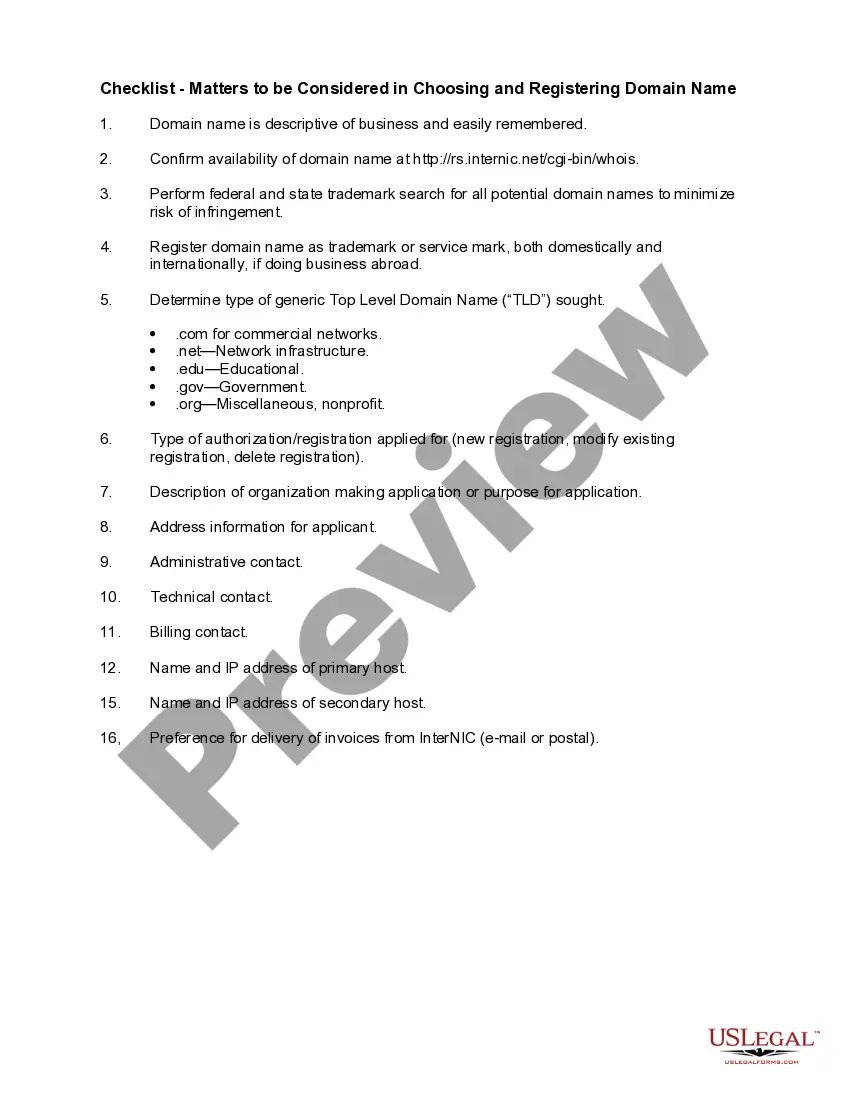

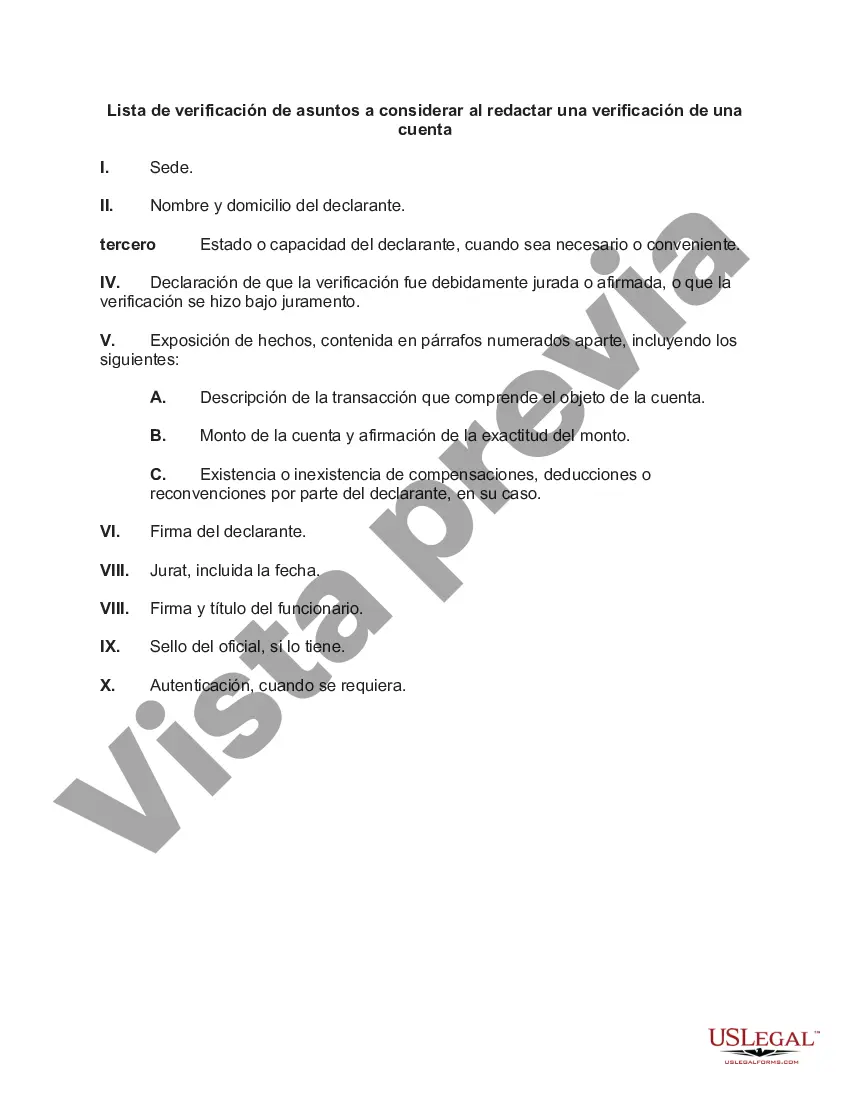

Connecticut Checklist of Matters to be Considered in Drafting a Verification of an Account is a document designed to ensure accuracy, completeness, and compliance with relevant laws when verifying an account. This verification process helps maintain the integrity of financial records, preventing fraud or errors. The following important matters should be considered when drafting a verification of an account in Connecticut: 1. Parties involved: Clearly identify the account holder and the verifying party to establish the credibility of the verification. 2. Account details: Include all necessary information about the account, such as the account number, type (e.g., savings, checking), and the financial institution where the account is held. 3. Verified period: Specify the duration for which the account statement is being verified, indicating the start and end dates. This ensures that the verification is up-to-date and relevant. 4. Account transaction history: Assess the accuracy of the account's transaction history by reviewing deposits, withdrawals, transfers, and any other significant financial activities during the verified period. Ensure all transactions align with the provided documentation. 5. Account balance: Calculate and validate the account balance as of a specific date within the verified period. This can be verified by comparing it to bank statements, financial records, or computerized accounting systems. 6. Supporting documents: Attach any pertinent supporting documents, including bank statements, receipts, invoices, or any other evidence that validates the account's accuracy. 7. Compliance with Regulation E: Verify compliance with Regulation E, a federal consumer protection regulation governing electronic funds transfers. Check if appropriate disclosures were made, transaction errors were handled appropriately, and all required notifications were provided. 8. Compliance with other legal obligations: Ensure the verification aligns with other applicable laws, such as the Fair Credit Reporting Act (FCRA), which governs the accuracy and privacy of consumer information. Different types of Connecticut Checklists of Matters to be Considered in Drafting a Verification of an Account may arise depending on the specific context or purpose of the verification. For example, there may be checklists specifically tailored for auditing purposes, loan applications, or legal disputes. These checklists might include additional considerations depending on their unique requirements and objectives. In conclusion, drafting a comprehensive verification of an account in Connecticut requires careful attention to detail. By considering the matters listed above, individuals and organizations can ensure accurate financial records, legal compliance, and safeguard against potential issues arising from improper verification.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Lista de verificación de asuntos a considerar al redactar una verificación de una cuenta - Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out Connecticut Lista De Verificación De Asuntos A Considerar Al Redactar Una Verificación De Una Cuenta?

If you want to total, acquire, or print legitimate file layouts, use US Legal Forms, the greatest selection of legitimate forms, which can be found on the web. Take advantage of the site`s basic and convenient look for to get the documents you want. Different layouts for enterprise and person reasons are categorized by classes and claims, or search phrases. Use US Legal Forms to get the Connecticut Checklist of Matters to be Considered in Drafting a Verification of an Account in a few clicks.

Should you be already a US Legal Forms buyer, log in to the accounts and click on the Download option to find the Connecticut Checklist of Matters to be Considered in Drafting a Verification of an Account. You can even access forms you formerly downloaded inside the My Forms tab of the accounts.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the shape for that appropriate metropolis/land.

- Step 2. Utilize the Review method to check out the form`s information. Never neglect to see the explanation.

- Step 3. Should you be not satisfied together with the form, use the Search field towards the top of the display screen to locate other models in the legitimate form design.

- Step 4. After you have discovered the shape you want, go through the Acquire now option. Choose the rates strategy you prefer and put your qualifications to sign up for an accounts.

- Step 5. Procedure the transaction. You can use your bank card or PayPal accounts to finish the transaction.

- Step 6. Find the format in the legitimate form and acquire it in your system.

- Step 7. Full, revise and print or indication the Connecticut Checklist of Matters to be Considered in Drafting a Verification of an Account.

Each legitimate file design you buy is your own for a long time. You might have acces to each form you downloaded within your acccount. Select the My Forms portion and pick a form to print or acquire again.

Be competitive and acquire, and print the Connecticut Checklist of Matters to be Considered in Drafting a Verification of an Account with US Legal Forms. There are many expert and condition-distinct forms you can utilize to your enterprise or person requirements.