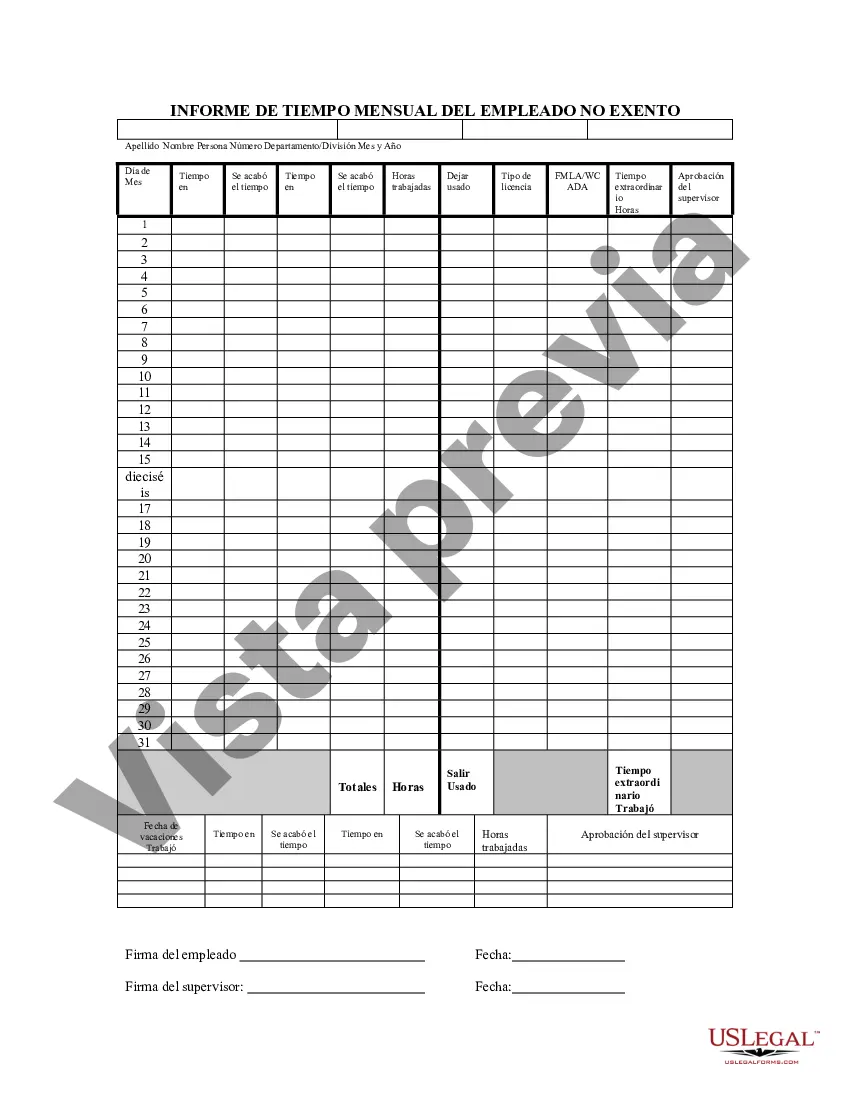

Connecticut Nonexempt Employee Time Report is a crucial document used by employers to accurately record and monitor the working hours of their nonexempt employees in compliance with Connecticut labor laws. This report helps ensure proper compensation for employees and adherence to the state's labor regulations. The Connecticut Nonexempt Employee Time Report typically includes essential details such as the employee's name, department, job title, and employee identification number. It encompasses a comprehensive breakdown of daily work hours, including regular hours, overtime hours, breaks, and unpaid time off. This document also accounts for specific dates worked, clock-in and clock-out times, and any deviations from the standard work schedule. Accurate tracking of all these factors is essential for calculating the employee's wages, ensuring proper overtime compensation, and validating compliance with state labor laws. Moreover, the Connecticut Nonexempt Employee Time Report enables employers to differentiate between various types of time worked, including regular hours, vacation or personal days, holidays, sick days, and other types of leave. By segregating these different types of time off on the report, employers can ensure accurate and fair compensation based on the respective labor laws governing each category. In addition to the standard Connecticut Nonexempt Employee Time Report, there may be variations or supplementary reports depending on the specific requirements or policies of an organization. Some possible types of additional time reports in Connecticut could include: 1. Overtime Report: This report focuses solely on the total hours of overtime worked by nonexempt employees during a specific pay period. It provides a detailed breakdown of the dates, hours, and reasons for overtime, allowing employers to track and manage overtime costs effectively. 2. Leave of Absence Report: This report is designed to keep track of employee leaves of absence, whether they are due to medical reasons, family emergencies, or personal reasons. It helps employers stay compliant with state and federal leave laws while accurately accounting for an employee's time away from work. 3. Holiday Pay Report: Connecticut recognizes certain designated holidays, and this report helps employers calculate and document the hours worked on these holidays. It allows for proper holiday pay distribution and ensures compliance with Connecticut labor regulations. Overall, the Connecticut Nonexempt Employee Time Report and its possible variations play a pivotal role in maintaining accurate records of nonexempt employees' working hours, facilitating fair compensation, and ensuring compliance with Connecticut labor laws. Employers must prioritize the accurate and timely completion of these reports to foster a healthy and compliant work environment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Connecticut Informe de tiempo de empleado no exento - Nonexempt Employee Time Report

Description

How to fill out Connecticut Informe De Tiempo De Empleado No Exento?

Are you inside a placement in which you need files for both company or personal functions nearly every working day? There are tons of authorized document layouts available on the net, but finding types you can depend on isn`t effortless. US Legal Forms gives a large number of kind layouts, just like the Connecticut Nonexempt Employee Time Report, which can be published in order to meet state and federal specifications.

Should you be presently knowledgeable about US Legal Forms site and have an account, merely log in. Afterward, you can obtain the Connecticut Nonexempt Employee Time Report format.

Should you not have an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Get the kind you require and ensure it is for your proper metropolis/county.

- Utilize the Preview option to check the form.

- See the outline to ensure that you have selected the right kind.

- If the kind isn`t what you are searching for, use the Research area to get the kind that fits your needs and specifications.

- Once you get the proper kind, click Get now.

- Select the rates strategy you would like, submit the desired information and facts to create your account, and buy the transaction utilizing your PayPal or bank card.

- Choose a practical file file format and obtain your copy.

Get all of the document layouts you possess bought in the My Forms menus. You can obtain a extra copy of Connecticut Nonexempt Employee Time Report at any time, if needed. Just go through the essential kind to obtain or print out the document format.

Use US Legal Forms, the most comprehensive collection of authorized types, in order to save some time and avoid mistakes. The assistance gives appropriately produced authorized document layouts which you can use for a range of functions. Produce an account on US Legal Forms and commence producing your life easier.