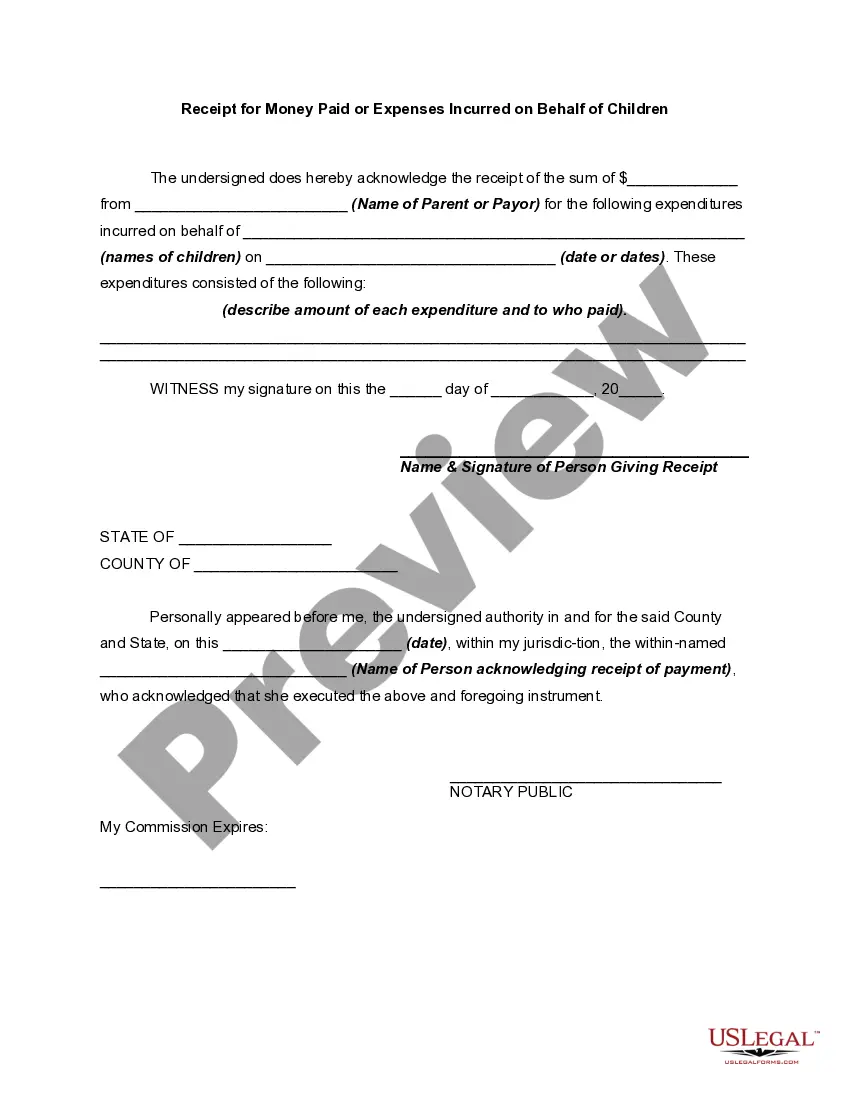

District of Columbia Receipt for Money Paid on Behalf of Another Person

Description

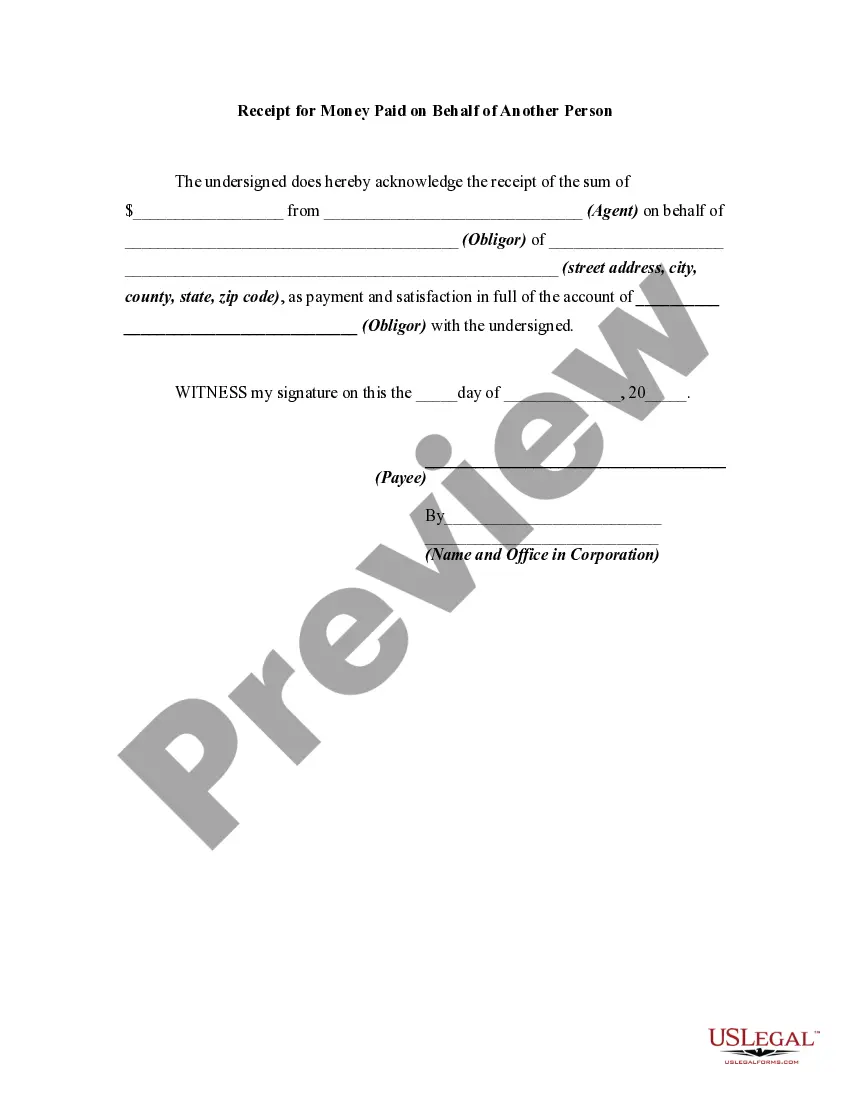

How to fill out Receipt For Money Paid On Behalf Of Another Person?

Are you in a situation where you require documentation for both business or specific purposes nearly every day? There are numerous legal form templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of template forms, such as the District of Columbia Receipt for Money Paid on Behalf of Another Person, that are crafted to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, just sign in. After that, you can download the District of Columbia Receipt for Money Paid on Behalf of Another Person template.

Select a convenient document format and download your copy.

Explore all the form templates you have purchased in the My documents section. You can download an additional copy of the District of Columbia Receipt for Money Paid on Behalf of Another Person at any time, if needed. Just click on the required form to download or print the document template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/county.

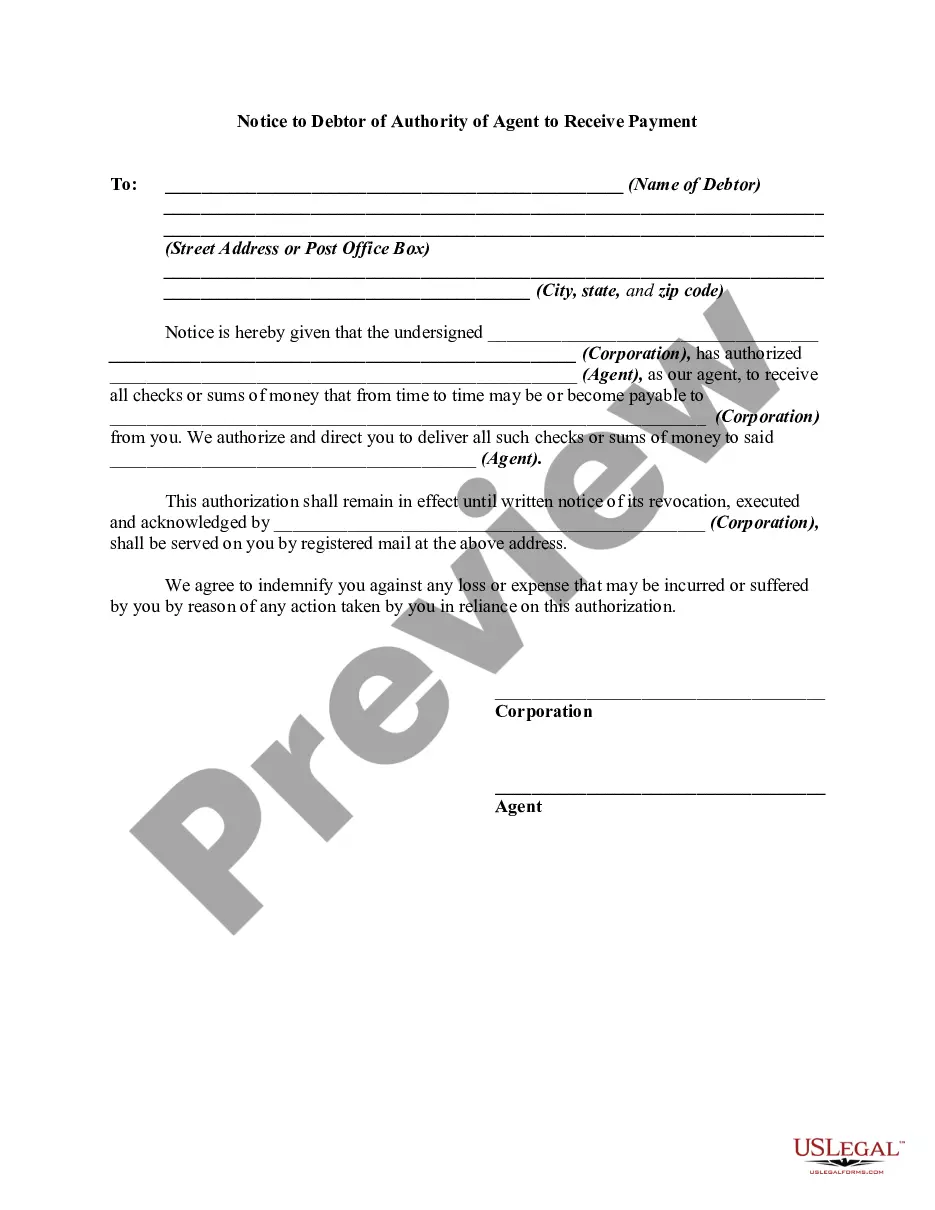

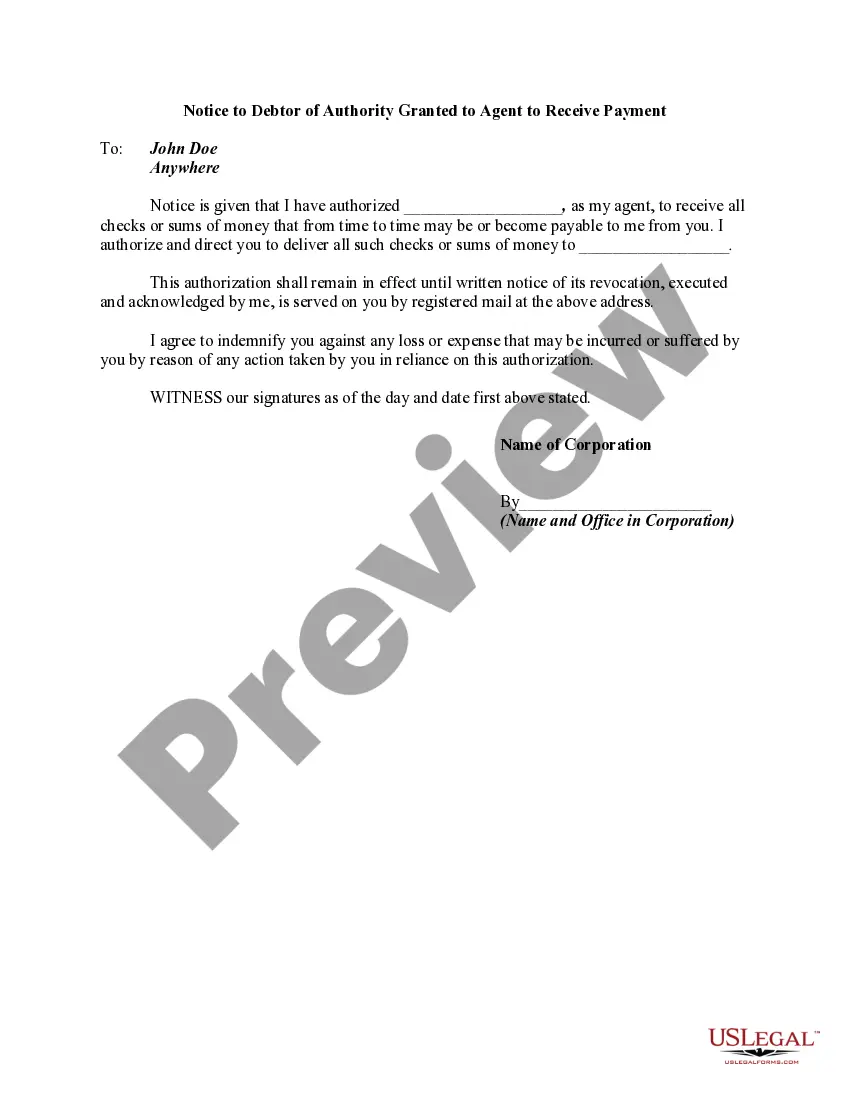

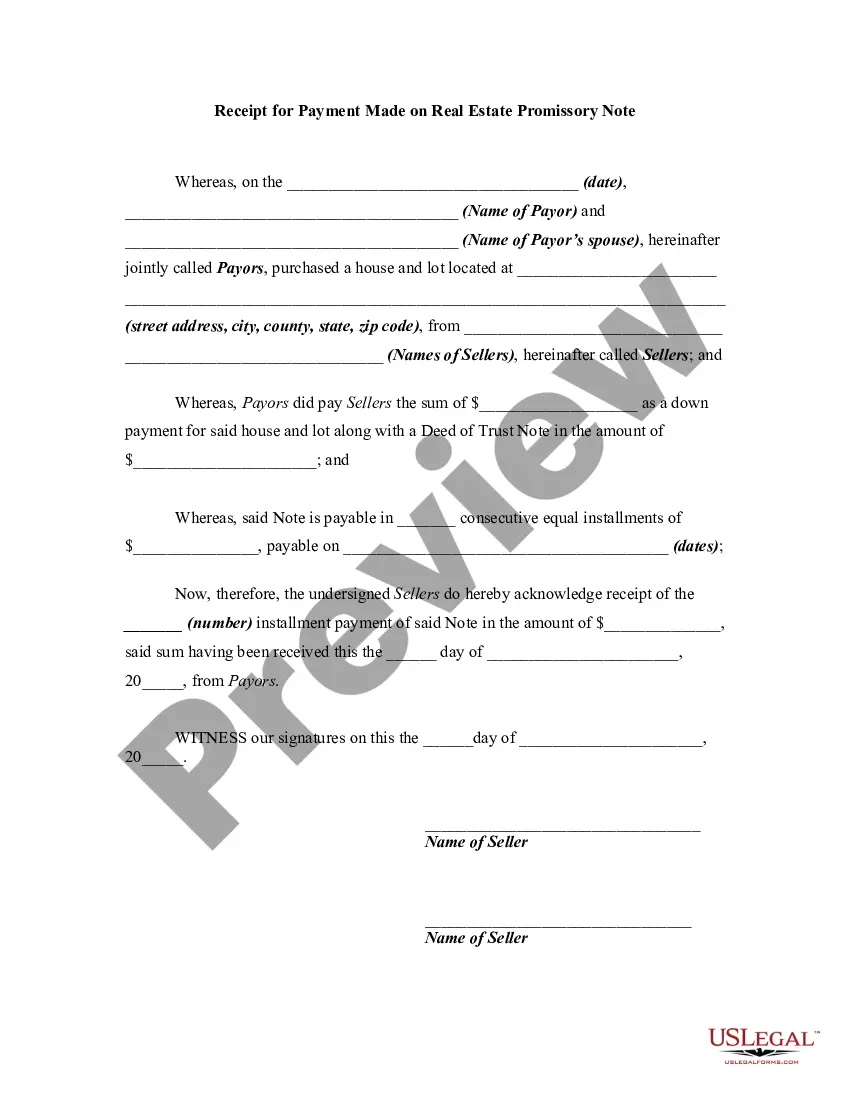

- Use the Preview option to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you're looking for, utilize the Search field to find the form that suits your needs and requirements.

- Once you locate the right form, click Acquire now.

- Choose the payment plan you prefer, fill in the required information to create your account, and pay for the transaction with your PayPal or credit card.

Form popularity

FAQ

Generally, an unincorporated business, with gross income (Line 10) more than $12,000 from District sources, must file a D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

If you are not a resident of DC you must file a Form D-4A with your employer to establish that you are not subject to DC income tax withholding. You qualify as a nonresident if: Your permanent residence is outside DC during all of the tax year and you do not reside in DC for 183 days or more in the tax year.

Through a commercial online filing service. This allows taxpayers to transmit their DC and federal returns from their PC for a fee. Note: An Unincorporated business must have an FEIN to file through MeF.

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.

THE ANSWER: D.C., Maryland and Virginia have a reciprocity agreement, which means that their tax laws make it so that if you work in one state and live in another, you only need to file one return in the state where you live.

A DC Resident is an individual that maintains a place of abode within DC for 183 days or more. If the individual is domiciled in the state at anytime, you are considered to be a DC resident. A DC Nonresident is an individual that did not spend any time domiciled in the state.

Additional information. Form D-30 can be e-filed. Refer to this article for information on the date you can begin e-filing this form. Generally, an unincorporated business with gross income over $12,000 from D.C. sources must file a D-30, regardless of whether it has net income.

Washington, D.C. Income Taxes and D.C. Tax Forms. Washington, D.C. State Income Taxes for Tax Year 2021 (January 1 - Dec. 31, 2021) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a D.C. state return).

You are not required to file a DC return if you are a nonresident of DC unless you are claiming a refund of DC taxes withheld or DC estimated taxes paid. Use Form D-40B, Non-Resident Request for Refund (available by visiting ).

As of November 1, sales and use filers can file and pay their tax returns electronically via OTR's tax portal, MyTax.DC.gov.