Connecticut Installment Promissory Note with Bank Deposit as Collateral is commonly used by individuals or businesses seeking to borrow funds from a lender while utilizing their bank deposit as collateral. This arrangement provides security for the lender, as the bank deposit can be utilized to recover the borrowed amount in case of default. There are different types of Connecticut Installment Promissory Note with Bank Deposit as Collateral, each tailored to suit varying circumstances: 1. Residential Loan Note: This type of promissory note is typically used when an individual or couple borrows funds to finance the purchase or refinancing of a residential property in Connecticut. The bank deposit serves as collateral to secure the lender's interest in the loan. 2. Commercial Loan Note: Primarily used by businesses, this promissory note documents a loan agreement for acquiring or expanding commercial properties or financing business operations. The bank deposit acts as collateral, offering the lender security in the event of default. 3. Personal Loan Note: This promissory note is utilized when an individual borrows money from a lender for personal use, such as funding education, medical expenses, or other personal projects. The bank deposit is pledged as collateral, providing assurance to the lender. 4. Business Loan Note: This type of promissory note is suitable for businesses requiring financing for various purposes, including working capital, equipment purchase, or business expansion. The bank deposit is used as collateral to protect the lender's interests. The Connecticut Installment Promissory Note with Bank Deposit as Collateral typically includes essential details such as the loan amount, interest rate, repayment terms, rights and responsibilities of both parties, and provisions for default and dispute resolution. It is crucial to consult legal professionals or financial advisors to ensure the agreement aligns with Connecticut's laws and regulations. Overall, a Connecticut Installment Promissory Note with Bank Deposit as Collateral provides a structured framework and legal protection for both borrowers and lenders involved in loan transactions in the state.

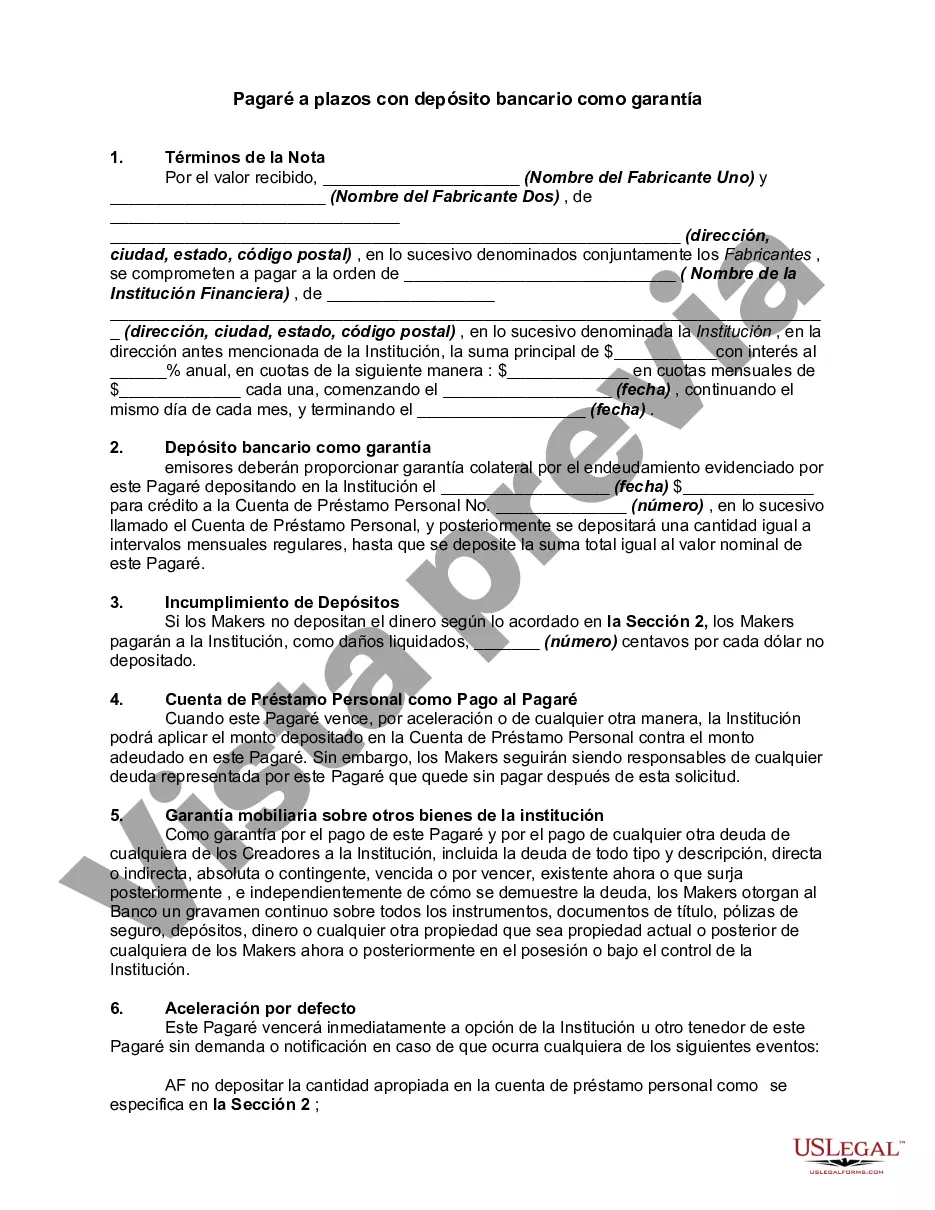

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Connecticut Pagaré A Plazos Con Depósito Bancario Como Garantía?

US Legal Forms - one of many greatest libraries of lawful kinds in the United States - offers a wide range of lawful papers templates you can obtain or produce. Using the site, you can find thousands of kinds for business and individual functions, sorted by types, states, or keywords and phrases.You will find the newest variations of kinds such as the Connecticut Installment Promissory Note with Bank Deposit as Collateral within minutes.

If you already have a monthly subscription, log in and obtain Connecticut Installment Promissory Note with Bank Deposit as Collateral from your US Legal Forms local library. The Obtain button will show up on every single kind you view. You get access to all previously saved kinds from the My Forms tab of the profile.

If you wish to use US Legal Forms initially, here are simple instructions to help you started out:

- Ensure you have picked the correct kind for your city/area. Select the Review button to analyze the form`s content. Browse the kind explanation to actually have chosen the right kind.

- In case the kind does not fit your demands, use the Research field near the top of the screen to obtain the one who does.

- When you are pleased with the shape, validate your choice by simply clicking the Acquire now button. Then, choose the rates program you want and give your credentials to register for the profile.

- Process the financial transaction. Make use of your charge card or PayPal profile to finish the financial transaction.

- Pick the formatting and obtain the shape on your gadget.

- Make modifications. Fill up, modify and produce and sign the saved Connecticut Installment Promissory Note with Bank Deposit as Collateral.

Each template you put into your money lacks an expiry time and is also your own property permanently. So, if you wish to obtain or produce one more copy, just proceed to the My Forms segment and click on the kind you will need.

Get access to the Connecticut Installment Promissory Note with Bank Deposit as Collateral with US Legal Forms, the most considerable local library of lawful papers templates. Use thousands of professional and status-specific templates that meet up with your company or individual requirements and demands.