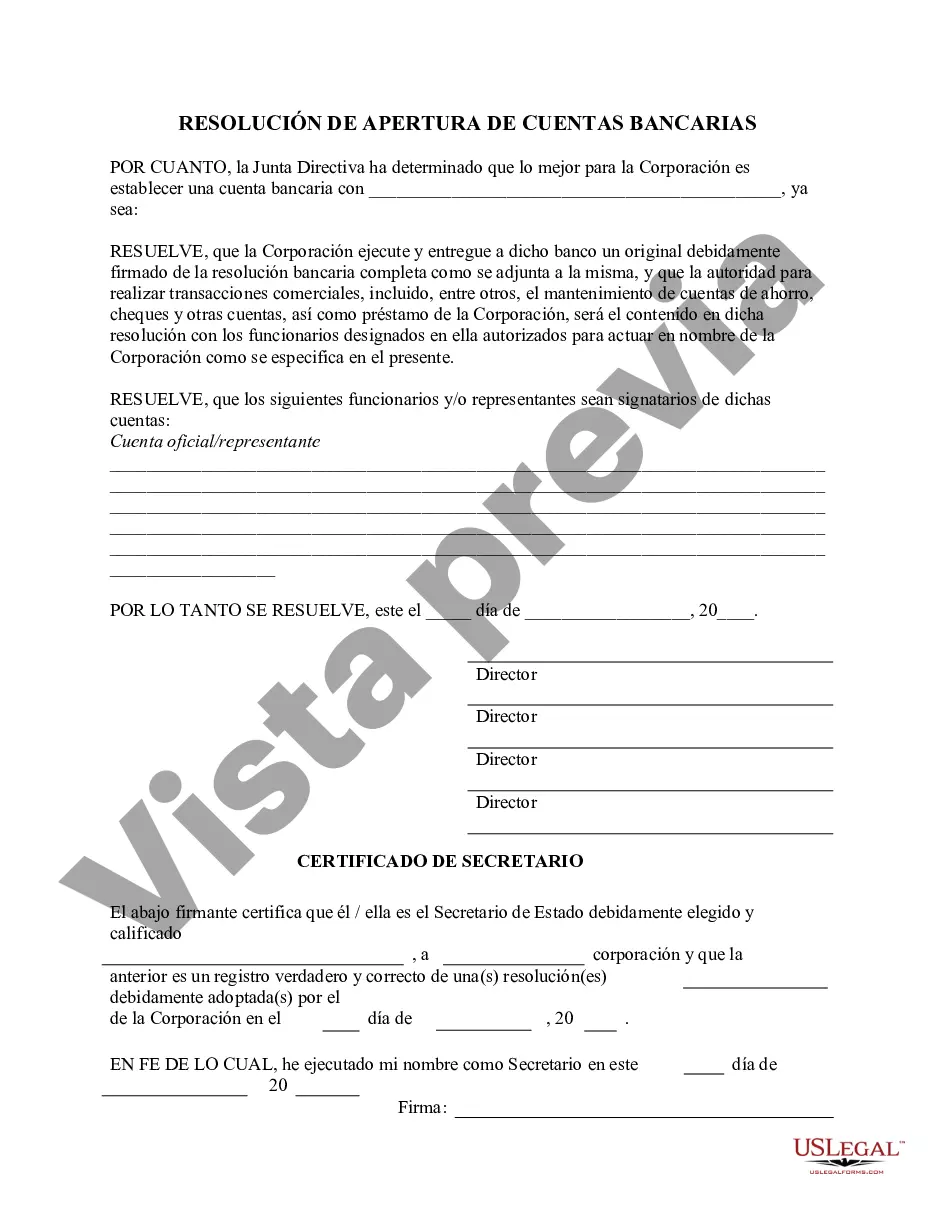

District of Columbia Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions is a legal document that outlines the process and details for selecting a bank to serve as a financial institution for a corporation based in the District of Columbia. This resolution is crucial for establishing a formal banking relationship and designating authorized signatories for the corporation's accounts. The resolution begins by stating the name and legal address of the corporation. It then presents the purpose of the resolution, which is to select a bank to handle the corporation's financial affairs and to appoint individuals who will have the authority to sign and transact on behalf of the corporation. The resolution highlights the importance of considering factors such as the bank's reputation, service quality, financial stability, and proximity to the corporation's primary place of business. A thorough evaluation of multiple potential banks is advised to ensure the best fit for the corporation's banking needs. Once the preferred bank is identified, the resolution authorizes the designated individuals, commonly the corporation's officers or directors, to execute all necessary agreements with the bank. These agreements may include account opening documents, signature cards, and related paperwork required by the bank. The resolution also specifies the powers granted to the authorized signatories, such as the ability to deposit and withdraw funds, issue checks, make wire transfers, establish electronic banking services, and initiate other transactions on behalf of the corporation. It is crucial to define and limit these powers to maintain internal control and prevent any unauthorized or fraudulent activities. Moreover, it may be necessary to name certain individuals as alternate signatories to ensure the continuity of banking operations, especially in the event that the designated primary signatory is unavailable or incapacitated. The resolution can address this concern by providing clear instructions on the procedure for designating and removing alternate signatories. In the District of Columbia, there might not be different types of resolutions for selecting a bank for a corporation and appointing account signatories specifically. However, corporations may have variations in their specific requirements or preferences regarding banking services and signatory appointments. These variations can be accommodated through customization or additional clauses in the resolution, as long as they comply with relevant banking regulations and the corporation's bylaws. In summary, the District of Columbia Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions is an essential legal document that establishes the corporation's banking relationship, designates authorized signatories, and outlines their powers. It ensures proper financial management and operational efficiency for the corporation while complying with relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Resolución de Selección de Banco para Sociedades Anónimas y Signatarios de Cuentas - Resoluciones Corporativas - Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions

Description

How to fill out District Of Columbia Resolución De Selección De Banco Para Sociedades Anónimas Y Signatarios De Cuentas - Resoluciones Corporativas?

You are able to invest hours on-line looking for the lawful document web template which fits the state and federal needs you require. US Legal Forms gives a huge number of lawful types that are analyzed by pros. You can actually down load or printing the District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions from the assistance.

If you currently have a US Legal Forms profile, you are able to log in and click on the Acquire option. Afterward, you are able to full, revise, printing, or signal the District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions. Every lawful document web template you buy is your own eternally. To obtain another copy for any bought develop, check out the My Forms tab and click on the corresponding option.

Should you use the US Legal Forms internet site for the first time, stick to the straightforward guidelines beneath:

- Initially, be sure that you have selected the proper document web template for that county/town of your choosing. See the develop information to make sure you have picked the appropriate develop. If offered, take advantage of the Review option to search through the document web template at the same time.

- If you want to discover another version of your develop, take advantage of the Search field to discover the web template that meets your requirements and needs.

- Once you have located the web template you want, just click Acquire now to continue.

- Select the costs plan you want, type in your references, and register for your account on US Legal Forms.

- Comprehensive the deal. You can use your charge card or PayPal profile to pay for the lawful develop.

- Select the structure of your document and down load it to your product.

- Make modifications to your document if necessary. You are able to full, revise and signal and printing District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions.

Acquire and printing a huge number of document themes utilizing the US Legal Forms Internet site, that offers the largest collection of lawful types. Use specialist and state-particular themes to tackle your business or individual requirements.