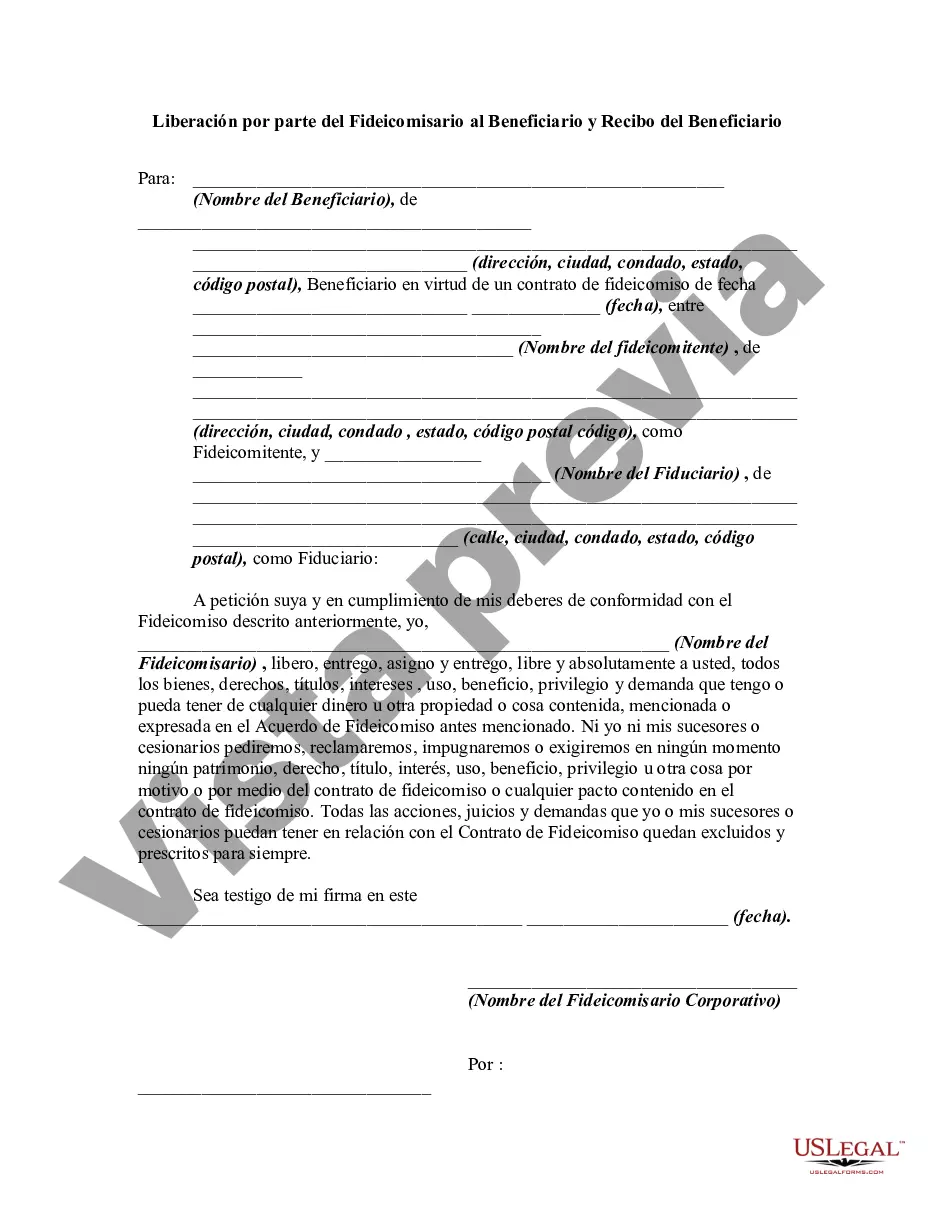

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A District of Columbia Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document that establishes the transfer of assets or property from a trustee to a beneficiary in the District of Columbia. This document serves as proof of the completion of the trustee's duties and the final settlement between the trustee and the beneficiary. It ensures that the beneficiary receives the assets or property they are entitled to and releases the trustee from any further obligations or liabilities. There are two main types of District of Columbia Release by Trustee to Beneficiary and Receipt from Beneficiary: 1. Discharge of Trust: This type of release is executed when the trustee has successfully fulfilled their obligations and transferred the trust assets to the beneficiary. It acknowledges the trustee's compliance with the terms and conditions of the trust, granting them a formal discharge from further responsibilities. The beneficiary signs the receipt, acknowledging the receipt of the assets or property and waiving any future claims against the trustee. 2. Termination of Trust: This type of release is used when a trust comes to its scheduled or agreed-upon end. It signifies the completion of the trust's purpose or the occurrence of a predetermined event that triggers its termination. The trustee distributes the remaining assets to the beneficiary or beneficiaries according to the trust agreement. The release and receipt document confirm the trustee's delivery of the assets and formally terminates the trust, providing closure to the trustee-beneficiary relationship. Both types of releases typically contain key information such as the names and contact details of the trustee and beneficiary, details of the trust agreement, a comprehensive list of the assets being transferred, and any conditions or requirements laid out by the trust. They also include a statement of acknowledgment, where the beneficiary confirms the receipt of the assets or property and declares their satisfaction with the trustee's performance. It is crucial for both parties involved in the release process to carefully review the document before signing to ensure accuracy and compliance with local laws. If there are any concerns or disputes, seeking legal advice is advisable to protect the interests of both the trustee and beneficiary.A District of Columbia Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document that establishes the transfer of assets or property from a trustee to a beneficiary in the District of Columbia. This document serves as proof of the completion of the trustee's duties and the final settlement between the trustee and the beneficiary. It ensures that the beneficiary receives the assets or property they are entitled to and releases the trustee from any further obligations or liabilities. There are two main types of District of Columbia Release by Trustee to Beneficiary and Receipt from Beneficiary: 1. Discharge of Trust: This type of release is executed when the trustee has successfully fulfilled their obligations and transferred the trust assets to the beneficiary. It acknowledges the trustee's compliance with the terms and conditions of the trust, granting them a formal discharge from further responsibilities. The beneficiary signs the receipt, acknowledging the receipt of the assets or property and waiving any future claims against the trustee. 2. Termination of Trust: This type of release is used when a trust comes to its scheduled or agreed-upon end. It signifies the completion of the trust's purpose or the occurrence of a predetermined event that triggers its termination. The trustee distributes the remaining assets to the beneficiary or beneficiaries according to the trust agreement. The release and receipt document confirm the trustee's delivery of the assets and formally terminates the trust, providing closure to the trustee-beneficiary relationship. Both types of releases typically contain key information such as the names and contact details of the trustee and beneficiary, details of the trust agreement, a comprehensive list of the assets being transferred, and any conditions or requirements laid out by the trust. They also include a statement of acknowledgment, where the beneficiary confirms the receipt of the assets or property and declares their satisfaction with the trustee's performance. It is crucial for both parties involved in the release process to carefully review the document before signing to ensure accuracy and compliance with local laws. If there are any concerns or disputes, seeking legal advice is advisable to protect the interests of both the trustee and beneficiary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.