Connecticut Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

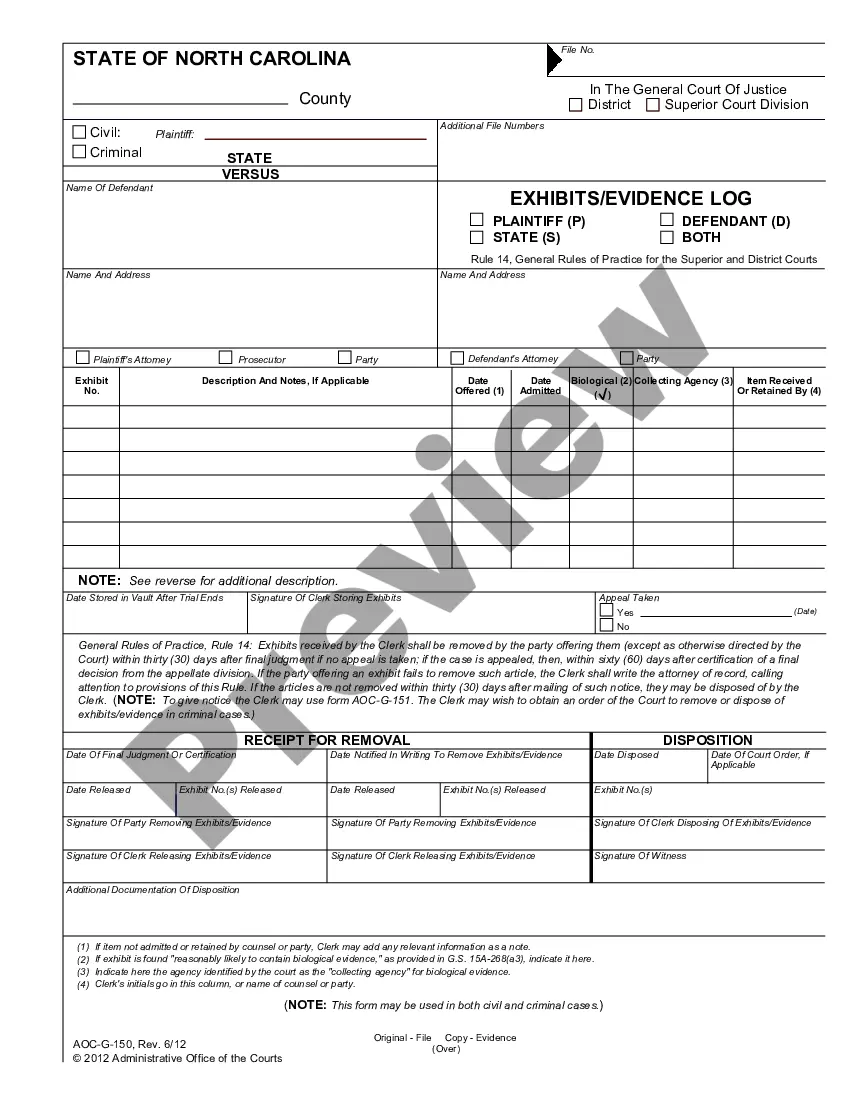

How to fill out Waiver Of Qualified Joint And Survivor Annuity - QJSA?

Are you presently in a place in which you will need documents for both organization or personal reasons just about every day? There are a variety of legitimate file themes available on the net, but getting types you can rely is not effortless. US Legal Forms gives a huge number of form themes, much like the Connecticut Waiver of Qualified Joint and Survivor Annuity - QJSA, that are published to meet state and federal needs.

If you are currently informed about US Legal Forms website and get a merchant account, basically log in. Afterward, you are able to acquire the Connecticut Waiver of Qualified Joint and Survivor Annuity - QJSA design.

Should you not come with an accounts and want to begin to use US Legal Forms, follow these steps:

- Get the form you will need and ensure it is for your appropriate metropolis/state.

- Utilize the Preview button to analyze the form.

- Browse the explanation to ensure that you have chosen the right form.

- In case the form is not what you`re trying to find, make use of the Search area to obtain the form that fits your needs and needs.

- If you discover the appropriate form, click Buy now.

- Select the costs plan you need, fill in the specified information and facts to make your account, and pay money for the order utilizing your PayPal or bank card.

- Select a handy data file file format and acquire your backup.

Discover every one of the file themes you might have bought in the My Forms food list. You can obtain a further backup of Connecticut Waiver of Qualified Joint and Survivor Annuity - QJSA whenever, if needed. Just click the essential form to acquire or printing the file design.

Use US Legal Forms, one of the most comprehensive variety of legitimate varieties, to save time and steer clear of errors. The assistance gives professionally manufactured legitimate file themes that you can use for a range of reasons. Generate a merchant account on US Legal Forms and begin producing your life easier.

Form popularity

FAQ

When the participant dies, the spouse will receive lifetime payments in the same or reduced amount. The participant may waive the Qualified Joint and Survivor Annuity with spousal consent and elect to receive another form of payment.

Under the 50% survivor provisions, the Pension System pays the Member his or her normal monthly pension over their lifetime, but only one-half of that benefit to their Spouse after your death.

A 50 percent joint and survivor annuity will pay the surviving annuitant half the payment amount that payees were receiving when both annuitants were alive. And a 75 percent joint and survivor annuity will pay three-quarters of that amount to the surviving annuitant.

A joint and survivor annuity is an insurance product designed for couples that continues to make regular payments as long as one spouse lives. A joint and survivor annuity has the advantage of providing income if one or both people live longer than expected. This is not a good choice for a younger couple.

A joint life annuity, also known as a joint and survivor annuity, is an annuity and ensures that both you and your spouse receive annuity payments. And, if one of you should die, this product provides the surviving spouse with annuity payments for the remainder of their life.

QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits. They can also apply to profit-sharing and 401(k) and 403(b) plans, but only if so elected under the plan.

Qualified Joint and Survivor AnnuityIf your spouse consents to change the way the Plan's retirement benefits are paid, your spouse gives up his or her right to the QJSA payments. This is referred to as a waiver of the QJSA payment form.

A joint and survivor annuity is an insurance product designed for couples that continues to make regular payments as long as one spouse lives. A joint and survivor annuity has the advantage of providing income if one or both people live longer than expected. This is not a good choice for a younger couple.

andsurvivor annuity pays you during your lifetime and then continues to pay your spouse or other named beneficiary. You might be able to choose either a 100, 75, or 50 percent jointandsurvivor annuity. The 100 percent option gives your survivor the same monthly benefit that you received.

This special payment form is often called a qualified joint and survivor annuity or QJSA payment form. This benefit is paid to the participant each year and, on the participant's death, a survivor annuity is paid to the surviving spouse.