District of Columbia Owner Financing Contract for Mobile Home: A Comprehensive Guide Owner financing for mobile homes in the District of Columbia is an alternative method for buyers to attain homeownership without relying on traditional bank loans. This type of contract allows the seller (the owner) of the mobile home to act as the lender, providing financing options directly to the buyer, making it more accessible and suitable for individuals who may have difficulty securing a mortgage through conventional means. Below, we will explore the various types of owner financing contracts available in the District of Columbia and provide a detailed description of the process. Types of District of Columbia Owner Financing Contracts for Mobile Homes: 1. Installment Contracts: Under an installment contract, the seller provides financing to the buyer, who agrees to make regular payments over a specific period. These payments typically include a portion of the principal (the mobile home's purchase price) along with interest charges. Once the buyer fulfills all payment obligations, they obtain full ownership of the mobile home. Keywords: District of Columbia, owner financing, mobile home, installment contract 2. Lease Option Contracts: A lease option contract combines elements of both leasing and purchasing. The owner (seller) leases the mobile home to the buyer, along with an option to buy it at a predetermined price within a specified timeframe. During the lease period, a portion of the rent may be allocated towards the down payment or applied as credit towards the purchase price if the buyer exercises the option to buy. Keywords: District of Columbia, owner financing, mobile home, lease option contract 3. Contract for Deed (Land Contract): This contract involves the seller financing the purchase of the mobile home while retaining ownership of the property until the buyer pays off the entire balance. It allows the buyer to occupy and use the mobile home while making regular payments to the seller. Once the full payment is made, the ownership is transferred to the buyer. Keywords: District of Columbia, owner financing, mobile home, contract for deed, land contract 4. Rental Agreements with Option to Buy: In this agreement, the owner rents out the mobile home to the buyer, who has the option to purchase the property at a later date. This arrangement allows the buyer to test out living in the mobile home before committing to its purchase, providing flexibility and time to arrange financing. Keywords: District of Columbia, owner financing, mobile home, rental agreement, option to buy District of Columbia Owner Financing Contract for Mobile Home Process: 1. Property Search: The buyer searches for mobile homes available for owner financing in the District of Columbia through real estate listings, online platforms, or local agents. 2. Negotiation and Offer: The buyer contacts the seller to discuss the terms of the owner financing contract, including the purchase price, down payment, interest rate, and duration of payments. 3. Contract Creation: Once agreed upon, an attorney drafts a legally binding contract that outlines the terms and conditions of the financing agreement, including repayment schedules, consequences of default, and maintenance responsibilities. 4. Review and Approval: Both parties thoroughly review the contract, making any necessary amendments to ensure clarity and fairness. Once satisfied, the contract is signed by both the buyer and the seller. 5. Payments: The buyer begins making monthly payments to the seller as stipulated in the contract. These payments generally include principal and interest charges. 6. Completion of Payments: After fulfilling all financial obligations outlined in the contract, the buyer receives full ownership of the mobile home, and the seller transfers the title. Owner financing for mobile homes in the District of Columbia offers a flexible opportunity for aspiring homeowners. By carefully considering the various types of contracts available and understanding the process involved, buyers can find a suitable agreement to fulfill their dream of owning a mobile home in the District of Columbia.

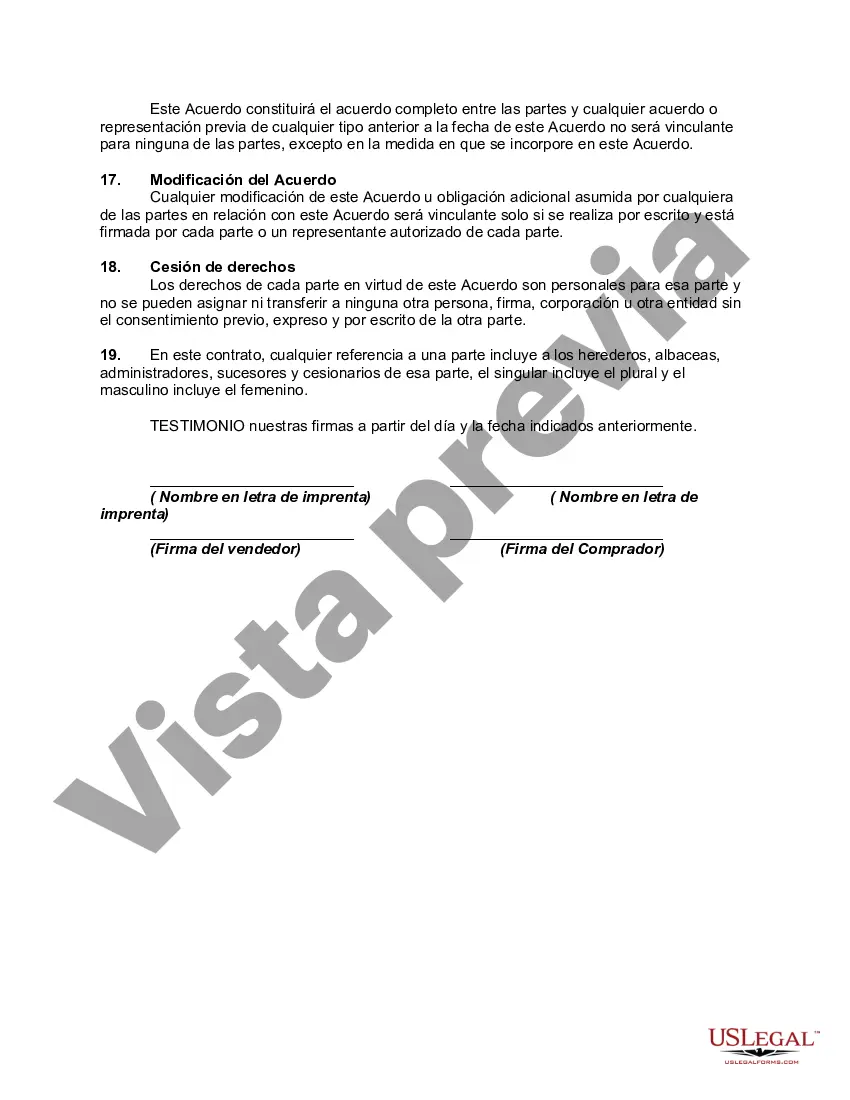

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.District of Columbia Contrato de financiación del propietario para Moblie Home - Owner Financing Contract for Moblie Home

Description

How to fill out District Of Columbia Contrato De Financiación Del Propietario Para Moblie Home?

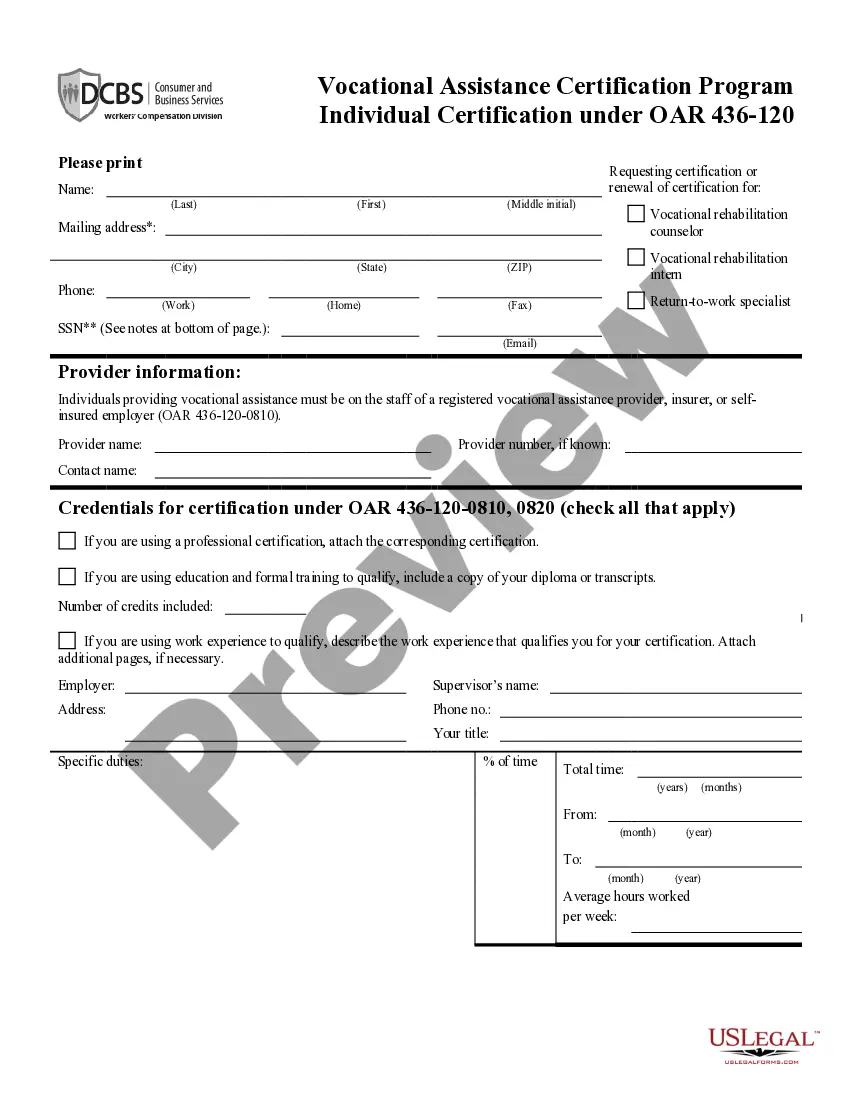

Choosing the best lawful file web template could be a struggle. Naturally, there are tons of web templates available online, but how will you obtain the lawful kind you need? Utilize the US Legal Forms website. The assistance offers 1000s of web templates, like the District of Columbia Owner Financing Contract for Moblie Home, which can be used for company and personal demands. All of the varieties are examined by experts and meet up with federal and state requirements.

In case you are previously signed up, log in for your bank account and then click the Down load button to find the District of Columbia Owner Financing Contract for Moblie Home. Utilize your bank account to appear through the lawful varieties you have purchased previously. Go to the My Forms tab of your bank account and get yet another duplicate in the file you need.

In case you are a whole new consumer of US Legal Forms, listed here are easy guidelines that you can comply with:

- Initially, make sure you have chosen the correct kind to your city/state. You may look through the shape making use of the Preview button and look at the shape information to guarantee this is the right one for you.

- If the kind fails to meet up with your requirements, use the Seach industry to obtain the proper kind.

- Once you are certain the shape is suitable, click the Get now button to find the kind.

- Pick the pricing strategy you desire and type in the needed details. Build your bank account and purchase an order with your PayPal bank account or credit card.

- Opt for the submit structure and obtain the lawful file web template for your system.

- Total, edit and produce and sign the obtained District of Columbia Owner Financing Contract for Moblie Home.

US Legal Forms will be the greatest local library of lawful varieties where you can discover a variety of file web templates. Utilize the service to obtain skillfully-manufactured files that comply with status requirements.