The District of Columbia Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction is a legal document used to officially transfer ownership of personal assets from one party to another in the District of Columbia. This transaction occurs when one party wishes to sell their business and its assets to another party. The Bill of Sale serves as a written record of the sale, documenting the details of the transaction such as the buyer, the seller, and the assets being transferred. It outlines the terms and conditions of the sale, including the purchase price, payment terms, and any warranties or representations made by the seller. This type of transaction can apply to various types of businesses and assets in the District of Columbia. Some examples of different types of District of Columbia Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transactions include: 1. Retail Business Sale: This type of transaction involves the sale of a retail business, such as a clothing store, restaurant, or convenience store. The assets being transferred may include inventory, equipment, furniture, and fixtures. 2. Service Business Sale: This transaction involves the sale of a service-based business, such as a salon, accounting firm, or consulting agency. The assets being transferred may include client lists, intellectual property, office equipment, and software. 3. Professional Practice Sale: This type of transaction involves the sale of a professional practice, such as a medical or dental practice, law firm, or architecture studio. The assets being transferred may include patient/client files, licenses, equipment, and goodwill. 4. Franchise Sale: This transaction involves the sale of a franchise business, where the buyer purchases the rights to operate a franchised brand within a specific territory. The assets being transferred may include the franchise agreement, training materials, inventory, and equipment. 5. E-commerce Business Sale: This type of transaction involves the sale of an online business, such as an e-commerce store or digital marketing agency. The assets being transferred may include domain names, websites, customer databases, intellectual property rights, and digital products. It is important to consult with a legal professional or utilize a licensed business broker to ensure the completion of a District of Columbia Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction appropriately and in compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Venta de negocio - Factura de venta de bienes personales - Transacción de compra de bienes - Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction

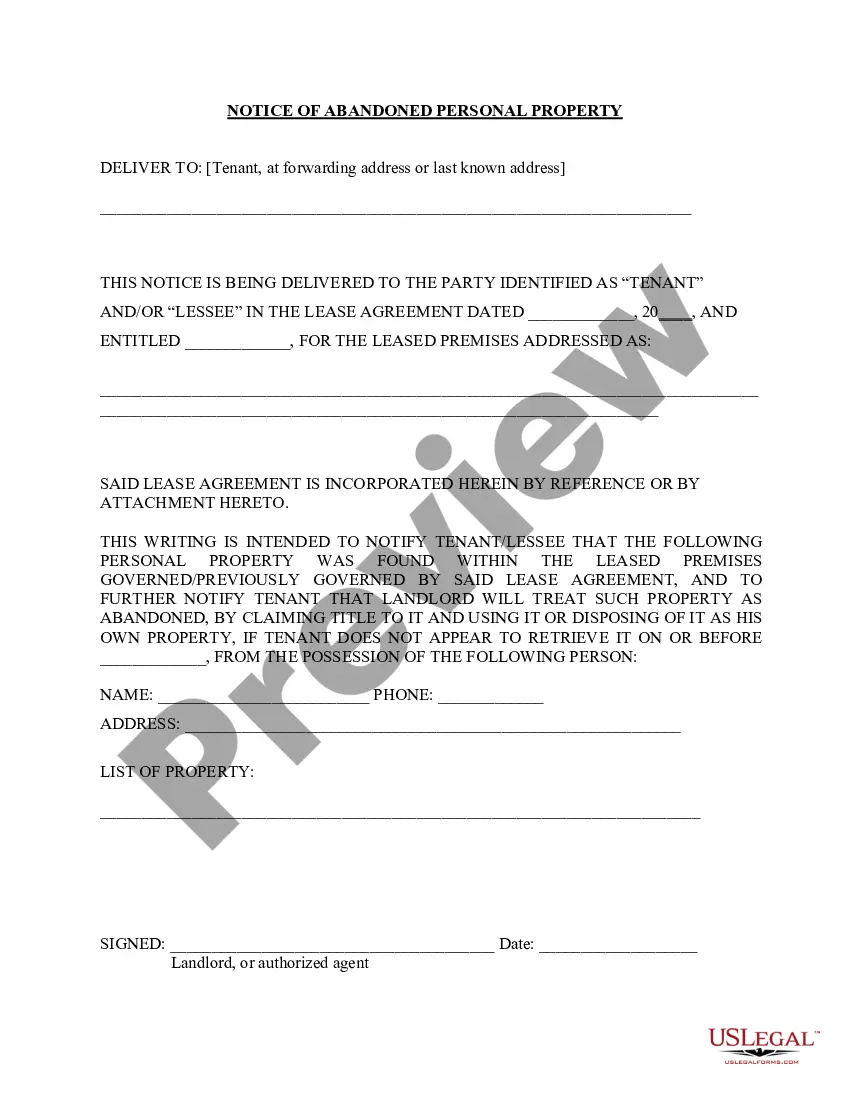

Description

How to fill out District Of Columbia Venta De Negocio - Factura De Venta De Bienes Personales - Transacción De Compra De Bienes?

Have you been within a position where you need to have papers for both organization or individual functions virtually every day time? There are tons of legal record themes available on the Internet, but locating types you can depend on is not easy. US Legal Forms offers thousands of form themes, just like the District of Columbia Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction, which are created in order to meet state and federal specifications.

Should you be already informed about US Legal Forms internet site and also have a merchant account, simply log in. After that, you are able to download the District of Columbia Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction web template.

Unless you come with an bank account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the form you require and ensure it is for your appropriate city/county.

- Use the Review key to analyze the form.

- See the description to ensure that you have selected the proper form.

- If the form is not what you`re seeking, utilize the Look for discipline to get the form that meets your needs and specifications.

- If you find the appropriate form, just click Buy now.

- Choose the rates prepare you want, fill out the required information to make your bank account, and pay for the order making use of your PayPal or Visa or Mastercard.

- Choose a handy file structure and download your copy.

Discover every one of the record themes you have bought in the My Forms food selection. You can get a further copy of District of Columbia Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction whenever, if needed. Just select the needed form to download or produce the record web template.

Use US Legal Forms, the most extensive collection of legal forms, to save lots of time and prevent faults. The service offers skillfully made legal record themes that you can use for an array of functions. Generate a merchant account on US Legal Forms and start making your lifestyle easier.