Connecticut Debt Adjustment Agreement with Creditor: Explained In the state of Connecticut, individuals who are struggling with overwhelming debt have an option to enter into a debt adjustment agreement with their creditors. A debt adjustment agreement is a legally binding contract between a debtor and a creditor where the terms of the repayment of the debt are renegotiated to make it more manageable for the debtor. This agreement allows the debtor to make agreed-upon payments towards the outstanding debt, helping them reduce their financial burden. Connecticut recognizes two primary types of debt adjustment agreements with creditors, namely: 1. Voluntary Debt Adjustment Agreement: A voluntary debt adjustment agreement is entered into when the debtor willingly approaches the creditor to negotiate new repayment terms. In this arrangement, both parties work together to create a modified payment plan that suits the debtor's financial situation. The goal is to establish a reasonable schedule for repayment that the debtor can afford while ensuring that the creditor receives their due payment over time. 2. Court-Ordered Debt Adjustment Agreement: A court-ordered debt adjustment agreement is initiated when a debtor chooses to file for bankruptcy under Chapter 13 of the United States Bankruptcy Code. In this scenario, the court intervenes to create a structured repayment plan for the debtor. The court reviews the debtor's assets, income, and outstanding debts to create a balanced repayment plan that satisfies both the debtor and the creditor. The court-appointed trustee assists in overseeing the repayment process and ensures that the debtor adheres to the terms of the agreement. When a debt adjustment agreement is reached, it typically involves renegotiating the principal balance, interest rates, and sometimes even extending the repayment period. The agreement may also include a provision to halt or reduce collection activities by the creditor, providing the debtor with relief from constant harassment or legal actions. It is important to note that debt adjustment agreements are a viable option for individuals struggling with unmanageable debt; however, they may have certain implications on the debtor's credit rating. Before entering into such an agreement, it is recommended to seek professional financial advice to fully understand the consequences and alternatives available. Connecticut's debt adjustment agreement with creditors acts as a lifeline for individuals facing financial hardship. It allows debtors to regain control over their finances, repay their debts, and work towards a more stable, debt-free future. By providing options for negotiation and rearrangement of debt terms, these agreements strive to offer a fair resolution to both debtors and creditors alike.

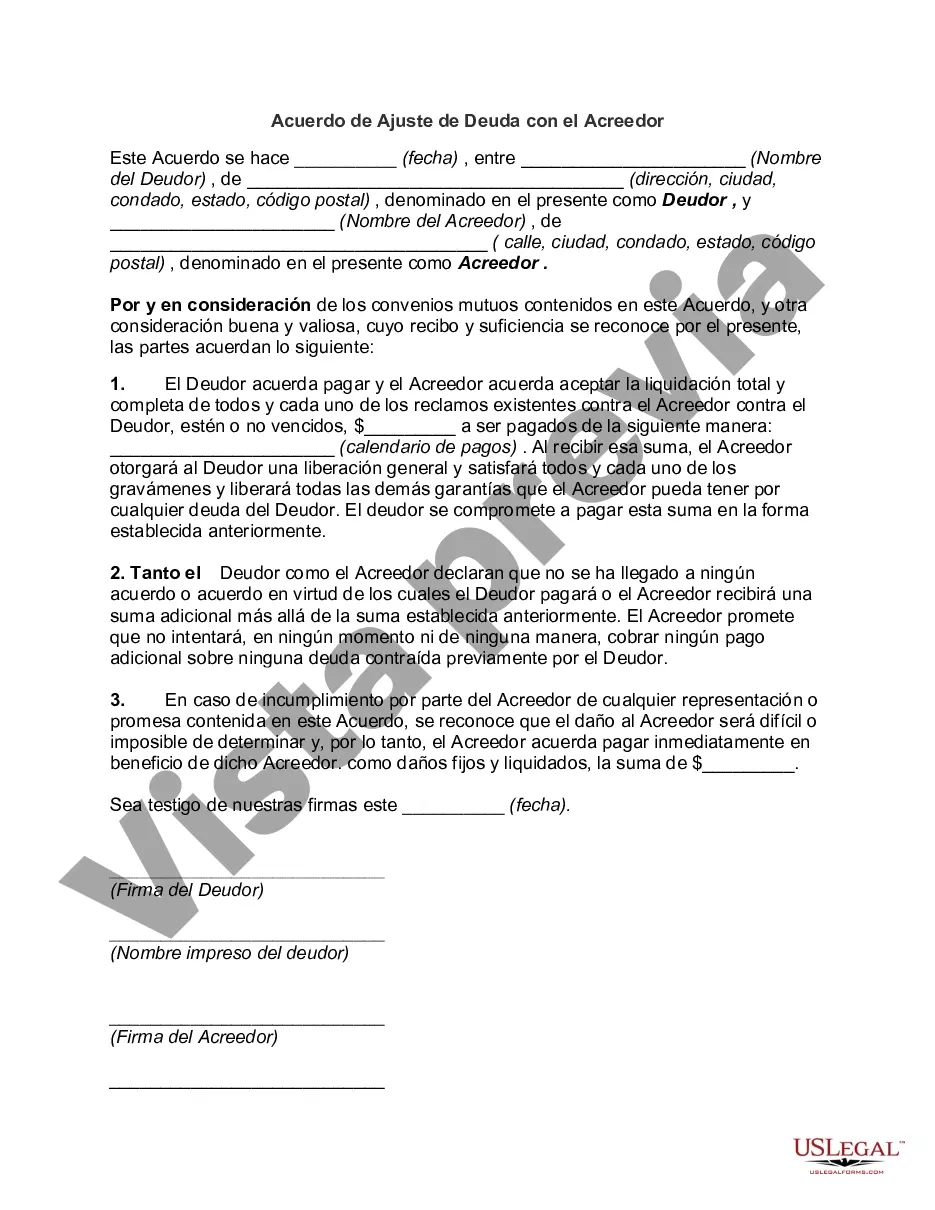

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Connecticut Acuerdo De Ajuste De Deuda Con El Acreedor?

US Legal Forms - one of many greatest libraries of legal types in the USA - offers a variety of legal document layouts you can download or print. Using the web site, you may get a huge number of types for company and person functions, categorized by types, suggests, or keywords and phrases.You will find the newest models of types much like the Connecticut Debt Adjustment Agreement with Creditor within minutes.

If you have a membership, log in and download Connecticut Debt Adjustment Agreement with Creditor from the US Legal Forms library. The Down load option can look on each and every develop you look at. You have access to all earlier downloaded types inside the My Forms tab of your accounts.

If you would like use US Legal Forms the first time, allow me to share easy instructions to get you began:

- Make sure you have picked the best develop for the city/county. Select the Review option to review the form`s content. Look at the develop outline to actually have chosen the appropriate develop.

- If the develop doesn`t satisfy your specifications, make use of the Look for area near the top of the display screen to get the one which does.

- Should you be pleased with the shape, validate your selection by visiting the Get now option. Then, pick the prices prepare you like and supply your accreditations to sign up for an accounts.

- Process the transaction. Make use of your credit card or PayPal accounts to complete the transaction.

- Choose the format and download the shape on the gadget.

- Make modifications. Load, modify and print and signal the downloaded Connecticut Debt Adjustment Agreement with Creditor.

Each and every template you included in your money does not have an expiration time and it is the one you have eternally. So, if you wish to download or print yet another version, just check out the My Forms section and click on in the develop you want.

Obtain access to the Connecticut Debt Adjustment Agreement with Creditor with US Legal Forms, the most comprehensive library of legal document layouts. Use a huge number of skilled and state-certain layouts that meet your business or person requires and specifications.