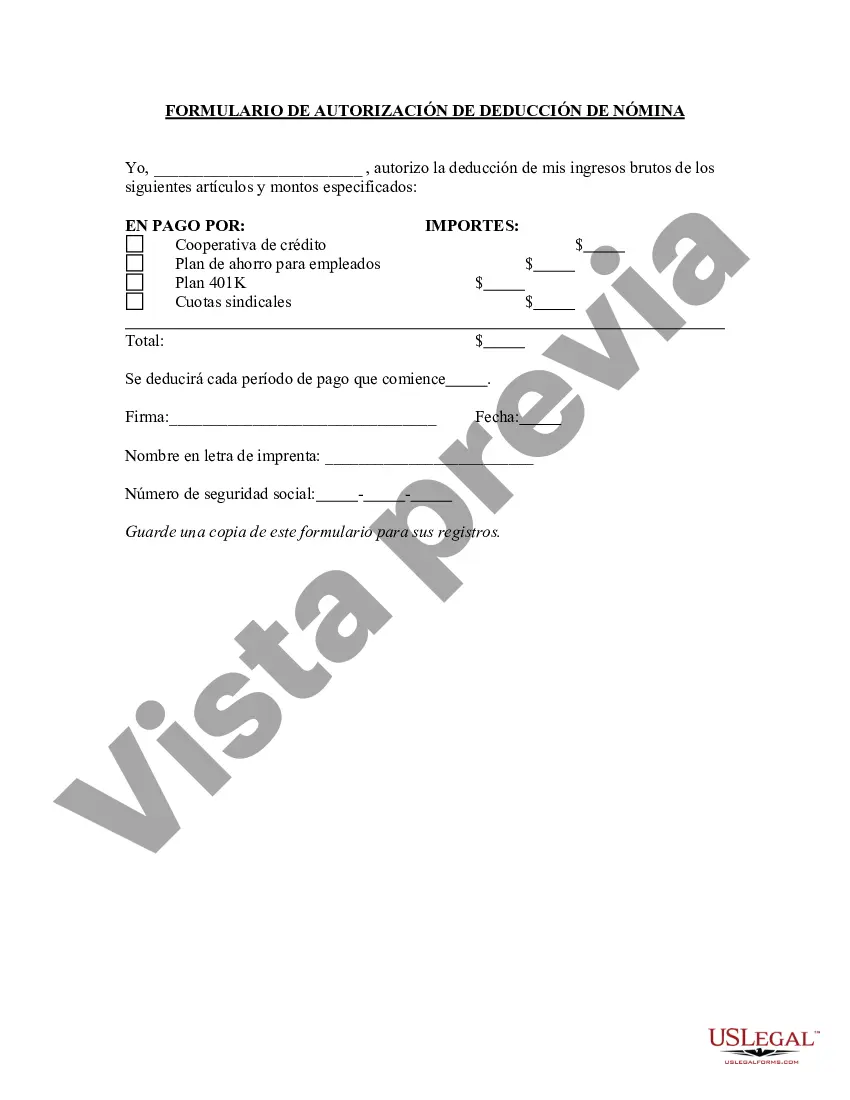

Connecticut Payroll Deduction Authorization Form is a legal document used by employers in the state of Connecticut to gain consent from their employees to make deductions from their wages. This form is crucial for employers to ensure compliance with state laws and to accurately process payroll. The Connecticut Payroll Deduction Authorization Form enables employees to authorize deductions for various purposes, such as health insurance premiums, retirement contributions, union dues, charitable contributions, and other voluntary deductions. It serves as written proof of an employee's consent and ensures transparency in the payroll process. There are different types of Connecticut Payroll Deduction Authorization Forms that vary based on the specific purpose of the deduction. Some common variations include: 1. Connecticut Health Insurance Payroll Deduction Authorization Form: Used by employers to collect premiums for health insurance coverage offered to employees. This form allows employees to authorize deductions for their share of health insurance premiums, ensuring smooth processing of payments. 2. Connecticut Retirement Plan Payroll Deduction Authorization Form: This form is specifically used to authorize payroll deductions for contributions towards retirement plans like 401(k), 403(b), or other qualified plans. Employees can choose to contribute a percentage or specific dollar amount from their wages, ensuring a convenient and automated retirement savings process. 3. Connecticut Charitable Contribution Payroll Deduction Authorization Form: This form allows employees to voluntarily contribute a portion of their wages to a recognized charitable organization through payroll deductions. Employers may offer this option to encourage employee philanthropy, and the form ensures accurate deduction and transparent processing. 4. Connecticut Union Dues Payroll Deduction Authorization Form: If an employee is a union member, this form permits the employer to deduct union dues directly from their wages. It serves as proof of the employee's authorization, ensuring efficient transfer of funds to the union. In summary, the Connecticut Payroll Deduction Authorization Form is a vital document that enables employers to deduct various types of payments from employee wages while maintaining legal compliance and transparency. Different types of these forms exist depending on the purpose of the deduction, including health insurance, retirement contributions, charitable contributions, and union dues.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Connecticut Formulario De Autorización De Deducción De Nómina?

Choosing the best authorized file format could be a have difficulties. Obviously, there are a lot of templates available online, but how do you obtain the authorized kind you require? Utilize the US Legal Forms website. The service provides a large number of templates, like the Connecticut Payroll Deduction Authorization Form, which you can use for company and private requires. All the varieties are checked out by specialists and meet federal and state demands.

If you are presently listed, log in to the account and click the Download option to have the Connecticut Payroll Deduction Authorization Form. Use your account to appear with the authorized varieties you possess bought formerly. Check out the My Forms tab of the account and obtain an additional duplicate in the file you require.

If you are a brand new end user of US Legal Forms, listed below are simple instructions for you to comply with:

- Very first, make certain you have chosen the right kind to your city/state. You are able to look over the shape making use of the Review option and study the shape outline to guarantee it will be the right one for you.

- If the kind fails to meet your requirements, use the Seach discipline to find the right kind.

- Once you are sure that the shape would work, click on the Acquire now option to have the kind.

- Select the costs prepare you need and enter in the essential information. Create your account and pay for an order using your PayPal account or bank card.

- Pick the file structure and acquire the authorized file format to the device.

- Total, modify and print out and indication the attained Connecticut Payroll Deduction Authorization Form.

US Legal Forms may be the greatest local library of authorized varieties in which you can find numerous file templates. Utilize the company to acquire expertly-made papers that comply with status demands.