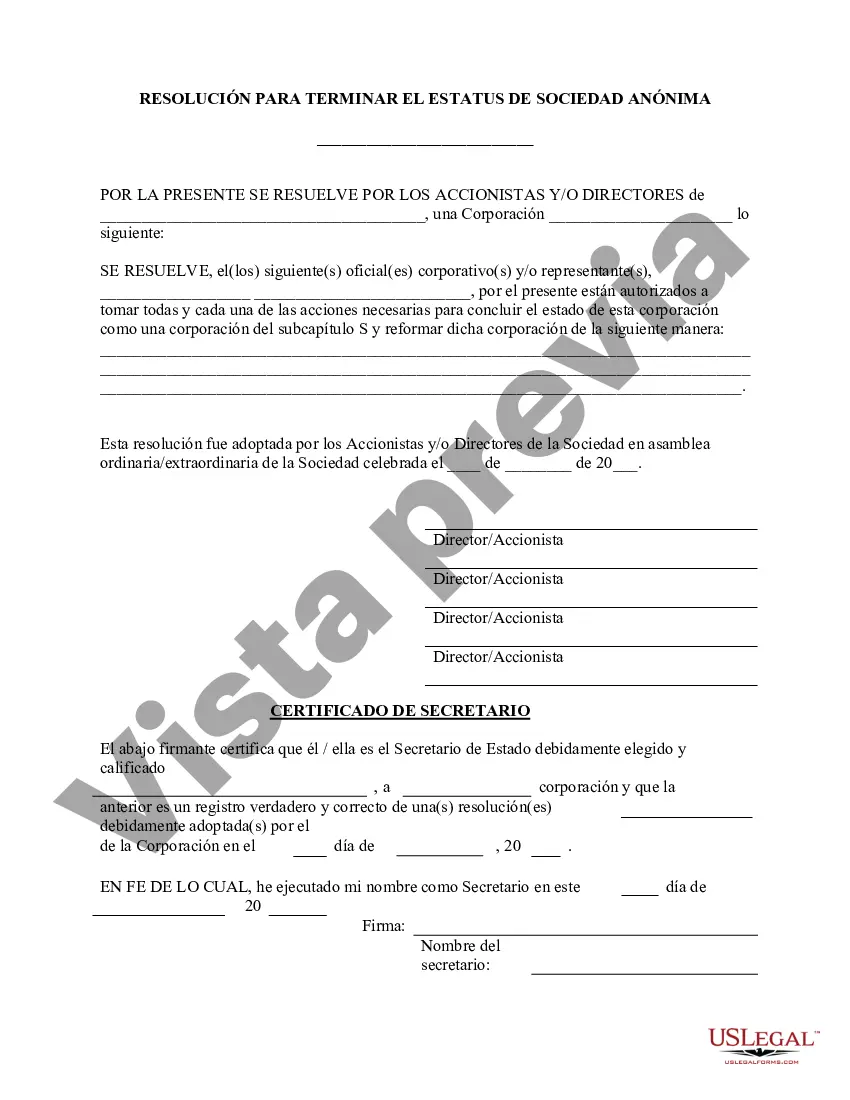

The District of Columbia Terminate S Corporation Status — Resolution For— - Corporate Resolutions is a legal document that allows an S Corporation in the District of Columbia to terminate it's S Corporation status. This form is crucial for S Corporations that wish to convert to regular C Corporations or dissolve their business operations altogether. By filing this form, S Corporations can sever their special tax status, which allows their profits to pass through directly to shareholders, avoiding double taxation. This termination is useful when an S Corporation wants to have more flexibility in issuing different classes of stock or adding more shareholders, which is generally not allowed under S Corporation rules. The District of Columbia Terminate S Corporation Status — Resolution Form requires certain specific information to be provided. It typically includes the legal name of the S Corporation, the date of adoption of the resolution, and a resolution statement supporting the termination of S Corporation status. Additionally, the form may require the signature of the corporation's president, secretary, or another authorized officer, affirming the decision to terminate the S Corporation status. It's important to note that there might be variations of the District of Columbia Terminate S Corporation Status — Resolution Form, depending on whether the termination is intended for a simple C Corporation conversion or a complete dissolution of the S Corporation. In the case of dissolution, the resolution may require additional information, such as a plan for distributing assets and paying off liabilities, as well as specifying the timeline for the dissolution process. Overall, the District of Columbia Terminate S Corporation Status — Resolution For— - Corporate Resolutions is a vital legal document for S Corporations seeking to terminate their special tax status and transition to C Corporations or dissolve their business operations. This form ensures compliance with the laws of the District of Columbia and enables a smooth and seamless transition for the corporation, its shareholders, and its stakeholders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Terminar el estado de la corporación S - Formulario de resolución - Resoluciones corporativas - Terminate S Corporation Status - Resolution Form - Corporate Resolutions

Description

How to fill out District Of Columbia Terminar El Estado De La Corporación S - Formulario De Resolución - Resoluciones Corporativas?

Choosing the best lawful papers format might be a struggle. Of course, there are tons of layouts available on the net, but how do you obtain the lawful kind you require? Take advantage of the US Legal Forms internet site. The assistance provides a huge number of layouts, for example the District of Columbia Terminate S Corporation Status - Resolution Form - Corporate Resolutions, which can be used for business and personal needs. All the types are examined by professionals and meet federal and state requirements.

When you are currently signed up, log in in your profile and then click the Acquire button to have the District of Columbia Terminate S Corporation Status - Resolution Form - Corporate Resolutions. Make use of profile to search with the lawful types you may have acquired in the past. Check out the My Forms tab of your respective profile and get another duplicate of the papers you require.

When you are a whole new consumer of US Legal Forms, listed here are basic directions that you should stick to:

- Initial, make sure you have chosen the proper kind for your town/county. You are able to look over the form using the Review button and browse the form outline to guarantee this is basically the best for you.

- If the kind does not meet your needs, take advantage of the Seach discipline to discover the correct kind.

- When you are certain the form would work, click on the Purchase now button to have the kind.

- Pick the costs strategy you would like and type in the essential info. Create your profile and pay money for an order utilizing your PayPal profile or charge card.

- Pick the data file format and obtain the lawful papers format in your gadget.

- Full, modify and print and signal the attained District of Columbia Terminate S Corporation Status - Resolution Form - Corporate Resolutions.

US Legal Forms is definitely the biggest library of lawful types that you can find various papers layouts. Take advantage of the service to obtain expertly-created paperwork that stick to express requirements.