A District of Columbia Balloon Unsecured Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the District of Columbia. This specific type of promissory note is called a "balloon" note because it defers a significant portion of the loan repayment until the end of the loan term, resulting in a larger final payment known as a "balloon payment." The District of Columbia Balloon Unsecured Promissory Note serves as evidence of the borrower's promise to repay the loaned amount, along with any accrued interest, within a specified timeframe. Unlike a secured promissory note, the balloon note does not require any collateral as security for the loan, which means that the lender solely relies on the borrower's creditworthiness and trustworthiness to repay the loan as agreed upon. The note typically contains essential details about the loan, such as the principal amount borrowed, the interest rate charged, the repayment schedule, and any applicable late fees or penalties. It also outlines the rights and obligations of both the lender and the borrower, clarifying the consequences of default, methods of repayment, and the jurisdiction under which the note is governed (in this case, the District of Columbia legislation). In the District of Columbia, different variations of balloon unsecured promissory notes may exist, tailored to specific needs and circumstances. Some common types include: 1. Fixed-Rate Balloon Unsecured Promissory Note: This type of balloon note establishes a fixed interest rate for the loan, often locked in at the beginning of the agreement. The fixed-rate remains unchanged throughout the loan term, ensuring stability for both the borrower and the lender. 2. Adjustable-Rate Balloon Unsecured Promissory Note: Unlike the fixed-rate note, an adjustable-rate balloon note allows the interest rate to fluctuate periodically based on prevailing market conditions. This can result in changes to the monthly payment amount, making it essential for borrowers to carefully monitor and plan for potential changes in interest rates. 3. Open-Ended Balloon Unsecured Promissory Note: An open-ended balloon note provides the borrower with the option to extend the loan term or increase the loan amount if mutually agreed upon by both parties. This flexibility enables borrowers to adjust their repayment obligations based on their financial situation. In order to protect the rights and interests of both parties, it is crucial for all terms and conditions to be clearly outlined in the District of Columbia Balloon Unsecured Promissory Note. Legal advice or assistance from a qualified professional should always be sought when drafting or entering into such binding loan agreements to ensure compliance with District of Columbia laws and regulations.

A District of Columbia Balloon Unsecured Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the District of Columbia. This specific type of promissory note is called a "balloon" note because it defers a significant portion of the loan repayment until the end of the loan term, resulting in a larger final payment known as a "balloon payment." The District of Columbia Balloon Unsecured Promissory Note serves as evidence of the borrower's promise to repay the loaned amount, along with any accrued interest, within a specified timeframe. Unlike a secured promissory note, the balloon note does not require any collateral as security for the loan, which means that the lender solely relies on the borrower's creditworthiness and trustworthiness to repay the loan as agreed upon. The note typically contains essential details about the loan, such as the principal amount borrowed, the interest rate charged, the repayment schedule, and any applicable late fees or penalties. It also outlines the rights and obligations of both the lender and the borrower, clarifying the consequences of default, methods of repayment, and the jurisdiction under which the note is governed (in this case, the District of Columbia legislation). In the District of Columbia, different variations of balloon unsecured promissory notes may exist, tailored to specific needs and circumstances. Some common types include: 1. Fixed-Rate Balloon Unsecured Promissory Note: This type of balloon note establishes a fixed interest rate for the loan, often locked in at the beginning of the agreement. The fixed-rate remains unchanged throughout the loan term, ensuring stability for both the borrower and the lender. 2. Adjustable-Rate Balloon Unsecured Promissory Note: Unlike the fixed-rate note, an adjustable-rate balloon note allows the interest rate to fluctuate periodically based on prevailing market conditions. This can result in changes to the monthly payment amount, making it essential for borrowers to carefully monitor and plan for potential changes in interest rates. 3. Open-Ended Balloon Unsecured Promissory Note: An open-ended balloon note provides the borrower with the option to extend the loan term or increase the loan amount if mutually agreed upon by both parties. This flexibility enables borrowers to adjust their repayment obligations based on their financial situation. In order to protect the rights and interests of both parties, it is crucial for all terms and conditions to be clearly outlined in the District of Columbia Balloon Unsecured Promissory Note. Legal advice or assistance from a qualified professional should always be sought when drafting or entering into such binding loan agreements to ensure compliance with District of Columbia laws and regulations.

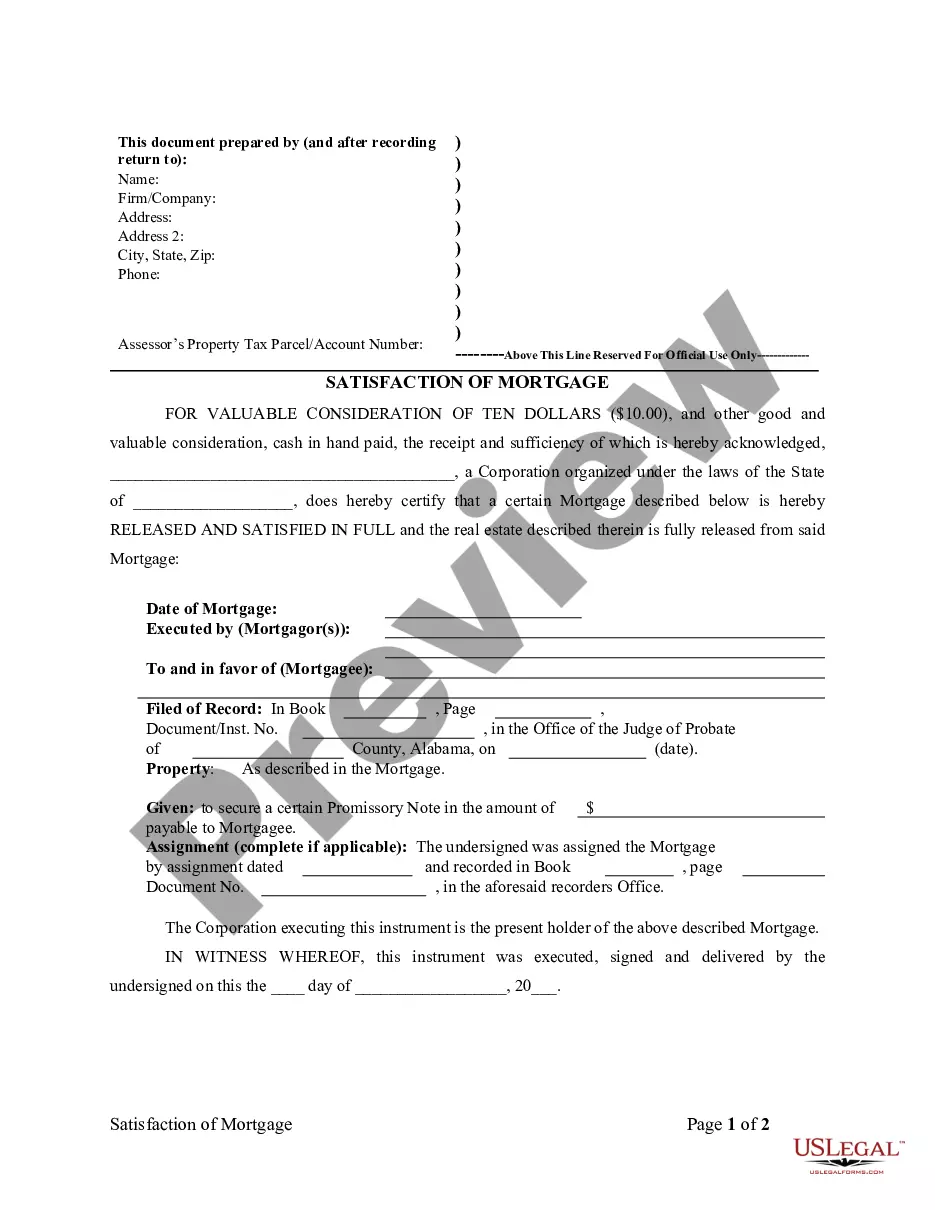

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.