Connecticut Cash Disbursements and Receipts refers to the financial transactions involving the outflow and inflow of money within the state of Connecticut. These transactions play a crucial role in the governance and financial management of the state. Understanding and tracking these cash disbursements and receipts are essential for effective budgeting, financial planning, and ensuring transparency in government operations. Connecticut State Government follows a standardized procedure for handling cash disbursements. These disbursements primarily involve the payment of salaries, vendor bills, debt obligations, grants, and other expenses incurred by various state agencies and departments. The state government ensures that these disbursements are executed within authorized guidelines and regulations to maintain fiscal responsibility and avoid any misuse of public funds. Similarly, cash receipts refer to the money flowing into the Connecticut State Treasury. These receipts include tax revenues, federal aid, fees and fines, lottery proceeds, and other sources of income collected by the state. Proper recording and tracking of these receipts are crucial to maintaining an accurate financial record and ensuring funds are allocated appropriately. Connecticut Cash Disbursements and Receipts are often categorized into different types based on their nature and purpose. Some common types include: 1. Operating expenses: These include routine expenditures incurred by state agencies for day-to-day operations, such as office supplies, maintenance, utilities, and employee salaries. 2. Debt service payments: Connecticut has various outstanding debts, including bonds and loans, which require regular payments to lenders. These payments ensure the state's financial obligations are met promptly. 3. Vendor payments: State agencies often contract with vendors or suppliers for goods and services. Cash disbursements are made to these vendors as payment for the services rendered or products delivered. 4. Transfer payments: Connecticut State Government also makes transfer payments to individuals or organizations in the form of grants, subsidies, or assistance programs. These payments aim to support various sectors, such as education, healthcare, social welfare, and economic development. 5. Tax receipts: Connecticut relies on tax revenues as a significant source of income. Cash receipts include taxes collected from individuals and businesses, such as income tax, sales tax, property tax, and corporate tax. 6. Federal aid receipts: The state receives grants and financial assistance from the federal government for specific programs and initiatives. These receipts contribute to the overall revenue of the state. In conclusion, Connecticut Cash Disbursements and Receipts encompass the financial transactions involving the state's monetary outflows and inflows. Understanding the various types of disbursements and receipts is crucial for effective financial management, transparency, and accountability in the state's governance.

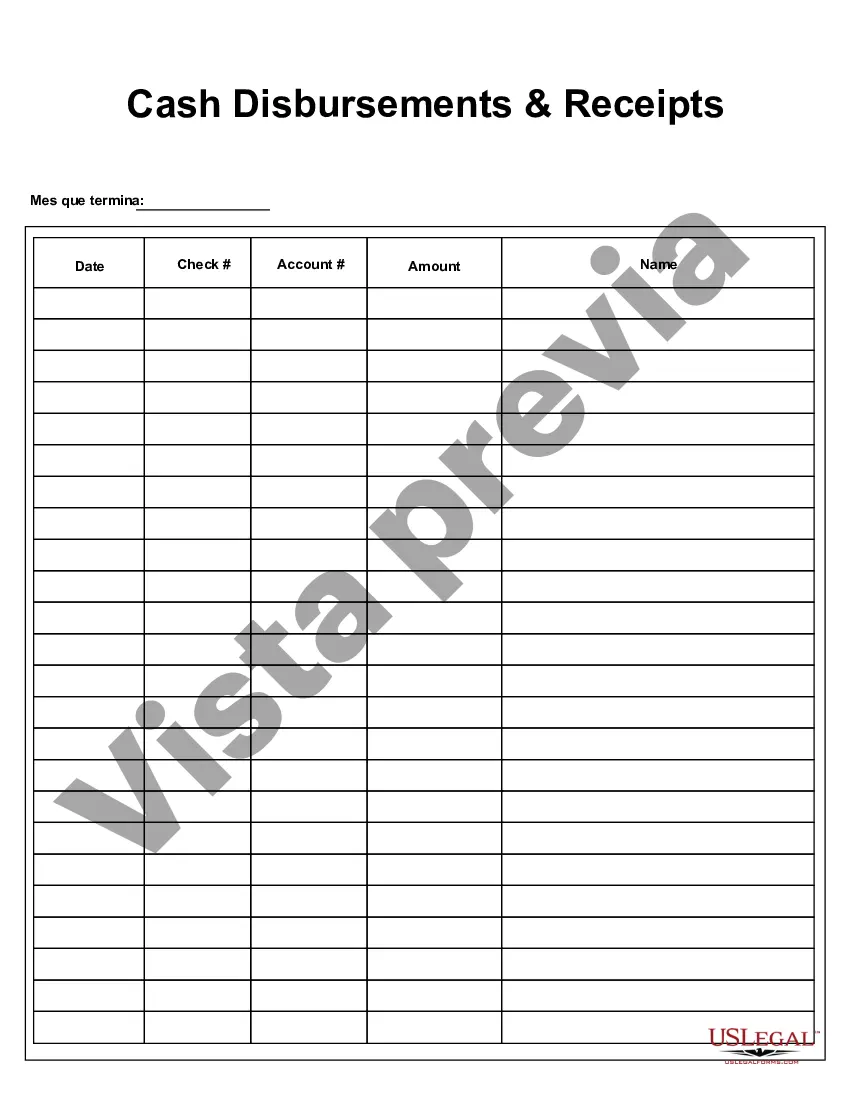

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Desembolsos y recibos de efectivo - Cash Disbursements and Receipts

Description

How to fill out Connecticut Desembolsos Y Recibos De Efectivo?

If you have to comprehensive, download, or print out lawful papers themes, use US Legal Forms, the largest assortment of lawful types, that can be found on the Internet. Use the site`s basic and hassle-free lookup to find the papers you require. A variety of themes for enterprise and individual uses are categorized by classes and states, or key phrases. Use US Legal Forms to find the Connecticut Cash Disbursements and Receipts with a few clicks.

If you are previously a US Legal Forms customer, log in in your accounts and click the Acquire key to have the Connecticut Cash Disbursements and Receipts. You may also access types you formerly acquired from the My Forms tab of the accounts.

If you work with US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have selected the form for that correct city/land.

- Step 2. Make use of the Review option to examine the form`s information. Never forget to read through the explanation.

- Step 3. If you are not satisfied using the type, take advantage of the Look for discipline on top of the monitor to get other versions from the lawful type web template.

- Step 4. After you have identified the form you require, select the Buy now key. Pick the costs plan you like and put your qualifications to sign up for an accounts.

- Step 5. Procedure the financial transaction. You can utilize your Мisa or Ьastercard or PayPal accounts to perform the financial transaction.

- Step 6. Choose the formatting from the lawful type and download it on the product.

- Step 7. Total, edit and print out or indication the Connecticut Cash Disbursements and Receipts.

Each and every lawful papers web template you buy is your own property forever. You may have acces to each type you acquired inside your acccount. Click on the My Forms section and choose a type to print out or download yet again.

Be competitive and download, and print out the Connecticut Cash Disbursements and Receipts with US Legal Forms. There are millions of expert and status-particular types you may use to your enterprise or individual requires.