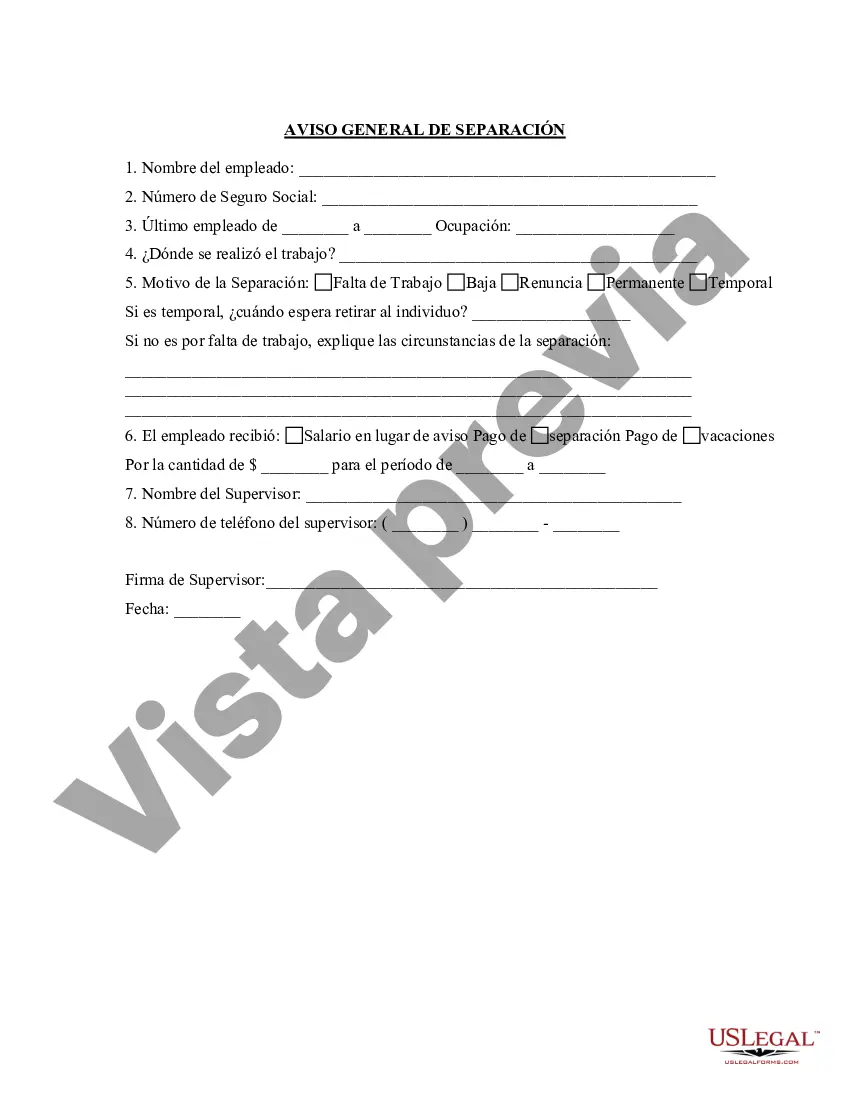

A detailed description of the Connecticut Separation Notice for 1099 Employees, highlights its purpose, importance, and the different types available. The Connecticut Separation Notice for 1099 Employees is a legal document used by employers in Connecticut when terminating a working relationship with an independent contractor or a self-employed individual who is classified as a 1099 employee. This notice complies with the state's regulations and ensures proper communication of separation details. This separation notice serves several key purposes. Firstly, it provides the Connecticut Department of Labor with important information regarding the separation, enabling them to process unemployment benefits for the affected individual if eligible. Additionally, it serves as an official record of the separation for both the employer and the employee. There are two main types of Connecticut Separation Notice for 1099 Employees: 1. Voluntary Separation: This type of notice is used when an independent contractor voluntarily ends their working relationship with the employer. It may occur due to personal reasons, career advancements, or other opportunities. The completion of this notice allows the independent contractor to pursue unemployment benefits if they meet the eligibility criteria. 2. Involuntary Separation: This type of notice is used when an employer terminates the working relationship with an independent contractor. Reasons for involuntary separation may include poor performance, breach of contract, budget cuts, or any other valid cause. The completion of this notice ensures that the independent contractor is made aware of the termination and may also allow them to apply for unemployment benefits, depending on the circumstances. The Connecticut Separation Notice for 1099 Employees contains various crucial details that need to be accurately filled out. These details include the name and contact information of the employer, the independent contractor's information, such as their name, address, Social Security Number, and their last working day. It may also require additional information, such as the reason for separation and any outstanding payments owed to the contractor. It's important for both employers and independent contractors to carefully complete and submit the Connecticut Separation Notice for 1099 Employees promptly. Failure to do so may lead to delays in unemployment benefit claims or potential legal complications in the future. Employers should ensure that the information provided is accurate and complete, avoiding any potential discrepancies or misunderstandings. In conclusion, the Connecticut Separation Notice for 1099 Employees is a vital document in the termination process for independent contractors in Connecticut. This notice, available in both voluntary and involuntary separation types, serves to comply with state regulations and maintain clear communication between employers, independent contractors, and the Connecticut Department of Labor. Accuracy and timely submission of these notices are crucial for ensuring smooth transitions and adherence to legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Aviso de separación para el empleado 1099 - Separation Notice for 1099 Employee

Description

How to fill out Connecticut Aviso De Separación Para El Empleado 1099?

Choosing the best authorized file template can be a struggle. Of course, there are a variety of themes accessible on the Internet, but how will you get the authorized form you will need? Utilize the US Legal Forms web site. The services delivers a huge number of themes, for example the Connecticut Separation Notice for 1099 Employee, which you can use for company and private requirements. All the varieties are checked by professionals and satisfy federal and state specifications.

When you are presently signed up, log in to the account and click on the Down load option to obtain the Connecticut Separation Notice for 1099 Employee. Use your account to check from the authorized varieties you may have acquired previously. Proceed to the My Forms tab of your own account and have an additional version from the file you will need.

When you are a new customer of US Legal Forms, listed below are straightforward guidelines for you to stick to:

- Very first, make sure you have selected the appropriate form for your metropolis/area. You may examine the shape utilizing the Review option and browse the shape information to make certain it will be the best for you.

- When the form does not satisfy your requirements, take advantage of the Seach area to obtain the right form.

- Once you are certain the shape would work, click on the Get now option to obtain the form.

- Choose the rates plan you would like and enter in the necessary info. Make your account and pay money for the order making use of your PayPal account or charge card.

- Select the data file structure and obtain the authorized file template to the product.

- Total, edit and print and sign the obtained Connecticut Separation Notice for 1099 Employee.

US Legal Forms will be the greatest catalogue of authorized varieties in which you will find various file themes. Utilize the company to obtain appropriately-produced documents that stick to state specifications.