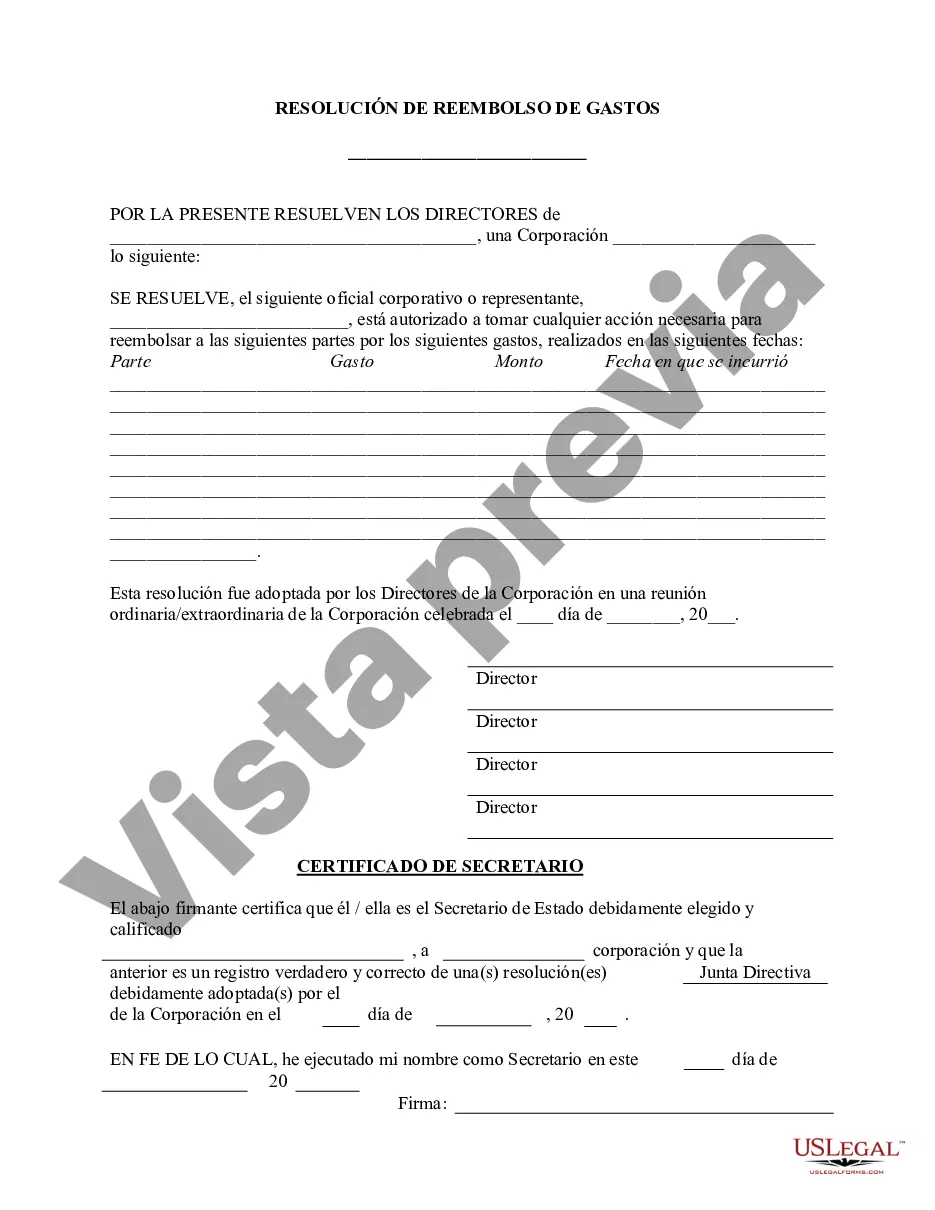

The District of Columbia Reimbursement for Expenditures — Resolution For— - Corporate Resolutions is a vital document used to outline the process of authorizing and recording reimbursements for expenditures incurred by a corporation in the District of Columbia. This comprehensive resolution form ensures the smooth reimbursement process while adhering to the regulations and guidelines set by the District of Columbia. Key elements covered in the District of Columbia Reimbursement for Expenditures — Resolution For— - Corporate Resolutions include: 1. Title and Identification: The form begins with a clear title indicating it is a resolution form specific to the District of Columbia. It also includes essential identification details such as the corporation's name, address, and relevant contact information. 2. Purpose and Authority: This section describes the purpose of the resolution, which is to authorize reimbursements for various expenditures. It outlines the authority of the corporation's directors or officers to make reimbursement decisions, ensuring transparency and accountability. 3. Definitions and Interpretations: This part defines key terms and interpretations for clarity and consistency throughout the document. Common terms include "reimbursement," "expenditures," "corporate funds," and other relevant terms specific to the corporation. 4. Reimbursement Procedures: This section delineates the steps and procedures to be followed when seeking reimbursement for expenditures. It covers details regarding the submission of reimbursement requests, required supporting documentation, approval processes, and any specific guidelines imposed by the District of Columbia. 5. Types of Expenditures Covered: The form should specify the types of expenditures eligible for reimbursement. These may include travel expenses, office supplies, professional fees, marketing expenses, or any other relevant category of expenditure allowed by the corporation's bylaws. 6. Reimbursement Limits and Restrictions: This segment establishes any limitations or restrictions on reimbursements, such as maximum reimbursement amounts, timeframes for submission, or specific conditions required for approval. It ensures that expenditures fall within reasonable boundaries, preventing abuse of corporate funds. 7. Record Keeping and Reporting: The resolution form addresses the requirement for accurate record keeping and reporting of reimbursements. It highlights the importance of maintaining detailed records, including dates, amounts, descriptions of expenditures, and the individuals involved. 8. Approval and Signatures: The final section provides space for authorized signatories to endorse the resolution. This demonstrates their agreement and compliance with its provisions, ensuring legal validation and confirmation of the reimbursement process. In summary, the District of Columbia Reimbursement for Expenditures — Resolution For— - Corporate Resolutions is a comprehensive document used to establish a clear framework for managing reimbursements within a corporation operating in the District of Columbia. It ensures compliance with relevant regulations, provides transparency, and allows proper record keeping.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Reembolso de Gastos - Formulario de Resolución - Resoluciones Corporativas - Reimbursement for Expenditures - Resolution Form - Corporate Resolutions

Description

How to fill out District Of Columbia Reembolso De Gastos - Formulario De Resolución - Resoluciones Corporativas?

US Legal Forms - among the biggest libraries of lawful forms in the United States - gives an array of lawful record themes you may acquire or produce. Using the website, you can find thousands of forms for enterprise and person purposes, sorted by categories, claims, or search phrases.You will discover the latest models of forms just like the District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions in seconds.

If you already possess a membership, log in and acquire District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions from your US Legal Forms catalogue. The Obtain key can look on every single type you view. You have accessibility to all formerly delivered electronically forms inside the My Forms tab of your own accounts.

If you want to use US Legal Forms initially, here are easy recommendations to get you started out:

- Make sure you have selected the right type for your area/area. Click on the Review key to check the form`s information. Browse the type information to ensure that you have chosen the proper type.

- If the type does not satisfy your needs, take advantage of the Search field towards the top of the monitor to get the one that does.

- When you are content with the shape, verify your decision by simply clicking the Get now key. Then, choose the costs program you prefer and supply your accreditations to register to have an accounts.

- Method the financial transaction. Make use of your bank card or PayPal accounts to complete the financial transaction.

- Select the formatting and acquire the shape on the product.

- Make changes. Load, modify and produce and signal the delivered electronically District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

Every design you included with your bank account lacks an expiry day and is also the one you have forever. So, if you wish to acquire or produce one more duplicate, just proceed to the My Forms area and click in the type you want.

Obtain access to the District of Columbia Reimbursement for Expenditures - Resolution Form - Corporate Resolutions with US Legal Forms, probably the most extensive catalogue of lawful record themes. Use thousands of skilled and condition-distinct themes that meet up with your organization or person requires and needs.