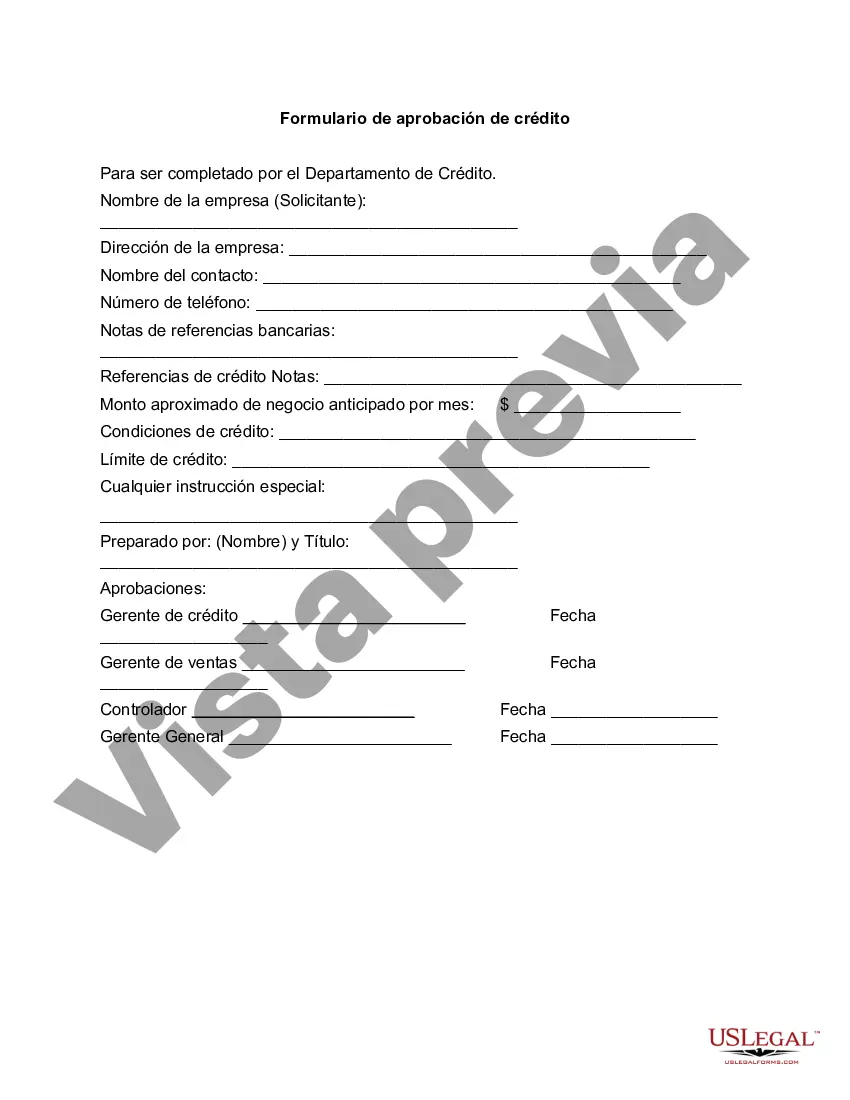

Connecticut Credit Approval Form is a document that allows individuals or businesses in Connecticut to apply for credit and seek approval from a financial institution. This form is an essential part of the credit application process and provides the necessary information to assess an applicant's creditworthiness. The Connecticut Credit Approval Form typically includes various sections such as personal details, employment information, financial history, and references. The form collects important data, including the applicant's full name, address, social security number, contact details, and date of birth, to establish their identity and contact information. Additionally, the form requires applicants to provide details about their current and previous employment, such as job title, employer name, address, and contact information. This information helps lenders evaluate an applicant's stability and income source. Financial history is another critical section in the Connecticut Credit Approval Form, where applicants are asked to disclose their income, assets, liabilities, and monthly expenses. This information allows financial institutions to assess an applicant's financial capacity to repay the credit. The form may also request references, like the applicant's character and personal/professional relationships, to verify their credibility and reputation. Connecticut may have multiple types of Credit Approval Forms to cater to different credit products or financial institutions. Some possible variations could include Personal Credit Approval Form, Business Credit Approval Form, Mortgage Credit Approval Form, Auto Loan Credit Approval Form, and Credit Card Approval Form. Each type of form may have specific requirements and information relevant to the credit product being applied for. In conclusion, the Connecticut Credit Approval Form is a comprehensive document designed to collect essential information from applicants seeking credit approval from financial institutions in the state. By providing accurate and detailed information, applicants enhance their chances of obtaining credit and meeting their financial obligations effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Connecticut Formulario De Aprobación De Crédito?

You are able to spend hrs on the web looking for the legal file template that meets the federal and state specifications you need. US Legal Forms gives a large number of legal types which are evaluated by experts. You can easily obtain or print out the Connecticut Credit Approval Form from your services.

If you already have a US Legal Forms profile, you can log in and click on the Down load key. Next, you can complete, change, print out, or sign the Connecticut Credit Approval Form. Each legal file template you acquire is your own forever. To acquire an additional version of the bought form, proceed to the My Forms tab and click on the corresponding key.

If you are using the US Legal Forms web site initially, stick to the easy directions under:

- First, be sure that you have selected the correct file template for the county/area of your choosing. Read the form explanation to ensure you have selected the correct form. If available, make use of the Review key to check through the file template also.

- If you wish to locate an additional variation of the form, make use of the Look for area to find the template that suits you and specifications.

- When you have located the template you would like, click on Get now to continue.

- Find the costs plan you would like, enter your accreditations, and register for a free account on US Legal Forms.

- Full the purchase. You can utilize your Visa or Mastercard or PayPal profile to fund the legal form.

- Find the file format of the file and obtain it to the system.

- Make modifications to the file if needed. You are able to complete, change and sign and print out Connecticut Credit Approval Form.

Down load and print out a large number of file templates using the US Legal Forms website, which provides the largest assortment of legal types. Use expert and express-certain templates to take on your small business or individual requirements.