Connecticut Personnel Change Form

Description

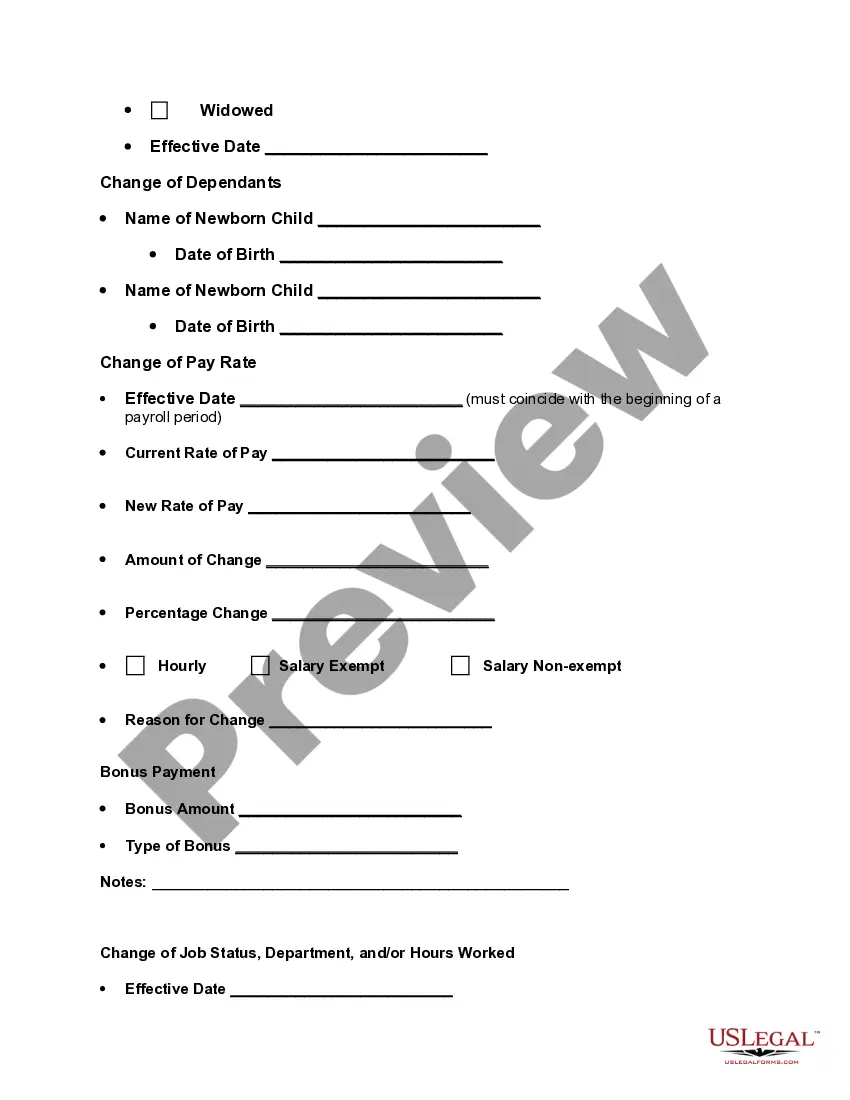

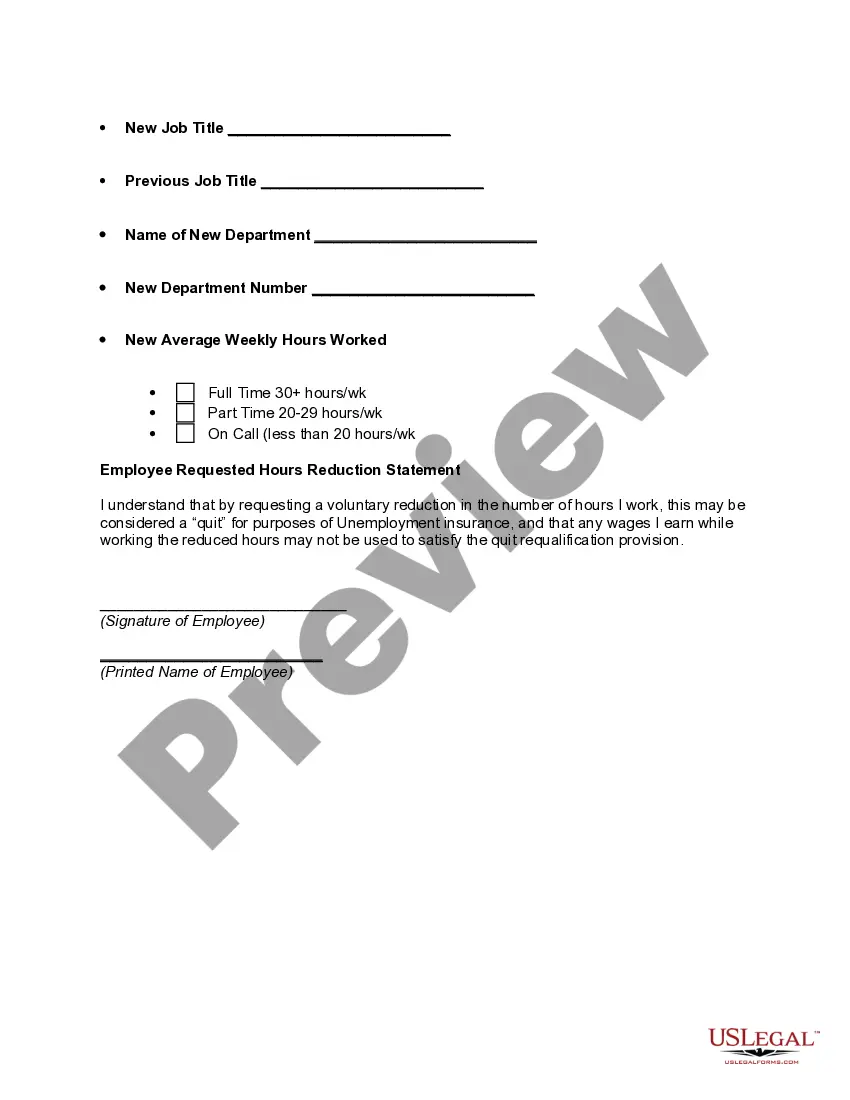

How to fill out Personnel Change Form?

US Legal Forms - one of the largest collections of legal documents in the United States - provides an assortment of legal form templates that you can download or print.

By utilizing the website, you can access a plethora of forms for business and personal purposes, categorized by types, states, or keywords. You will find the most current versions of documents such as the Connecticut Employee Change Form in moments.

If you already hold a membership, Log In and obtain the Connecticut Employee Change Form from your US Legal Forms repository. The Download button will appear on every document you examine. You have access to all previously saved forms from the My documents section of your profile.

Make modifications. Fill out, modify, print, and sign the saved Connecticut Employee Change Form.

Each template you save in your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Connecticut Employee Change Form through US Legal Forms, one of the most extensive collections of legal document templates. Utilize countless professional and state-specific templates that cater to your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have chosen the correct form for your city/state. Click on the Review button to view the content of the form. Check the form summary to confirm that you have selected the appropriate document.

- If the form does not meet your requirements, use the Search field located at the top of the screen to find one that does.

- Once you are satisfied with the form, validate your choice by clicking the Get now button. Next, select the pricing plan you prefer and provide your details to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the purchase.

- Choose the format and download the document to your device.

Form popularity

FAQ

Filling out the back of a CT title involves providing information about the sale or transfer of ownership. You need to complete the seller’s section and include the buyer’s information. Make sure all parties sign the required areas for verification and documentation purposes. If you've had any changes in personnel or business structure, the Connecticut Personnel Change Form can help you update that information efficiently.

Form CT-W4, Employee's Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld.

Form CT-W4NA, in addition to Form CT-W4, Employee's Withholding Certificate, will assist your employer in withholding the correct amount of Connecticut income tax from your wages for services performed in Connecticut.

HOW TO OBTAIN CONNECTICUT TAX FORMSConnecticut state tax forms can be downloaded at the Department of Revenue Services (DRS) website: tax forms and publications are available at any DRS office and at some libraries and post offices, during tax filing season.

Written by a TurboTax Expert 2022 Reviewed by a TurboTax CPA. The W-4 Form is an IRS form that you complete to let your employer know how much money to withhold from your paycheck for federal taxes. Accurately completing your W-4 can help you prevent having a big balance due at tax time.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

If you are a married individual filing jointly and you and your spouse both select Withholding Code A, you may have too much or too little Connecticut income tax withheld from your pay. This is because the phase2011out of the personal exemption and credit is based on your combined incomes.

C Married, filing jointly, and spouse is not employed; this the default when the federal marital status is M. D Married, filing jointly, both work, and combined income. is more than $100,500; or there is significant non-wage income; this code also applies to nonresident employees.

Code Description. D Married, filing separately. M Married, filing jointly.

You are required to pay Connecticut income tax as income is earned or received during the year. You should complete a new Form CT-W4 at least once a year or if your tax situation changes.