Connecticut Exempt Survey

Description

How to fill out Exempt Survey?

You might spend numerous hours online attempting to locate the legal document template that complies with the federal and state stipulations you need.

US Legal Forms provides an extensive collection of legal forms that are reviewed by experts.

You can effortlessly download or print the Connecticut Exempt Survey from your platform.

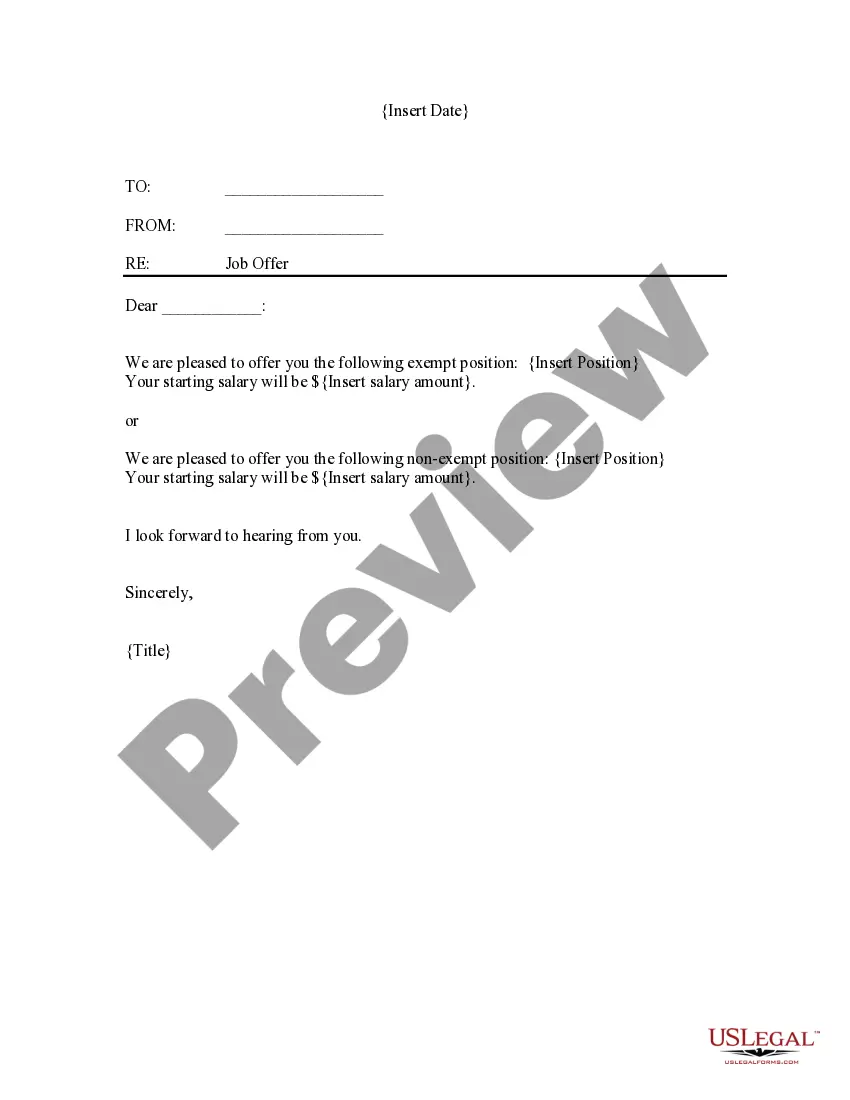

Review the form description to confirm you have chosen the appropriate form. If available, utilize the Preview option to examine the document template as well.

- If you currently possess a US Legal Forms account, you can sign in and click on the Obtain button.

- Afterward, you can fill out, modify, print, or sign the Connecticut Exempt Survey.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of any purchased form, visit the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/region of your choice.

Form popularity

FAQ

By law, children age 6 months through 4 years who attend a licensed child care program and children age 24 months through 4 years who attend school must now receive an annual flu vaccination.

While the specific criteria for duties vary somewhat depending on whether exempt status is claimed as an Executive, Administrative, and/or Professional employee, examples of exempt duties include hiring and firing employees, scheduling employees, determining credit policies, formulating personnel policies, assessing

Exempt Employees in Connecticut For an employee to be classified as an exempt employee they must pass both the duties and the salary tests, under both Connecticut and Federal law. Duties Test - Under the Duties Test, the employee's primary duty must require that they act with discretion and independent judgment.

In Connecticut and Massachusetts, effective January 1, 2020: Exempt white-collar employees must be paid a guaranteed salary of at least $684 per workweek.

Key Takeaways. An exempt employee is an employee who does not receive overtime pay or qualify for minimum wage. Exempt employees are paid a salary rather than by the hour, and their work is executive or professional in nature.

September 1, 2020: $12. August 1, 2021: $13. July 1, 2022: $14.

What is the 2021 minimum wage in Connecticut? The Connecticut minimum wage is $13 per hour, which is $5.75 higher than the federal minimum wage of $7.25.

Executive Exemption The employment must customarily and regularly direct the work of two or more other employees. The employee must be paid a salary basis of $475.00 per week ($455.00 under FLSA).

Overtime Exemptions in Connecticut Out of an estimated 120 million workers in America, almost 50 million are exempt from overtime law. Executives, administrators, and other professionals earning at least $455 per week do not have to be paid overtime under Section 13(a)(1) of the Fair Labor Standards Act.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).