The District of Columbia Corporation — Transfer of Stock is a legal process that allows for the transfer of ownership in a corporation located in the District of Columbia. This formal procedure is essential when an individual or entity wishes to sell or transfer their shares of stock in a particular corporation to another party. The transfer of stock involves the selling party (usually referred to as the transferor) signing over their ownership rights to the purchasing party (usually referred to as the transferee). This transfer can occur for various reasons, such as a change in ownership structure, financial restructuring, or simply the desire to liquidate one's investment. To initiate the District of Columbia Corporation — Transfer of Stock, certain steps must be followed. Firstly, both the transferor and transferee must agree on the terms of the transfer, including the number of shares, the price, and any conditions or restrictions. It is essential to carefully review the corporation's bylaws, articles of incorporation, and any existing commercial agreements to ensure compliance with any relevant provisions or limitations. Once the terms are agreed upon, the transferor must complete a stock transfer form, which is a legally binding document that reflects the transfer of ownership. This form typically includes details such as the names and contact information of the transferor and transferee, the stock certificate number, the number of shares being transferred, and any specific representations or warranties made by the transferor. Additionally, the transferor will need to deliver the physical stock certificates to the transferee. The stock certificates are legal documents that represent ownership of shares in the corporation and may need to be signed or endorsed by the transferor to confirm the transfer. After completing the stock transfer form and delivering the stock certificates, it is important to notify the corporation of the transfer. This is typically done by submitting the relevant documentation, such as the stock transfer form and the original stock certificates, to the corporation's secretary or an authorized representative. The corporation will then update its records to reflect the new ownership and issue new stock certificates in the transferee's name, if necessary. It is worth mentioning that there are no specific types of District of Columbia Corporation — Transfer of Stock in terms of different categories or variations. However, variations in the terms, conditions, and restrictions of the stock transfer can arise, depending on the specific circumstances and agreements between the transferor and transferee. These variations may include restrictions on the sale or transfer of shares, rights of first refusal, or terms regarding the payment or consideration for the shares. In summary, the District of Columbia Corporation — Transfer of Stock is a formal process that allows for the transfer of ownership in a corporation located in the District of Columbia. It involves agreement between the transferor and transferee, completion of a stock transfer form, delivery of stock certificates, and notification to the corporation. While there are no specific types of transfers, variations can occur based on agreed-upon terms and conditions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Corporación - Transferencia de Acciones - Corporation - Transfer of Stock

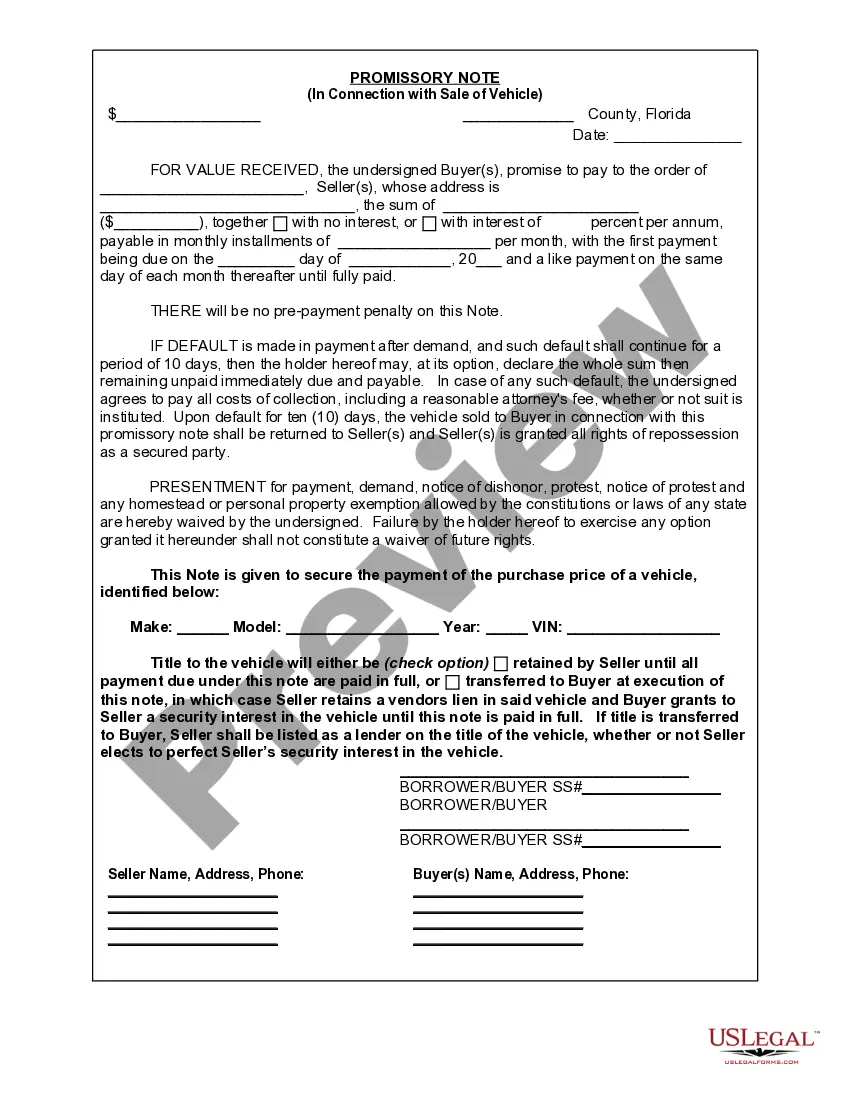

Description

How to fill out District Of Columbia Corporación - Transferencia De Acciones?

Have you been in a situation that you need to have papers for both enterprise or person reasons virtually every working day? There are tons of authorized file layouts available on the net, but finding versions you can depend on isn`t easy. US Legal Forms delivers a large number of form layouts, such as the District of Columbia Corporation - Transfer of Stock, that happen to be written to fulfill state and federal needs.

Should you be already informed about US Legal Forms site and get a merchant account, merely log in. Following that, it is possible to acquire the District of Columbia Corporation - Transfer of Stock template.

If you do not have an accounts and need to begin using US Legal Forms, abide by these steps:

- Find the form you require and ensure it is for the appropriate area/region.

- Use the Review switch to examine the form.

- Look at the information to actually have selected the right form.

- When the form isn`t what you are searching for, take advantage of the Search field to find the form that suits you and needs.

- Whenever you discover the appropriate form, click on Purchase now.

- Pick the pricing prepare you would like, submit the specified info to make your account, and pay for an order making use of your PayPal or Visa or Mastercard.

- Pick a handy data file structure and acquire your backup.

Find all the file layouts you might have bought in the My Forms menus. You can get a further backup of District of Columbia Corporation - Transfer of Stock at any time, if possible. Just go through the required form to acquire or print the file template.

Use US Legal Forms, by far the most considerable variety of authorized types, to conserve time as well as prevent blunders. The service delivers appropriately made authorized file layouts that you can use for a selection of reasons. Make a merchant account on US Legal Forms and initiate producing your lifestyle a little easier.