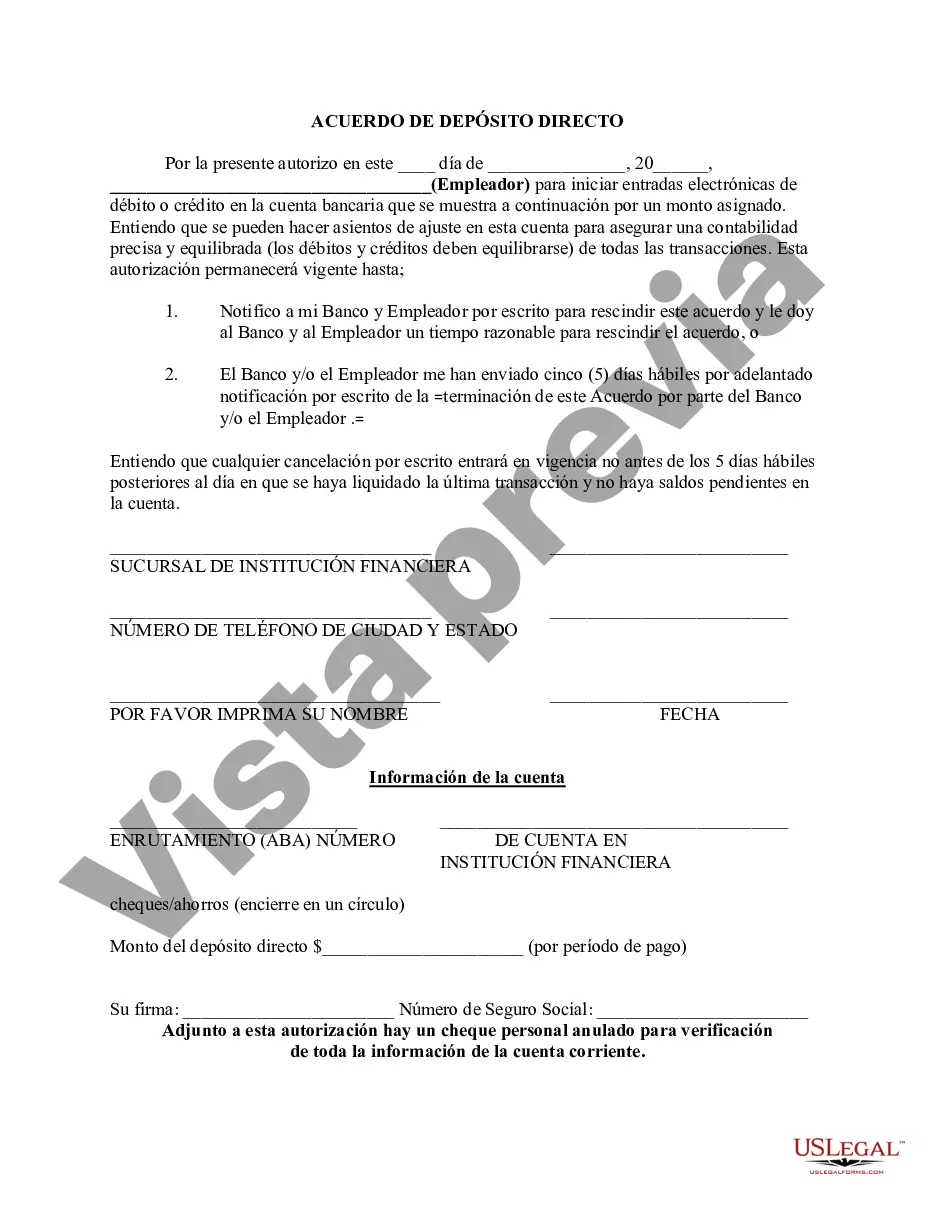

The District of Columbia Direct Deposit Form for Chase is a document used to authorize an individual or organization to deposit funds directly into a Chase bank account located within the District of Columbia. This form is specifically designed for Chase customers residing or conducting business in the District of Columbia, allowing them to conveniently receive payments electronically. The form typically requires the account holder to provide their personal information, such as name, address, and contact details. Additionally, the account number and routing number of the Chase bank account must be included to ensure accurate and successful transfers. This information can be found on the bottom of a Chase check or obtained by contacting the bank directly. The District of Columbia Direct Deposit Form for Chase may also require the account holder to provide additional details, such as the name of the company or organization making the deposit, their address, and relevant account information. These details help ensure that the funds are allocated correctly and securely. It is important to note that there may be different variations of the District of Columbia Direct Deposit Form for Chase depending on the specific purpose of the deposit. For example, there may be separate forms for employee payroll deposits, government benefit payments, or regular vendor payments. These distinctions allow for the appropriate processing and tracking of funds based on their origin and purpose. Chase understands the importance of convenience and security when it comes to banking transactions, which is why the District of Columbia Direct Deposit Form is provided to eliminate the need for physical checks and manual deposits. By opting for direct deposit, account holders can enjoy the benefits of faster access to funds, reduced risk of lost or stolen checks, and the ability to easily manage and track deposits online or through Chase's mobile banking app. In summary, the District of Columbia Direct Deposit Form for Chase is a vital tool for Chase customers in the District of Columbia who wish to receive electronic deposits directly into their Chase bank account. It simplifies and expedites the process of receiving funds while enhancing security and convenience. Different variations of the form may exist based on the specific type of deposit being authorized.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Formulario de depósito directo para Chase - Direct Deposit Form for Chase

Description

How to fill out District Of Columbia Formulario De Depósito Directo Para Chase?

Choosing the right lawful file format can be a have a problem. Of course, there are a variety of templates available online, but how would you get the lawful develop you want? Use the US Legal Forms web site. The service delivers 1000s of templates, such as the District of Columbia Direct Deposit Form for Chase, that can be used for company and private requirements. All the types are inspected by experts and satisfy federal and state specifications.

Should you be presently signed up, log in to your accounts and click the Down load button to have the District of Columbia Direct Deposit Form for Chase. Use your accounts to search throughout the lawful types you might have bought earlier. Proceed to the My Forms tab of your respective accounts and acquire one more version from the file you want.

Should you be a whole new customer of US Legal Forms, here are simple directions that you should adhere to:

- Initial, be sure you have chosen the correct develop for the area/county. You may look through the form making use of the Preview button and look at the form explanation to ensure this is basically the right one for you.

- If the develop will not satisfy your requirements, take advantage of the Seach industry to find the appropriate develop.

- When you are certain the form is acceptable, click the Buy now button to have the develop.

- Pick the rates strategy you need and type in the needed information and facts. Build your accounts and pay for an order using your PayPal accounts or bank card.

- Pick the file formatting and acquire the lawful file format to your device.

- Full, edit and produce and indication the acquired District of Columbia Direct Deposit Form for Chase.

US Legal Forms will be the most significant collection of lawful types that you will find a variety of file templates. Use the service to acquire skillfully-manufactured files that adhere to express specifications.