Connecticut Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

How to fill out Letter To Creditor Confirming Agreement That Monthly Payments Be Temporarily Postponed?

It is possible to spend hours on the web attempting to find the legitimate record web template which fits the federal and state specifications you require. US Legal Forms supplies a large number of legitimate varieties that are analyzed by professionals. It is possible to down load or print out the Connecticut Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed from your support.

If you have a US Legal Forms bank account, you are able to log in and then click the Down load button. Next, you are able to total, revise, print out, or indicator the Connecticut Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed. Each legitimate record web template you buy is your own property for a long time. To get another backup of any bought develop, visit the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms internet site initially, stick to the straightforward recommendations under:

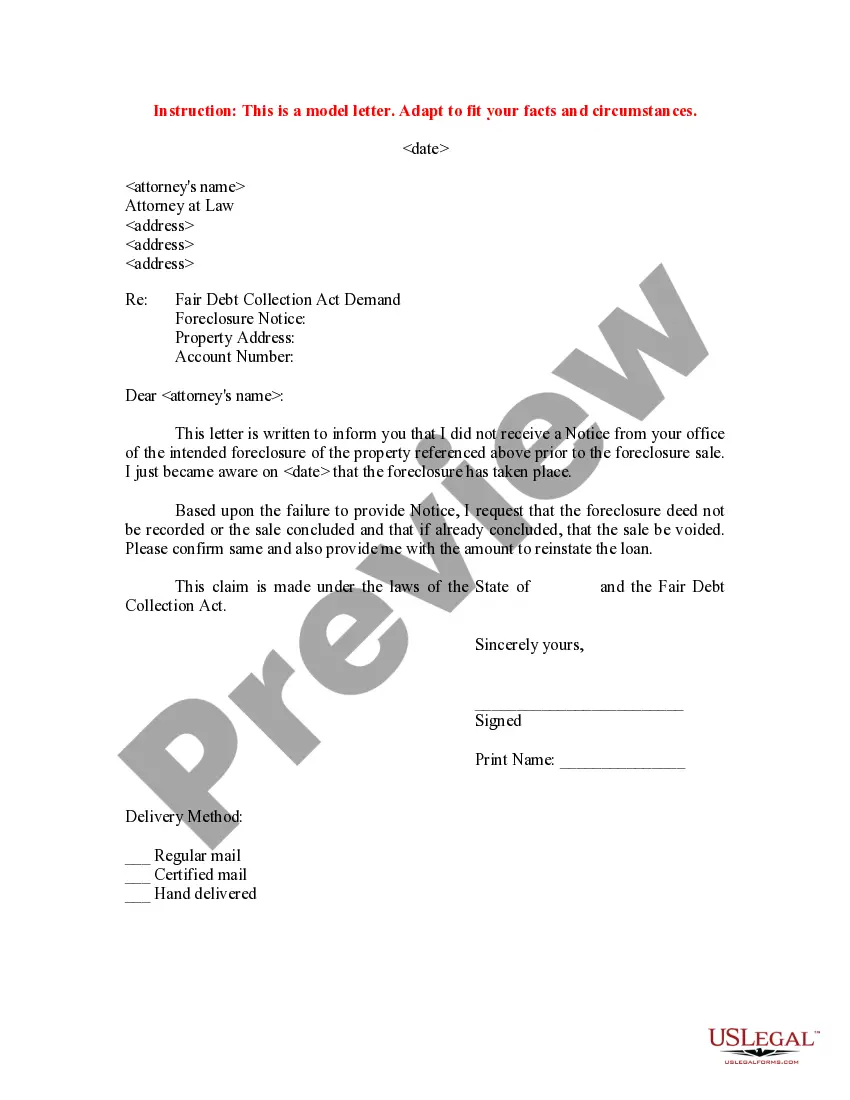

- Very first, be sure that you have chosen the correct record web template for the area/town of your choice. Look at the develop description to ensure you have chosen the appropriate develop. If available, make use of the Preview button to look with the record web template at the same time.

- If you want to locate another variation from the develop, make use of the Search area to discover the web template that meets your requirements and specifications.

- After you have identified the web template you want, click on Acquire now to move forward.

- Find the rates strategy you want, key in your accreditations, and register for an account on US Legal Forms.

- Total the purchase. You can use your Visa or Mastercard or PayPal bank account to cover the legitimate develop.

- Find the format from the record and down load it to your gadget.

- Make modifications to your record if possible. It is possible to total, revise and indicator and print out Connecticut Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed.

Down load and print out a large number of record templates making use of the US Legal Forms site, that offers the greatest variety of legitimate varieties. Use expert and state-specific templates to handle your company or personal requires.

Form popularity

FAQ

How to prepare to talk with your creditorsThe specifics of your account. If you're calling to discuss a current account or loan, be sure to have a current statement on hand.An explanation of your situation.A repayment option/plan.Proof of your situation.A cool head.

Pay for delete starts with a call or a letter to the debt collector in which you propose a deal: You'll pay off the account, and the collector will wipe the account from your credit reports.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.

10 Tips for Negotiating with CreditorsIs Negotiation the Right Move For You? It's important to think carefully about negotiation.Know Your Terms.Keep Your Story Straight.Ask Questions, and Don't Tolerate Bullying.Take Notes.Read and Save Your Mail.Talk to Creditors, Not Collection Agencies.Get It in Writing.More items...?

Failing to respond to a Debt Validation Letter while continuing to collect on the debt is a direct violation of the FDCPA. You can report a debt collector's failure to respond to your state's attorney general, the Consumer Financial Protection Bureau (CFPB), or the FTC.

Whether you're in arrears or struggling to keep on top of your regular payments, asking your creditors to freeze interest and charges can help you clear your debts and get back on track quicker. They may agree to freeze interest for an agreed length of time if you tell them about your financial difficulties.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

How to Write a Debt Verification LetterDetermine the exact amounts you owe.Gather documents that verify your debt.Get information on who you owe.Determine how old the debt is.Place a pause on the collection proceedings.

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.