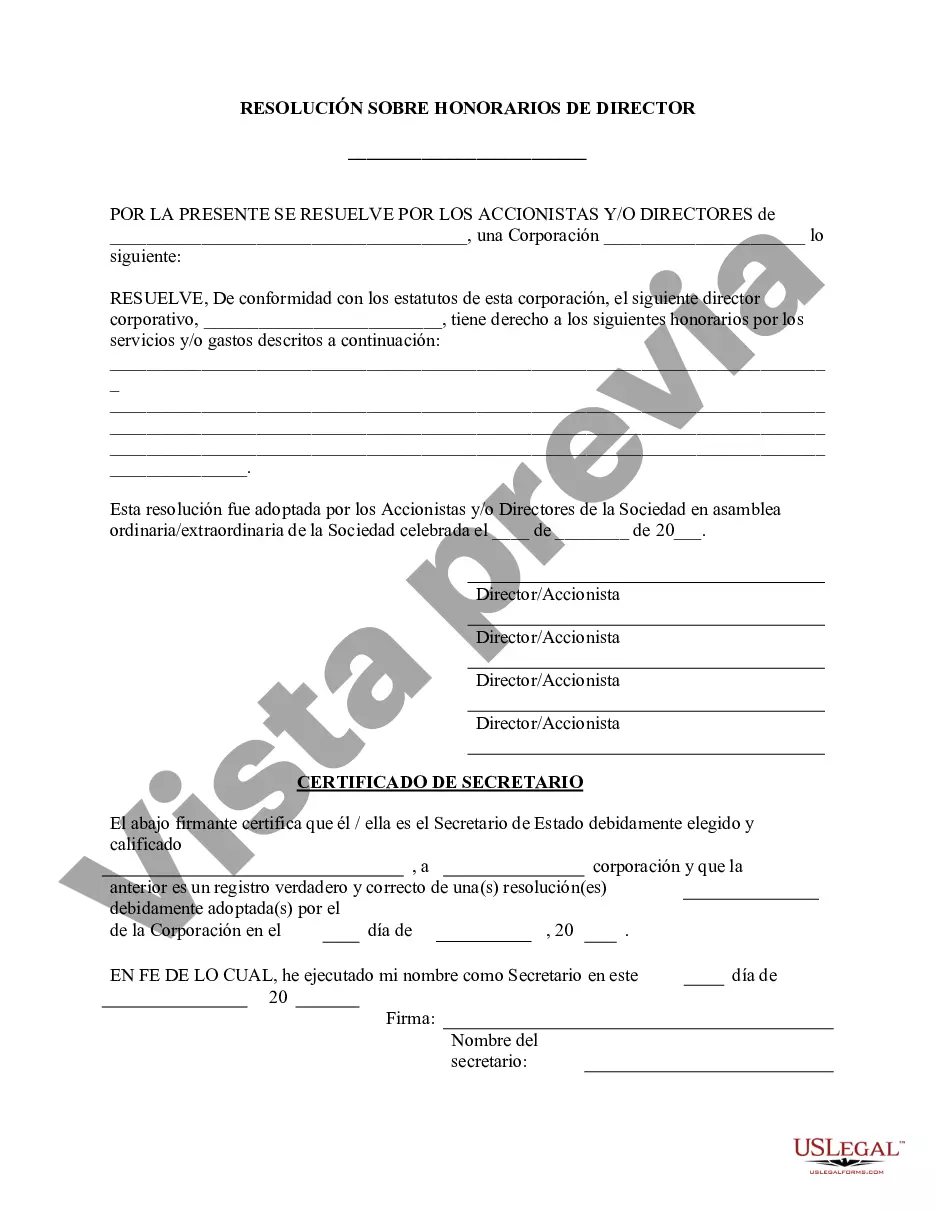

The District of Columbia Director's Fees — Resolution For— - Corporate Resolutions is a crucial legal document that outlines the process and details regarding the compensation provided to directors serving on corporate boards in the District of Columbia. This form is an essential part of corporate governance as it ensures transparency, compliance with laws, and establishes clear guidelines for director fees. The resolution form begins with a clear title stating its purpose, "District of Columbia Director's Fees — Resolution Form – Corporate Resolutions." This highlights that the document specifically pertains to director compensation in the District of Columbia. The form typically consists of several sections that provide comprehensive information about director fees. These sections encompass details such as the purpose of the resolution, its legality, and the corporate governance guidelines that should be followed while determining director fees. Some key details included in the form are: 1. Introduction: This section provides an overview of the purpose and importance of the document. It outlines the primary objectives of director fees, such as attracting top talent, incentivizing performance, and ensuring proper fiduciary obligations. 2. Resolved Clauses: This part contains a series of clauses that establish the guidelines for director fees. It may include provisions like the maximum compensation limit, frequency of payment, and eligibility criteria for directors to receive fees. 3. Compensation Determination: This section outlines the process for determining director compensation. It includes factors such as the director's responsibilities, time commitment, industry standards, company size, and financial performance. 4. Independent Assessment: In some cases, the resolution form may mandate an independent assessment to determine the reasonableness of director fees. This ensures that the compensation is fair, justifiable, and aligns with similar positions in the market. 5. Reporting and Disclosure: Directors are often required to disclose their compensation in various regulatory filings. This section emphasizes the importance of these disclosures and ensures compliance with reporting requirements. It is crucial to note that the types of District of Columbia Director's Fees — Resolution Forms vary depending on the specific needs and circumstances of each corporation. For instance, there may be different resolutions forms for non-profit organizations, private companies, and publicly traded corporations. These forms will address specific legal and regulatory requirements based on the organization's structure and sector. In conclusion, a District of Columbia Director's Fees — Resolution For— - Corporate Resolutions is a legally binding document designed to govern the compensation of directors serving on corporate boards in the District of Columbia. It highlights the importance of transparency, compliance, and fairness in determining director fees, while also establishing guidelines for reporting and disclosure. Different types of resolution forms may exist based on the organization's nature and legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Honorarios de los directores - Formulario de resolución - Resoluciones corporativas - Director's Fees - Resolution Form - Corporate Resolutions

Description

How to fill out District Of Columbia Honorarios De Los Directores - Formulario De Resolución - Resoluciones Corporativas?

If you wish to comprehensive, obtain, or printing lawful document web templates, use US Legal Forms, the largest collection of lawful types, which can be found on the web. Take advantage of the site`s easy and hassle-free search to find the papers you want. Various web templates for business and personal reasons are categorized by classes and states, or key phrases. Use US Legal Forms to find the District of Columbia Director's Fees - Resolution Form - Corporate Resolutions in just a couple of click throughs.

When you are currently a US Legal Forms consumer, log in to the bank account and click the Down load button to obtain the District of Columbia Director's Fees - Resolution Form - Corporate Resolutions. You can also entry types you earlier saved inside the My Forms tab of your own bank account.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have chosen the form for the correct area/nation.

- Step 2. Utilize the Preview choice to check out the form`s content material. Do not forget about to read the information.

- Step 3. When you are not happy together with the develop, use the Lookup industry on top of the screen to find other versions in the lawful develop template.

- Step 4. Once you have discovered the form you want, click the Purchase now button. Choose the costs prepare you favor and add your credentials to register on an bank account.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal bank account to finish the financial transaction.

- Step 6. Choose the file format in the lawful develop and obtain it on your device.

- Step 7. Comprehensive, change and printing or sign the District of Columbia Director's Fees - Resolution Form - Corporate Resolutions.

Every lawful document template you buy is your own forever. You have acces to each and every develop you saved with your acccount. Go through the My Forms section and decide on a develop to printing or obtain once more.

Compete and obtain, and printing the District of Columbia Director's Fees - Resolution Form - Corporate Resolutions with US Legal Forms. There are millions of expert and status-certain types you can use for the business or personal requires.