Stock Certificate Legend refers to wording found on the front or back of a stock certificate which serves as notice of and a brief explanation of certain restrictions affecting the stock shares represented by that stock certificate.

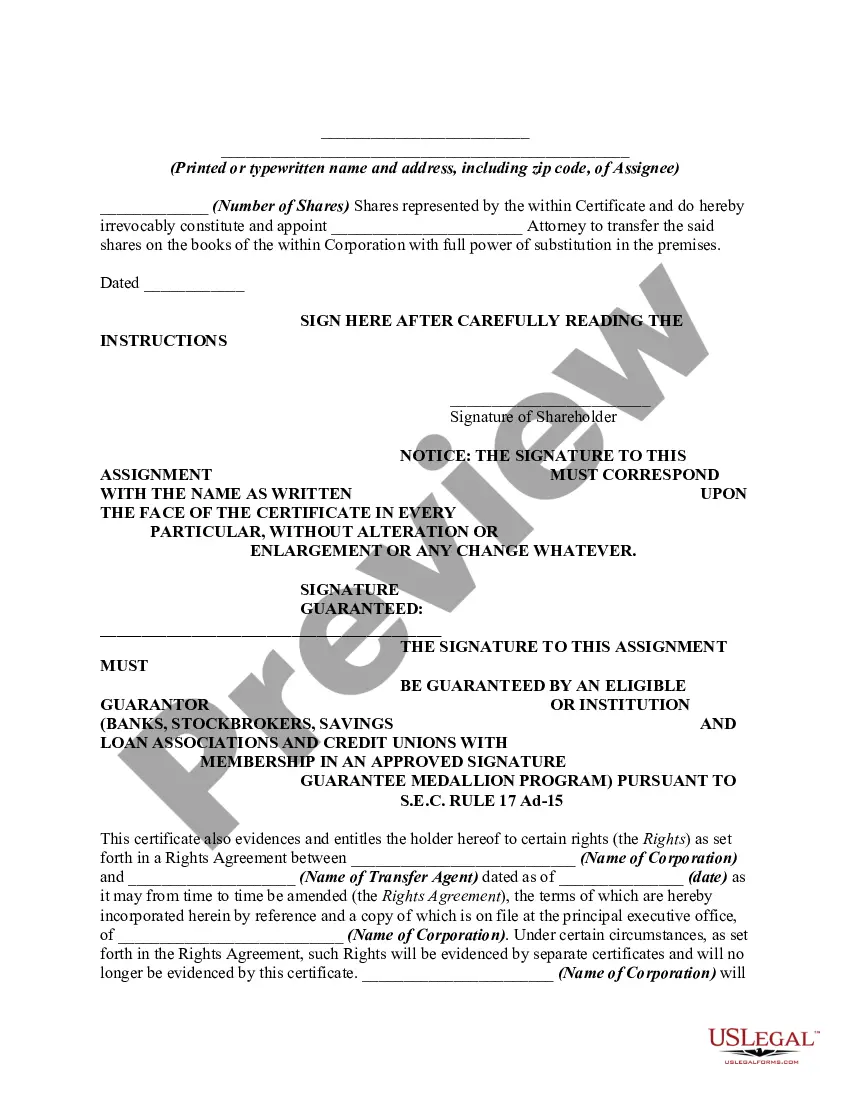

The reverse side of a stock certificate generally bears a form of assignment, which, when properly executed, transfers title to the stock represented by the certificate.

Connecticut Stock Certificate Legend — Common Stock serves as a legal document that accompanies the issuance of common stock in the state of Connecticut. This certificate allows individuals or entities to become shareholders in a company and signifies their ownership rights and participation in company decisions. The Connecticut Stock Certificate Legend — Common Stock contains vital information regarding the stock ownership, such as the company's name, identification number, the shareholder's name, the number of shares issued, and the class of stock being held (common stock in this case). This document also incorporates specific terms and conditions agreed upon by both the company and the shareholder. The legend section of the stock certificate provides important legal disclaimers and restrictions related to the common stock. It constitutes a protective measure for the company and warns potential buyers and subsequent holders about various restrictions that may apply to the stock. These limitations typically pertain to transferability, resale, and securities regulations. There might be different types of Connecticut Stock Certificate Legend — Common Stock, depending on the specific agreement between the issuing company and the shareholder. These could include: 1. Restricted Stock Certificate: This type of common stock certificate carries restrictions on the transferability of shares. It ensures that the stock remains within a certain group of individuals, such as company insiders, founders, or employees, for a specified period or until certain conditions are met. 2. Unrestricted Stock Certificate: An unrestricted common stock certificate allows shareholders to freely transfer their shares to other parties without any restrictions or limitations. The holder can sell, gift, or trade the shares as they desire, complying with applicable securities laws. 3. Voting Stock Certificate: Some common stock certificates may grant shareholders voting rights in the company's decision-making processes. This allows the shareholder to participate in electing the board of directors, approving corporate actions, and exercising a voice in crucial matters affecting the company. 4. Non-Voting Stock Certificate: Non-voting common stock certificates, on the other hand, do not grant shareholders the right to vote in company matters. These certificates primarily serve as a means of ownership without any involvement in the company's governance. Connecticut Stock Certificate Legend — Common Stock acts as an essential document for shareholders and companies, ensuring transparency, ownership verification, and compliance with relevant legal and regulatory requirements.Connecticut Stock Certificate Legend — Common Stock serves as a legal document that accompanies the issuance of common stock in the state of Connecticut. This certificate allows individuals or entities to become shareholders in a company and signifies their ownership rights and participation in company decisions. The Connecticut Stock Certificate Legend — Common Stock contains vital information regarding the stock ownership, such as the company's name, identification number, the shareholder's name, the number of shares issued, and the class of stock being held (common stock in this case). This document also incorporates specific terms and conditions agreed upon by both the company and the shareholder. The legend section of the stock certificate provides important legal disclaimers and restrictions related to the common stock. It constitutes a protective measure for the company and warns potential buyers and subsequent holders about various restrictions that may apply to the stock. These limitations typically pertain to transferability, resale, and securities regulations. There might be different types of Connecticut Stock Certificate Legend — Common Stock, depending on the specific agreement between the issuing company and the shareholder. These could include: 1. Restricted Stock Certificate: This type of common stock certificate carries restrictions on the transferability of shares. It ensures that the stock remains within a certain group of individuals, such as company insiders, founders, or employees, for a specified period or until certain conditions are met. 2. Unrestricted Stock Certificate: An unrestricted common stock certificate allows shareholders to freely transfer their shares to other parties without any restrictions or limitations. The holder can sell, gift, or trade the shares as they desire, complying with applicable securities laws. 3. Voting Stock Certificate: Some common stock certificates may grant shareholders voting rights in the company's decision-making processes. This allows the shareholder to participate in electing the board of directors, approving corporate actions, and exercising a voice in crucial matters affecting the company. 4. Non-Voting Stock Certificate: Non-voting common stock certificates, on the other hand, do not grant shareholders the right to vote in company matters. These certificates primarily serve as a means of ownership without any involvement in the company's governance. Connecticut Stock Certificate Legend — Common Stock acts as an essential document for shareholders and companies, ensuring transparency, ownership verification, and compliance with relevant legal and regulatory requirements.