A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor.

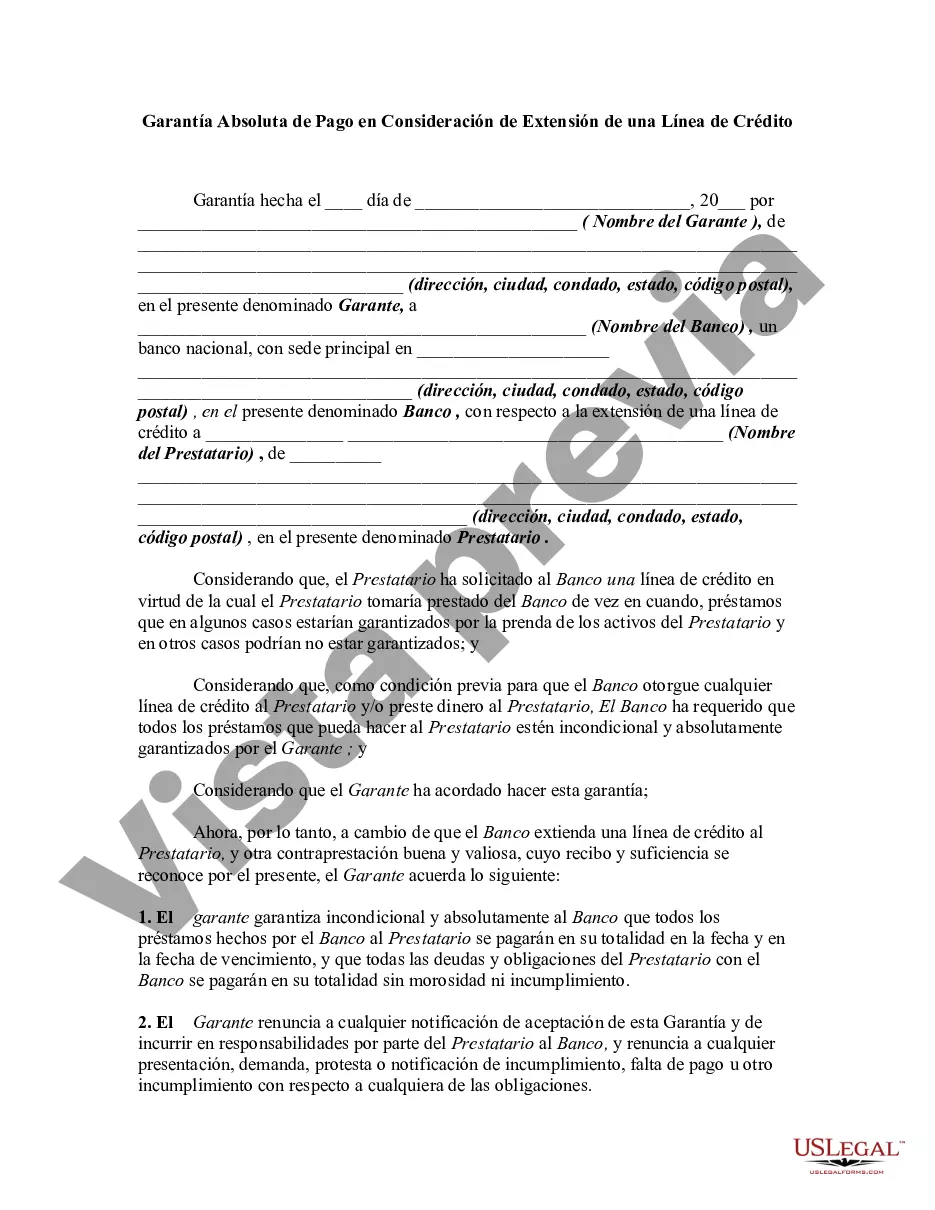

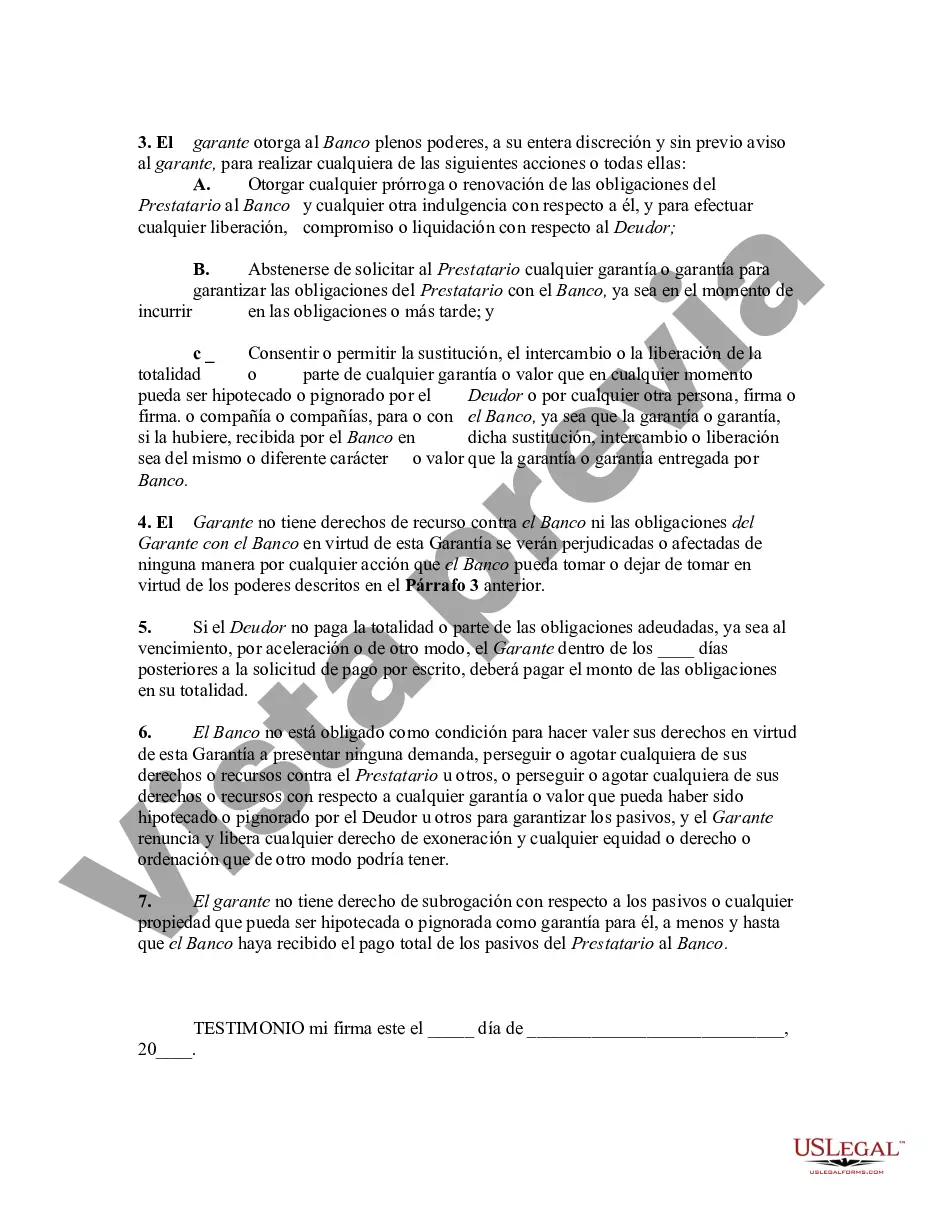

The contract of guaranty may be absolute or it may be conditional. An absolute guaranty is a contract by which the guarantor has promised that if the debtor does not perform the obligation or obligations, the guarantor will perform some act (such as the payment of money) to or for the benefit of the creditor.

A line of credit is an arrangement in which a lender extends a specified amount of credit to borrower for a specified time period.

The District of Columbia Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit is a legal document that provides an assurance of payment to a lender in exchange for the extension of a line of credit. This guarantee is specific to the District of Columbia jurisdiction and holds the guarantor responsible for repaying the debt if the debtor defaults on their obligations. Keywords: District of Columbia jurisdiction, absolute guaranty of payment, extension of a line of credit, legal document, lender, assurance, defaults, obligations. Different types of District of Columbia Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit may include: 1. Personal Guaranty: In this type, an individual personally guarantees the payment of the line of credit. If the debtor fails to repay, the guarantor becomes liable and responsible for the debt. 2. Corporate Guaranty: In this case, a corporation guarantees the repayment of the line of credit. The corporate entity assumes the liability if the debtor is unable to fulfill their obligations. 3. Individual and Spousal Guaranty: This type involves both an individual and their spouse providing a guarantee for the line of credit as a joint undertaking. Both parties become responsible for repayment if the debtor defaults. 4. Limited Guaranty: A limited guaranty only covers a specific portion or amount of the line of credit. The guarantor's liability is limited to the extent agreed upon in the document. 5. Continuing Guaranty: This type of guaranty remains in effect even if the line of credit is fully repaid. It provides the lender with ongoing assurance for future extensions or new lines of credit. Overall, the District of Columbia Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit offers protection to lenders and ensures that they have a source of repayment in case the debtor fails to fulfill their financial obligations. It is a legally binding agreement that holds the guarantor accountable for the debt in the specific jurisdiction of the District of Columbia.The District of Columbia Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit is a legal document that provides an assurance of payment to a lender in exchange for the extension of a line of credit. This guarantee is specific to the District of Columbia jurisdiction and holds the guarantor responsible for repaying the debt if the debtor defaults on their obligations. Keywords: District of Columbia jurisdiction, absolute guaranty of payment, extension of a line of credit, legal document, lender, assurance, defaults, obligations. Different types of District of Columbia Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit may include: 1. Personal Guaranty: In this type, an individual personally guarantees the payment of the line of credit. If the debtor fails to repay, the guarantor becomes liable and responsible for the debt. 2. Corporate Guaranty: In this case, a corporation guarantees the repayment of the line of credit. The corporate entity assumes the liability if the debtor is unable to fulfill their obligations. 3. Individual and Spousal Guaranty: This type involves both an individual and their spouse providing a guarantee for the line of credit as a joint undertaking. Both parties become responsible for repayment if the debtor defaults. 4. Limited Guaranty: A limited guaranty only covers a specific portion or amount of the line of credit. The guarantor's liability is limited to the extent agreed upon in the document. 5. Continuing Guaranty: This type of guaranty remains in effect even if the line of credit is fully repaid. It provides the lender with ongoing assurance for future extensions or new lines of credit. Overall, the District of Columbia Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit offers protection to lenders and ensures that they have a source of repayment in case the debtor fails to fulfill their financial obligations. It is a legally binding agreement that holds the guarantor accountable for the debt in the specific jurisdiction of the District of Columbia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.