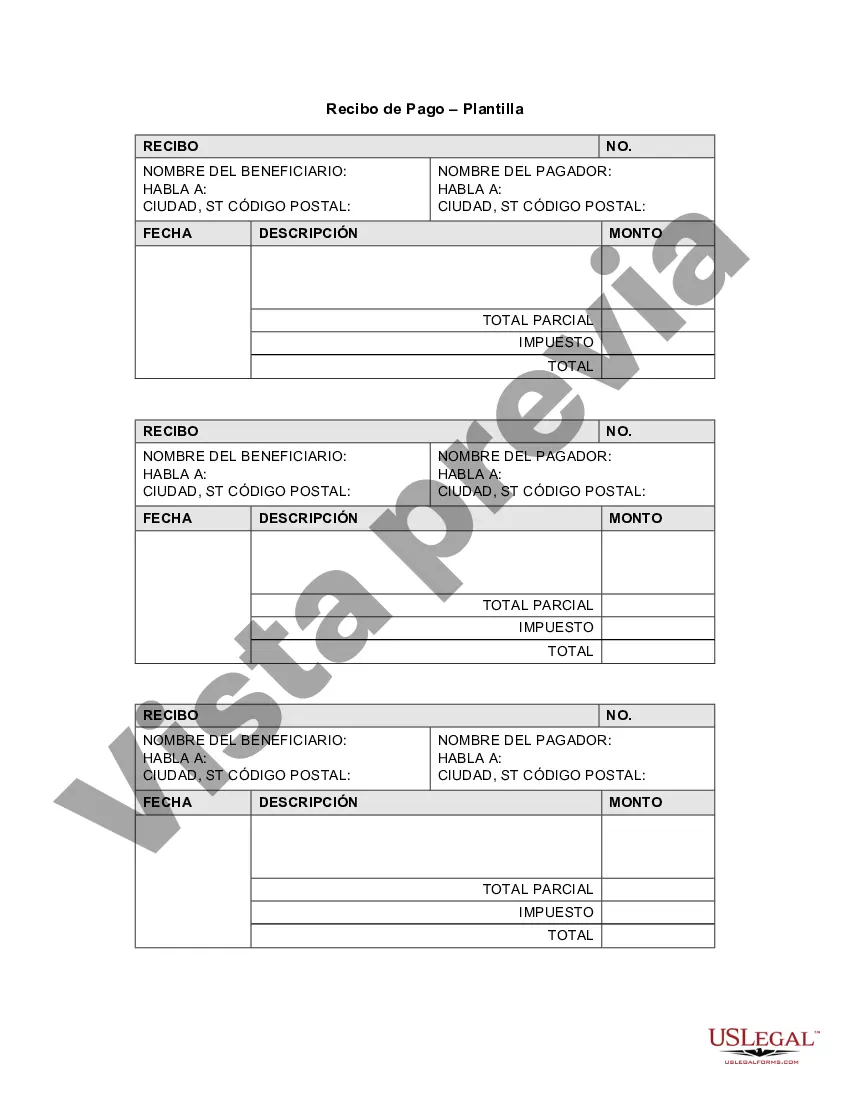

A District of Columbia Receipt Template for Small Business is a pre-designed document that helps small business owners in the District of Columbia accurately record and provide evidence of sales transactions. It serves as a legal proof of purchase and includes essential information such as the date of sale, payment method, items sold, quantity, and total amount paid. Using a receipt template ensures that small business owners have a consistent and professional-looking format for their receipts, which can enhance their credibility and create a positive impression on customers. These templates are typically customizable, enabling businesses to include their logo, contact details, and specific terms and conditions. In the District of Columbia, there are several types of receipt templates available for small businesses to cater to various needs: 1. Basic Receipt Template: This is the most common type of receipt template and includes essential details such as the seller's and buyer's names, item description, unit price, quantity, and total amount paid. It is suitable for a wide range of businesses, from service providers to retailers. 2. Sales Receipt Template: Specifically designed for retail businesses, this template provides options to record additional information like tax rates, discounts applied, and payment methods. It helps businesses calculate sales tax and maintains accurate financial records. 3. Service Receipt Template: Ideal for service-based businesses such as consultants, contractors, and freelancers, this template focuses on recording the nature of the services provided, hourly rates, and the duration of the service. It may also include space to mention any necessary add-ons or special instructions. 4. Itemized Receipt Template: For businesses that deal with multiple products or services, an itemized receipt template is beneficial. It allows business owners to provide a detailed breakdown of each item or service along with its individual cost, making it transparent for both the customer and the business. 5. Electronic Receipt Template: With the advent of digital transactions, electronic receipt templates have gained popularity. These templates can either be generated as PDFs or sent through email platforms, allowing businesses to streamline their record-keeping processes and minimize paper waste. Using a District of Columbia Receipt Template for Small Business ensures compliance with local regulations and best practices. It simplifies financial tracking, aids in tax preparation, and maintains consistency in documenting sales transactions. Businesses can choose the most suitable template based on their industry, specific requirements, and target audience.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Plantilla de recibo para pequeñas empresas - Receipt Template for Small Business

Description

How to fill out District Of Columbia Plantilla De Recibo Para Pequeñas Empresas?

US Legal Forms - among the greatest libraries of legal kinds in the USA - offers a variety of legal document layouts you can obtain or printing. Using the internet site, you can find a huge number of kinds for business and individual uses, sorted by groups, says, or keywords.You can get the most up-to-date types of kinds such as the District of Columbia Receipt Template for Small Business in seconds.

If you currently have a monthly subscription, log in and obtain District of Columbia Receipt Template for Small Business from your US Legal Forms library. The Acquire switch can look on each kind you see. You have access to all formerly acquired kinds from the My Forms tab of your own account.

If you wish to use US Legal Forms for the first time, allow me to share straightforward instructions to help you get started:

- Make sure you have selected the best kind for the metropolis/area. Click the Preview switch to review the form`s content material. Look at the kind outline to actually have chosen the correct kind.

- In the event the kind does not fit your specifications, make use of the Research industry on top of the display screen to obtain the one that does.

- If you are satisfied with the shape, verify your choice by clicking the Acquire now switch. Then, select the pricing strategy you want and give your credentials to sign up for the account.

- Procedure the deal. Make use of charge card or PayPal account to complete the deal.

- Pick the formatting and obtain the shape on your gadget.

- Make changes. Fill out, change and printing and indication the acquired District of Columbia Receipt Template for Small Business.

Each template you included with your money lacks an expiry particular date which is your own permanently. So, if you would like obtain or printing another copy, just visit the My Forms portion and click on on the kind you want.

Obtain access to the District of Columbia Receipt Template for Small Business with US Legal Forms, by far the most substantial library of legal document layouts. Use a huge number of expert and status-certain layouts that meet your company or individual demands and specifications.